Products You May Like

Yen remains the worst performer for the week but selling appears to have slowed after Japan’s intervention yesterday. Dollar is following as next weakest, as risk sentiment stabilized. Also, Dollar bulls are clearly on guard against sudden volatility in Yen. Australian Dollar is the strongest one together with New Zealander. European majors are mixed, with Sterling with a slight upper hand against Euro and Swiss Franc.

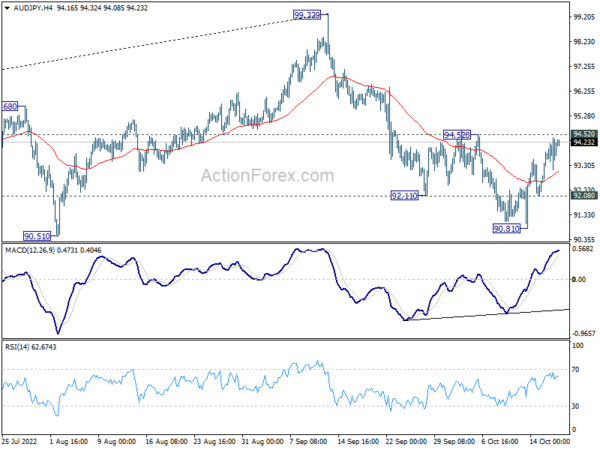

Technically, Aussie’s rise this week is seen generally as a corrective move, which might not extend much further. To be more specific, AUD/USD is held below 0.6362 minor resistance while EUR/AUD is staying above 1.5429 minor support. Even against the weak Yen, AUD/JPY’s recovery is capped by 94.52 resistance, keeping near term outlook bearish. Break of 92.08 minor support in AUD/JPY will argue that fall from 99.32 is ready to resume through 90.81 low. But of course, break of the mentioned levels will indicate that Aussie’s rebound is gaining momentum finally.

In Asia, at the time of writing, Nikkei is up 0.73%. Hong Kong HSI is down -0.96%. China Shanghai SSE is down -0.40%. Singapore Strait Times is up 0.32%. Japan 10-year JGB yield is down -0.0021 at 0.257. Overnight, DOW rose 1.12%. S&P 500 rose 1.14%. NASDAQ rose 0.90%. 10-year yield dropped -0.017 to 3.998.

Fed Kashkari: I don’t see how we can stop if underlying inflation doesn’t flatten out

Minneapolis Fed President Neel Kashkari said yesterday, “I’ve said publicly that I could easily see us getting into the mid-4%s early next year.”

“But if we don’t see progress in underlying inflation or core inflation, I don’t see why I would advocate stopping at 4.5%, or 4.75% or something like that,” he added. “We need to see actual progress in core inflation and services inflation and we are not seeing it yet.”

“That number that I offered is predicated on a flattening out of that underlying inflation,” Kashkari said. “If that doesn’t happen, then I don’t see how we can stop.”

BoJ Kuroda: Recent depreciation of Yen was sharp and one-sided

BoJ Governor Haruhiko Kuroda told a parliamentary committee that recent depreciation of Yen was sharp and one-sided “This kind of yen weakening makes it difficult for companies to set their business plans and raises uncertainties in their outlook,” he said. “This is negative for our economy and not desirable.”

Separately, board member Seiji Adachi said, “When looking at the global financial and economic environment surrounding Japan, downside risks are building up rapidly… When downside risks are so high, we should be cautious of shifting toward monetary tightening.”

Australia Westpac leading index points to material loss in momentum heading into 2023

Australia Westpac leading index six-month annualized growth rate declined from -0.33% to -1.15% in September. It’s now at the weakest level since the pandemic first hit in 2020, and prior to that, since early 2016. The index continued to point to a “material loss in momentum to a below-trend growth pace heading into 2023.”

Westpac added that the signal in broadly in line with forecast that economic growth will slow from 3.4% in 2022 to 1.0% in 2023, with sharp slowdown in consumer spending. It said, “that slowdown is likely to intensify through 2023 as rising interest rates and a softening labour market take their toll.”

On RBA policy, Westpac pointed to minutes of October meeting, which noted, “drawing out policy adjustments would also help to keep public attention focused for a longer period on the Board’s resolve to return inflation to target.” The thinking was in line with Westpac’s forecast that RBA will have a series of 25bps rate hikes in the future months of November, December, February, and March.

Looking ahead

UK CPI and PPI are the main feature in European session. Eurozone will also release CPI final. Later in the day, Canada CPI will take center stage with RMPI and IPPI. US will release building permits and housing starts, as well as Fed’s Beige Book report.

