Products You May Like

Dollar, Yen and Swiss Franc are currently trading as the strongest ones for the week, as supported by risk-off sentiment. Yen overpowers the other with help from intervention by Japan. Dollar is supported by hawkish Fed while Swiss Franc clearly lagged behind. Nevertheless, the Franc is still up against Euro and Sterling, which are among the worst performers together with New Zealand Dollar.

Technically, as long as some levels hold, there is prospect for Dollar to extend recent rally before weekly close. the levels include 0.9943 minor resistance in EUR/USD, 0.6698 minor resistance in AUD/USD, 0.9694 minor support in USD/CHF, and 1.3343 minor support in USD/CAD. But that would depend very much on how risk market flares.

In Asia at the time of writing, Hong Kong HSI is down -0.85%. China Shanghai SSE is down -1.08%. Singapore Strait Times is down -0.83%. Japan is on holiday. Overnight, DOW dropped -0.35%. S&P 500 dropped -0.84%. NASDAQ dropped -1.37%. 10-year yield rose 0.198 to 3.708.

Australia PMI composite edged up to 50.8, at risk of heading into contraction territory

Australia PMI Manufacturing ticked up from 53.8 to 53.9 in September. PI Services also rose slightly from 50.2 to 50.4. PMI Composite Output rose from 50.2 to 50.8.

Laura Denman, Economist at S&P Global Market Intelligence said: “September data indicated that the recent interest rate hikes made by the RBA have begun to have the desired effect in terms of prices…. At the same time, the private sector has remained in expansion territory with the pace of growth even accelerating very slightly…

“On the negative side, the full effects of recent interest rate hikes will be lagged… Should the RBA continue to increase the base rate further, the private sector economy may be at risk of heading into contraction territory in the future as disposable incomes across the nation tighten and overall demand conditions remain subdued.”

UK Gfk consumer confidence dropped to new record low at -49

UK Gfk consumer confidence dropped further from -44 to -49 in September, hitting another record low since 1974. Personal financial situation over next 12 months dropped -9 pts to -40. General economic situation over next 12 months dropped -8 pts to -68. Major purchase index was unchanged at -38.

“Consumers are buckling under the pressure of the UK’s growing cost-of-living crisis driven by rapidly rising food prices, domestic fuel bills and mortgage payments. They are asking themselves when and how the situation will improve.” Joe Staton, client strategy director at GfK, said.

ECB Schnabel: Inflation pressures crept into all parts of economy

ECB Executive Board member Isabel Schnabel said yesterday in Luxembourg, “What we are seeing is that the inflationary pressures have become much more broad-based. They have somehow crept into all parts of the economy.”

“At the moment, we are not in a situation where the normalization of monetary policy harms the economy,” she said. “It’s more like we have to remove the accommodation that we still have in the system.”

Looking ahead

PMIs from Eurozone, UK and US will be released today. Canada will also publish retail sales.

USD/CAD Daily Outlook

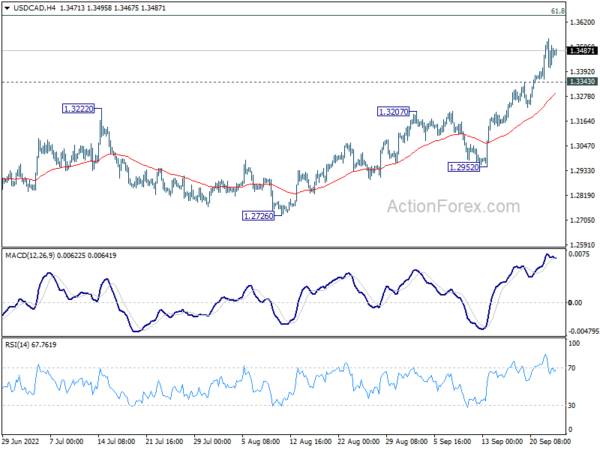

Daily Pivots: (S1) 1.3417; (P) 1.3480; (R1) 1.3552; More…

USD/CAD’s rally is still in progress and intraday bias stays on the upside. Current up trend should target medium term fibonacci level at 1.3650. On the downside, below 1.3343 minor support will turn intraday bias neutral and bring consolidations first, before staging another rally.

In the bigger picture, down trend from 1.4667 (2020 high) should have completed at 1.2005, after defending 1.2061 long term cluster support. Rise from there should target 61.8% retracement of 1.4667 to 1.2005 (2021 low) at 1.3650. This will remain the favored case now as long as 1.2716 support holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:00 | AUD | Manufacturing PMI Sep P | 53.9 | 53.8 | ||

| 23:00 | AUD | Services PMI Sep P | 50.4 | 50.2 | ||

| 23:01 | GBP | GfK Consumer Confidence Sep | -49 | -42 | -44 | |

| 07:15 | EUR | France Manufacturing PMI Sep P | 49.9 | 50.6 | ||

| 07:15 | EUR | France Services PMI Sep P | 50.4 | 51.2 | ||

| 07:30 | EUR | Germany Manufacturing PMI Sep P | 48.3 | 49.1 | ||

| 07:30 | EUR | Germany Services PMI Sep P | 47.2 | 47.7 | ||

| 08:00 | EUR | Eurozone Manufacturing PMI Sep P | 48.8 | 49.6 | ||

| 08:00 | EUR | Eurozone Services PMI Sep P | 49.1 | 49.8 | ||

| 08:30 | GBP | Manufacturing PMI Sep P | 47.4 | 47.3 | ||

| 08:30 | GBP | Services PMI Sep P | 50 | 50.9 | ||

| 12:30 | CAD | Retail Sales M/M Jul | -2.00% | 1.10% | ||

| 12:30 | CAD | Retail Sales ex Autos M/M Jul | -1.00% | 0.80% | ||

| 13:45 | USD | Manufacturing PMI Sep P | 51.2 | 51.5 | ||

| 13:45 | USD | Services PMI Sep P | 45 | 43.7 |