Products You May Like

Commodity currencies are generally stronger today following the rebound in risk markets. New Zealand Dollar is leading the way as additionally supported by stronger than expected consumer inflation reading. There are some talks that RBNZ would opt for a larger than before hike at the upcoming meeting. Dollar, Euro, and Yen are currently the worst performers, as followed by Swiss Franc, while Sterling is mixed.

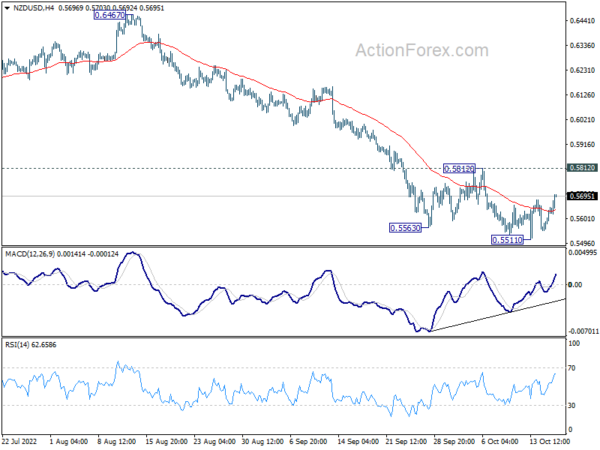

Technically, while NZD/USD recovers notably, it’s held well below 0.5812 resistance. Thus, near term outlook stays bearish for another fall through 0.5511 at a later stage. AUD/USD is also kept well below corresponding resistance at 0.6539 while USD/CAD is holding well above 1.3501 support. It’s too soon to declare a turn around in these three.

In Asia, at the time of writing, Nikkei is up 1.47%. Hong Kong HSI is up 1.33%. China Shanghai SSE is up 0.34%. Singapore Strait Times is up 0.07%. Japan 10-year JGB yield is down -0.0015 at 0.251. Overnight, DOW rose 1.86%. S&P 500 rose 2.65%. NASDAQ rose 3.43%. 10-year yield rose 0.005 to 4.015.

RBA minutes: Case for a smaller 25bps hike stronger

Minutes of RBA October 4 meeting revealed that members “carefully considered two options” of 50bps and 25bps rate hike. The arguments for a 25bps hike “rested on the risks to global and domestic growth, and the potential for inflation to subside quickly”.

Wages growth had “not reached levels that would be inconsistent with the inflation target”. External inflation pressures “might ease quickly given that the global outlook had deteriorated”. There was also an argument to slow for a time to “assess the effects of the significant increases in interest rates to date”.

RBA said the arguments for both options were “finely balanced”, with the case of 25bps hike stronger. “A smaller increase than that agreed at preceding meetings was warranted given that the cash rate had been increased substantially in a short period of time and the full effect of that increase lay ahead.”

At the meeting, RBA raised the cash rate target by 25bps to 2.60%.

RBA Bullock: We meet more frequently than most of our peers

RBA Deputy Governor Michele Bullock acknowledged in a speech that some commentators contracted the 24bps hike in October with those of other central banks that have been hiking by larger increments.

“In part, this reflects our particular economic circumstances,” she said. “But it is also relevant that the Board meets more frequently than most of our peer central banks.”

RBA is “making monetary policy decisions 11 times a year so it is discussing regularly the evidence on the economy and has more flexibility on the size and timing of rate increases… The incremental change in the policy rate at recent meetings has been smaller than some other major central banks. However, our policy rate trajectory has been as steep, or steeper, than other central banks”.

Both Fed and ECB hold monetary policy meetings 8 times a year.

New Zealand CPI up 2.2% qoq in Q3, annual rate at 7.7% yoy

New Zealand CPI rose 2.2% qoq in Q3, well above expectation of 1.6% qoq. Annual inflation slowed from 7.3% yoy to 7.2% yoy, but beat expectation of 6.6% yoy.

The quarterly rise in prices was mainly influenced by the food group and the housing and household utilities group. Vegetable prices rose 24% during the quarter, largest since the the series began in 1999.

The main driver for annual inflation was housing and household utilities due to rising prices for construction, rentals for housing, and local authority rates.

Japan Suzuki: We cannot tolerate excessive currency moves driven by speculators

Japanese Finance Minister Shunichi Suzuki told reporters today, “We cannot tolerate excessive currency moves driven by speculators. We are closely watching currency moves with a sense of urgency.”

