Products You May Like

Risk-off sentiment dominates Asian markets today, as the Chinese Yuan’s free fall accelerates. The steep depreciation could limit the room for the government to ease monetary policy further to help the economy that’s still troubled by pandemic measures. Yen and Dollar are currently the stronger ones in the currency markets, followed by Swiss Franc. Kiwi and Aussie are the worst together with Sterling, while Euro and Canadian are mixed.

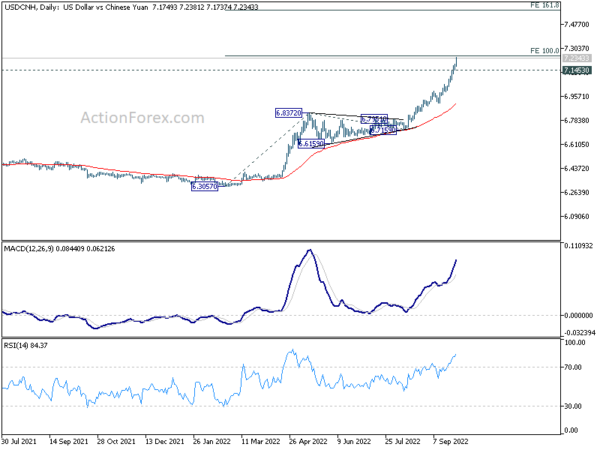

Technically, USD/CNY (onshore Yuan) hit the highest level since 2008 while USD/CNH (offshore Yuan) hits a record high since 2011. As for USD/CNH, it’s now close to 100% projection of 6.3057 to 6.8372 from 6.7159 at 7.2474. There is prospect of topping around current level and break of 7.1453 support will suggest that a correction is underway. However, barring government intervention, decisive break of 7.2474 could prompt further upside acceleration towards 161.8% projection at 7.5759, which would add more pressure on Asian sentiment.

In Asia, at the time of writing, Nikkei is down -2.05%. Hong Kong HSI is down -2.34%. China Shanghai SSE is down -0.75%. Singapore Strait Times is down -1.24%. Japan 10-year JGB yield is flat at 0.254. Overnight, DOW dropped -0.43%. S&P 500 dropped -0.21%. But NASDAQ rose 0.25%. 10-year yield rose 0.086 to 3.964, after hitting 3.992, just shy of 4% handle.

Fed Kashkari: We are moving at an appropriately aggressive pace

Minneapolis Fed Bank President Neel Kashkari said yesterday, “We are moving very aggressively. There’s a lot of tightening in the pipeline. We are committed to restoring price stability but we also recognize given these lags there is a risk of overdoing it.”

“We are committed to restoring price stability, but we also recognize, given these lags, there is the risk of overdoing it on the front end, and so I think we are moving at an appropriately aggressive pace,” he said.

“The economy is sending us a lot of mixed signals right now,” Kashkari said. “We need to keep tightening policy until we see some compelling evidence that core inflation is actually having peaked and is on its way down,”

“And then I think we need to sit there and we need to pause and wait and let the tightening work its way through the economy to see at that point, have we done enough?”

Fed Harker: Shelter inflation and food particularly alarming

Philadelphia Fed President Patrick Harker said in an article, “inflation is far too high across most goods and services in our economy. But I find shelter inflation, along with food inflation, particularly alarming…. We must do everything we can to get shelter inflation under control.”

“Monetary policy has a role to play here, and the Federal Reserve is working to stabilize inflation and put the economy on a firmer footing for the long haul,” he said. “But getting shelter inflation under control will require action not just by the Fed, but also by federal, state, and local governments.”

UK BRC shop price reported another record increase

UK BRC shop price index accelerated from 5.1% yoy to 5.7% yoy in August, hitting another record high since the index began in 2005. Food inflation surged from 9.3% yoy to 10.6% yoy. Non-food inflation also rose from 2.9% yoy to 3.3% yoy.

Helen Dickinson, Chief Executive, British Retail Consortium: “Retailers are battling huge cost pressures from the weak pound, rising energy bills and global commodity prices, high transport costs, a tight labour market and the cumulative burden of government-imposed costs.”

Mike Watkins, Head of Retailer and Business Insight, NielsenIQ: “NielsenIQ data shows that 76% of consumers are saying they expect to be moderately or severely affected by the cost-of-living crisis over the next 3 months, up from 57% in the summer.”

Australia retail sales rose 0.6% mom in Aug

Australia retail sales turnover rose 0.6% mom to AUD 34.88B in August, slightly above expectation of 0.5% mom. That’s the eighth consecutive monthly increase.

Ben Dorber, head of retail statistics at the ABS, said: “This month’s rise was driven by the combined increase in food related industries, with cafes, restaurants and takeaway food services up 1.3 per cent and food retailing up 1.1 per cent.”

“While households continue to spend, non-food industry results were mixed and only contributed a small amount to the total rise in retail turnover.”

Looking ahead

Germany Gfk consumer sentiment and Swiss Credit Suisse economic expectations will be released in European session. Later in the day, US will release goods trade balance and pending home sales.

AUD/USD Daily Report

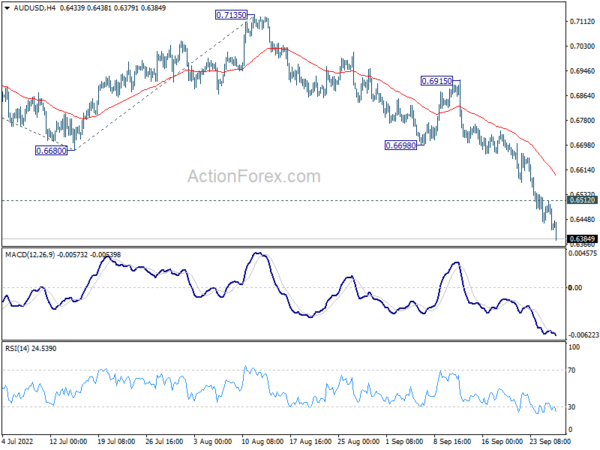

Daily Pivots: (S1) 0.6395; (P) 0.6454; (R1) 0.6494; More…

AUD/USD’s down trend continues today and hits as low as 0.6379 so far. Intraday bias stays on the downside. Next target is 100% projection of 0.7660 to 0.6680 from 0.7135 at 0.6155. On the upside, above 0.6512 minor resistance will turn intraday bias neutral and bring consolidations first, before staging another decline.

In the bigger picture, down trend form 0.8006 (2021 high) is expected to continue as long as 0.7135 resistance holds. With 61.8% retracement of 0.5506 (2020 low) to 0.8006 at 0.6461 firmly taken out, next target is 0.5506 low. Medium term momentum will now be closely monitored to gauge the chance of break of 0.5506.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:01 | GBP | BRC Shop Price Index Y/Y Sep | 5.70% | 5.10% | ||

| 23:50 | JPY | BoJ Minutes | ||||

| 01:30 | AUD | Retail Sales M/M Aug | 0.60% | 0.50% | 1.30% | |

| 06:00 | EUR | Germany Gfk Consumer Confidence Oct | -38.8 | -36.5 | ||

| 08:00 | CHF | Credit Suisse Economic Expectations Sep | -56.3 | |||

| 12:30 | USD | Goods Trade Balance (USD) Aug P | -88.0B | -90.2B | ||

| 12:30 | USD | Wholesale Inventories Aug P | 0.40% | 0.60% | ||

| 14:00 | USD | Pending Home Sales M/M Aug | -0.70% | -1.00% | ||

| 14:30 | USD | Crude Oil Inventories | 1.1M |