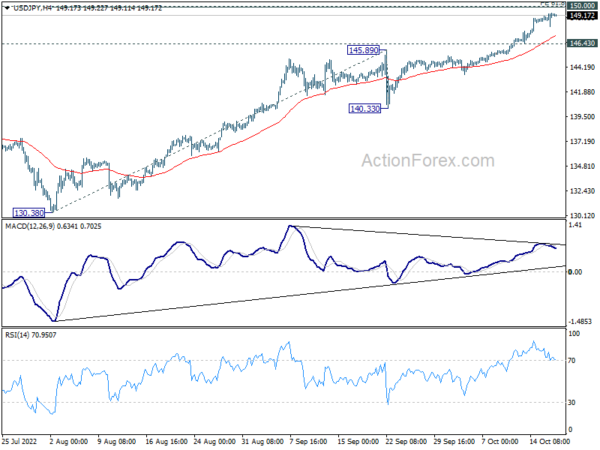

USD/JPY Daily Outlook

Daily Pivots: (S1) 148.80; (P) 149.09; (R1) 149.52; More…

There is no clear sign of topping in USD/JPY yet even though it continues to lose upside moment. Further rise is in favor to 61.8% projection of 130.38 to 140.33 from 145.89 at 149.91. Yet, beware that Japan might intervene again to defend 150 psychological level. On the downside, break of 146.43 minor support will indicate short term topping and bring deeper pull back.

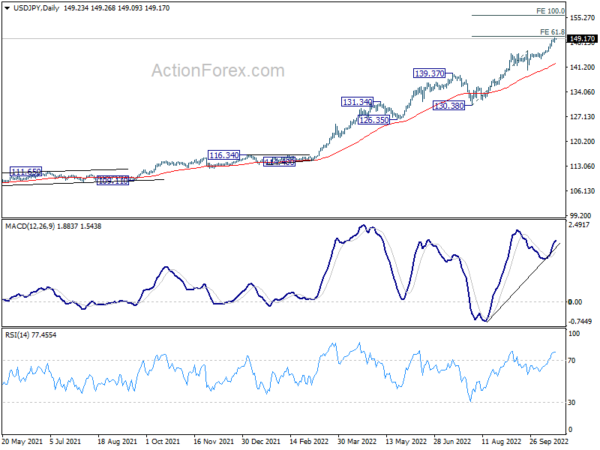

In the bigger picture, up trend from 101.18 is still in progress, as part of the whole up trend from 75.56 (2011 low). 147.68 (1998 high) was already met and there is not clearly sign of topping yet. In any case, break of 139.37 resistance turned support is needed to be the first sign of medium term topping. Otherwise, further rise is in favor to next target at 160.16 (1990 high).

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:30 | AUD | Westpac Leading Index M/M Sep | 0.00% | -0.10% | -0.20% | |

| 06:00 | GBP | CPI M/M Sep | 0.40% | 0.50% | ||

| 06:00 | GBP | CPI Y/Y Sep | 10.00% | 9.90% | ||

| 06:00 | GBP | Core CPI Y/Y Sep | 6.40% | 6.30% | ||

| 06:00 | GBP | RPI M/M Sep | 0.50% | 0.60% | ||

| 06:00 | GBP | RPI Y/Y Sep | 12.40% | 12.30% | ||

| 06:00 | GBP | PPI Input M/M Sep | 1.10% | -1.20% | ||

| 06:00 | GBP | PPI Input Y/Y Sep | 17.20% | 20.50% | ||

| 06:00 | GBP | PPI Output M/M Sep | 0.60% | -0.10% | ||

| 06:00 | GBP | PPI Output Y/Y Sep | 15.00% | 16.10% | ||

| 06:00 | GBP | PPI Core Output M/M Sep | 0.90% | 0.30% | ||

| 06:00 | GBP | PPI Core Output Y/Y Sep | 12.70% | 13.70% | ||

| 09:00 | EUR | Eurozone CPI M/M Sep F | 10.00% | 10.00% | ||

| 09:00 | EUR | Eurozone CPI Core Y/Y Sep F | 4.80% | 4.80% | ||

| 12:30 | USD | Building Permits Sep | 1.55M | 1.54M | ||

| 12:30 | USD | Housing Starts Sep | 1.46M | 1.58M | ||

| 12:30 | CAD | Raw Material Price Index Sep | -3.50% | -4.20% | ||

| 12:30 | CAD | Industrial Product Price M/M Sep | -0.90% | -1.20% | ||

| 12:30 | CAD | CPI M/M Sep | -0.10% | -0.30% | ||

| 12:30 | CAD | CPI Y/Y Sep | 6.80% | 7.00% | ||

| 12:30 | CAD | CPI Median Y/Y Sep | 4.80% | 4.80% | ||

| 12:30 | CAD | CPI Trimmed Y/Y Sep | 5.10% | 5.20% | ||

| 12:30 | CAD | CPI Common Y/Y Sep | 5.60% | 5.70% | ||

| 14:30 | USD | Crude Oil Inventories | 2.5M | 9.9M | ||

| 18:00 | USD | Fed’s Beige Book |