Suzuki later told the parliament that the government is ready to take actions “decisively” and “we have intervened in the currency markets (last month)”.

“Generally speaking, there are times when we intervene by making announcements and some other times when we do without it,” Suzuki said.

BoJ Governor Haruhiko Kuroda told the parliament, “Recent sharp yen fall, coupled with raw material price rise, driving up Japan’s prices”. ”Consumer inflation likely to accelerate toward year-end before sliding below 2% next fiscal year,” he added.

Looking ahead

Germany ZEW economic sentiment is the main feature in European session. Later in the day, Canada will release housing starts. US will release industrial production and NAHB housing index.

EUR/JPY Daily Outlook

Daily Pivots: (S1) 145.14; (P) 145.93; (R1) 147.49; More….

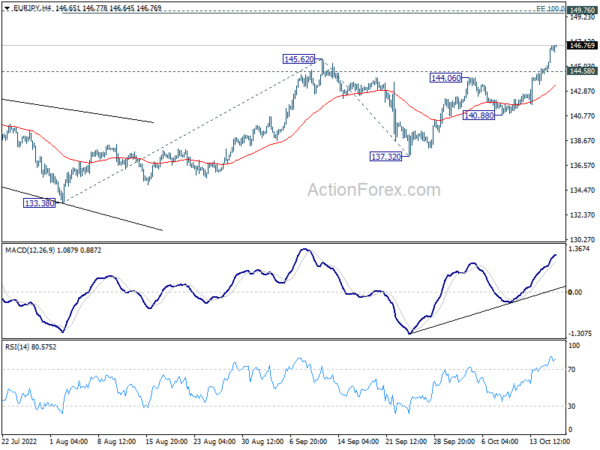

EUR/JPY’s break of 145.62 resistance confirms up trend resumption. Intraday bias stays on the upside for 100% projection of 133.38 to 145.62 from 137.32 at 149.56, which is close to 149.76 long term resistance. On the downside, below 144.58 minor support will turn intraday bias neutral and bring consolidations first, before staging another rally.

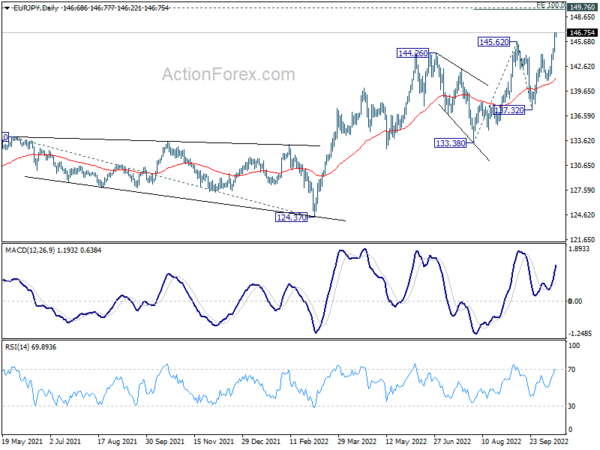

In the bigger picture, the up trend from 114.42 (2020 low) is still in progress for 149.75 (2014 high). Decisive break there will pave the way to 161.8% projection of 114.42 to 134.11 from 124.37 at 156.22. This will now remain the favored case as long as 137.32 support holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:45 | NZD | CPI Q/Q Q3 | 2.20% | 1.60% | 1.70% | |

| 21:45 | NZD | CPI Y/Y Q3 | 7.20% | 6.60% | 7.30% | |

| 00:30 | AUD | RBA Meeting Minutes | ||||

| 09:00 | EUR | Germany ZEW Economic Sentiment Oct | -66 | -61.9 | ||

| 09:00 | EUR | Germany ZEW Current Situation Oct | -69 | -60.5 | ||

| 09:00 | EUR | Eurozone ZEW Economic Sentiment Oct | -60.6 | -60.7 | ||

| 12:15 | CAD | Housing Starts Y/Y Sep | 262K | 267K | ||

| 13:15 | USD | Industrial Production M/M Sep | -0.10% | -0.20% | ||

| 13:15 | USD | Capacity Utilization Sep | 80.00% | 80.00% | ||

| 14:00 | USD | NAHB Housing Market Index Oct | 43 | 46 |