Products You May Like

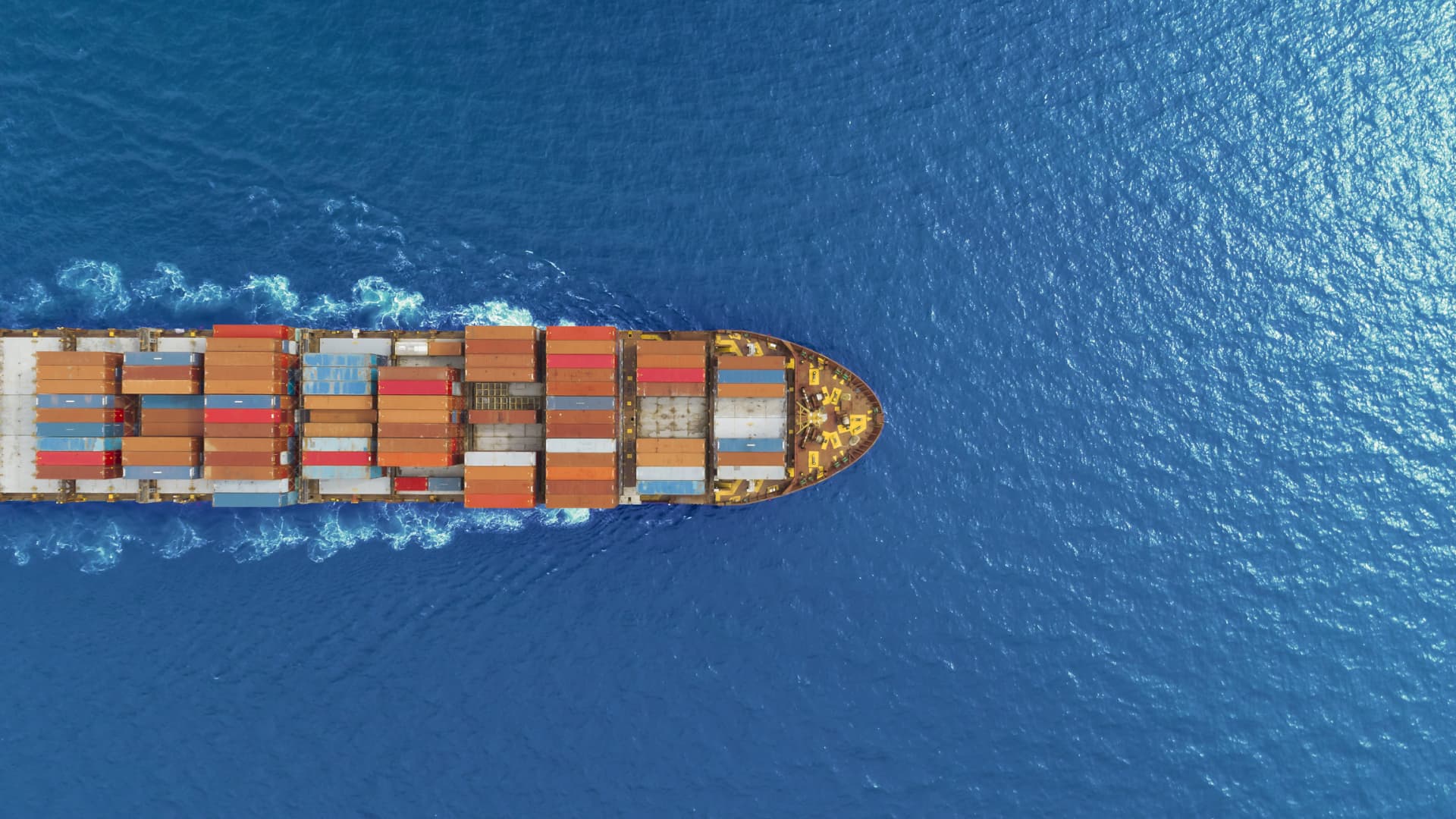

After two years of port congestions and container shortages, disruptions are now easing as Chinese exports slow in light of waning demand from Western economies and softer global economic conditions, logistics data shows.

Container freight rates, which soared to record prices at the height of the pandemic, have been falling rapidly and container shipments on routes between Asia and the U.S. have also plunged, data shows.

“The retailers and the bigger buyers or shippers are more cautious about the outlook on demand and are ordering less,” logistics platform Container xChange CEO Christian Roeloffs said in an update on Wednesday.

“On the other hand, the congestion is easing with vessel waiting times reducing, ports operating at less capacity, and the container turnaround times decreasing which ultimately, frees up the capacity in the market.”

The latest Drewry composite World Container Index — a key benchmark for container prices — is $3,689 per 40-foot container. That’s 64% lower than the same time last September after falling 32 weeks in a row, Drewry said in a recent update.

The current index is much lower than record-high prices of over $10,000 during the height of the pandemic but still remains 160% higher than pre-pandemic rates of $1,420.

According to Drewry, freight rates on major routes have also fallen. Costs for routes like Shanghai-Rotterdam and Shanghai-New York have fallen by up to 13%.

The falling freight rates tie in with a “sharp drop” in container shipments that Nomura Bank has observed.

Nomura, quoting data from U.S.-based Descartes Datamyne, said container shipments from Asia to the U.S. for all products except rubber products in September are down year on year.

“We assume that the sharp drop in container shipments largely reflects US retailers stopping orders and reducing inventories due to the risk of an economic slowdown,” Nomura analyst Masaharu Hirokane said in a note on Wednesday, adding that the bank has yet to see signs of a sharp fall in U.S. retail sales.

Port throughput around the world has also dropped. When Shanghai reopened after its recent lockdowns, port traffic volumes lifted but weren’t enough to offset the “wider downturn in port handling levels,” Drewry said.

What’s different now

In Europe, sliding container prices and rates reflect declining consumer confidence, Container xChange said.

“The European market is finding itself flooded with 40-foot high-cube containers. As a result, the region is experiencing a fall in the prices of these boxes,” Container xChange said.

The trends in logistics and supply chains from the past two years have reversed, logistics companies said. During that period, container shortages were constant as a result of delays at ports affected by lockdowns and soaring demand.

But now, demand for containers is falling and so are their rates, Seacube Containers chief sales director Danny den Boer said at the Digital Container Summit held earlier this month.

Idle time for containers is also on the rise, Sogese CEO Andrea Monti said at the same conference.

“Containers are stacking up at a lot of import-led ports. Shippers are giving containers away just because containers are being stuck there,” said Container xChange account manager Gregoire van Strydonck at the conference.

India’s Arcon Containers CEO Supal Shah said factories in China have stopped production for the foreseeable future.

“We heard four months,” he said at the Digital Container Summit conference.

“The container depot space is full in China, Europe, India, Singapore and most parts of the world.”