Products You May Like

The USDJPY trades target a trading range of 140.00-145.00

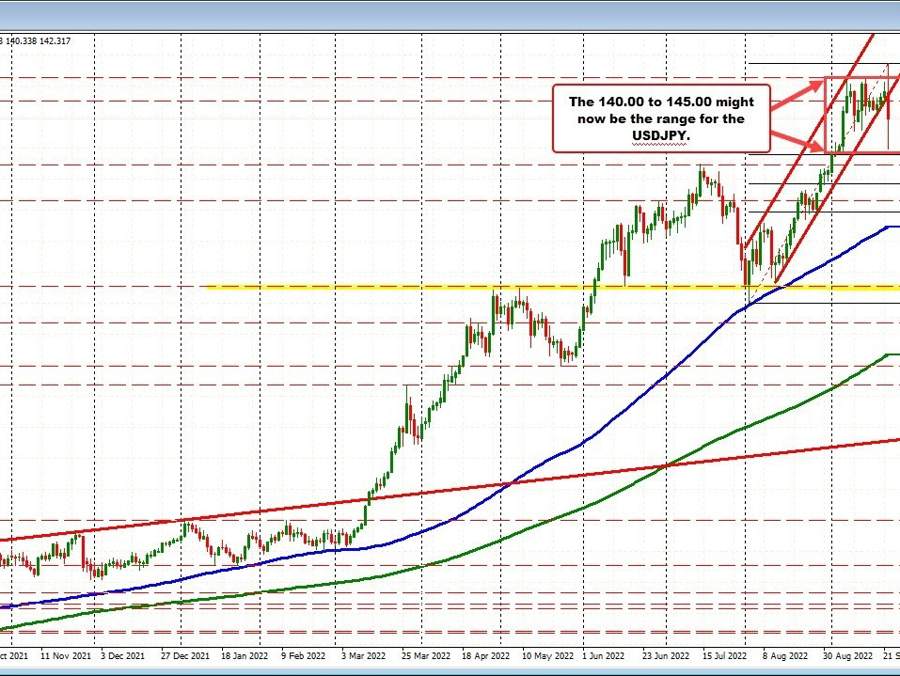

Adam discussed the intervention from the Bank of Japan today in his post here. The action sent the pair down from a high of 145.89 to a low of 140.338. That is a good 556 pips. Certainly nothing to sneeze about in a few hours of trading.

However, if you look at the daily chart, the move lower stalled ahead of the 38.2% of the move higher from the August low. That retracement comes in at 139.967 (call it 140.00). The decline got within about 40 pips of that retracement level. NOTE that is just off the last trend leg higher.

If the correction off of a trend move cannot extend to and through the 38.2% of the last trend leg, I like to characterize the correction as nothing more than a plain-vanilla variety. In other words, there is nothing special about it

Yes in the shorter term it certainly did do damage to a traders account. With the threat of intervention on September 13 against the earlier September high, traders were playing with fire on the break above that 145.00 September ceiling level today.

However, long-term the bounce ahead of the 38.2% retracement is keeping the selling in check for the pair, and creating a new floor.

Going forward, the range from 140.00 to 145.00 may now be what traders will now focus on. It would take the BOJ changing their stance to likely lead to something more bearish – at least for now. With intervention, in play moving above the 145.00 level would be playing with fire.

Looking at the hourly chart, there are some interim levels on the topside and downside that might be used to swing the pair within a narrower range.

On the topside, the 142.82 level is sticking out as a potential interim ceiling ahead of the 100/200 hour MAs at 143.37 and 143.48 respectively.

On the downside, I will be watching for support at the 141.50 to 141.60 area for an interim floor (see green numbered circles) ahead of the 140.00 area below.

What I don’t expect is for a run to foreign either direction now that the range has somewhat been established. So expect traders to put on their range trading at for the time being at least.

USDJPY on the hourly chart