Products You May Like

- Gold price has faltered on its previous rebound as the US dollar makes a comeback.

- Cooling aggressive Fed rate hike calls, China concerns and dismal US tech earnings weigh on risk sentiment.

- XAU/USD sees range play amid battle lines well-defined ahead of critical US events.

Gold price is treading water in a familiar range around the $1,650 psychological level, lacking a follow-through upside bias amid a modest comeback staged by the US dollar across the board. The risk-off flows have returned to markets, as disappointing earnings from the US tech giants, Microsoft and Google, revived recession fears and revived the dollar’s safe-haven appeal. However, the risk-aversion-driven weakness in the Treasury yields combined with easing aggressive Fed rate hike expectations keep the downside cushioned in the bright metal. Investors also refrain from placing big bets on the bullion ahead of the critical event risks, including the ECB rate hike decision and the US advance Q3 GDP, scheduled later this week. The US corporate earnings reports and China’s covid updates will be closely followed for any impact on the risk sentiment, which will be pivotal for fresh dollar and gold valuations.

Also read: Markets steady as investors eye earnings and ECB

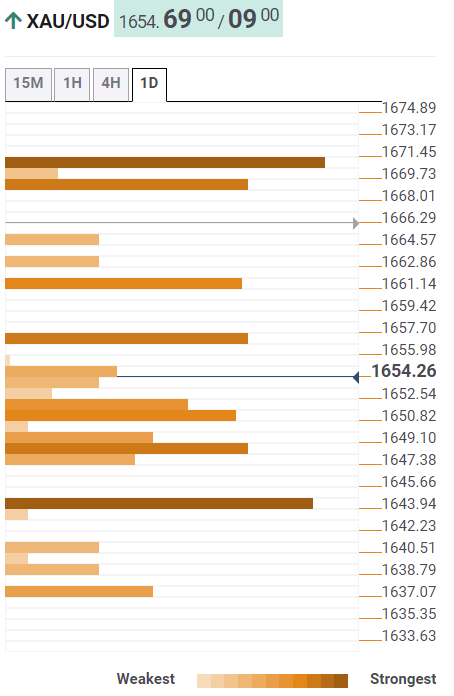

Gold Price: Key levels to watch

The Technical Confluence Detector shows that the gold price is flirting with a bunch of healthy support levels at around $1,650, the convergence of the SMA50 one-hour, SMA10 one-day and the previous low four-hour.

The next cushion is placed at $1,648, where the Fibonacci 61.8% one-day meets with the Fibonacci 38.2% one-week.

The last line of defense for XAU buyers is envisioned at $1,644, the intersection of the SMA5 one-day and Fibonacci 23.6% one-month.

Alternatively, gold price needs to clear the convergence of the Fibonacci 23.6% one-week and one-day at $1,657. A firm break above the latter will trigger a fresh upswing towards the Fibonacci 38.2% one-month at $1,660.

The previous day’s high at $1,662 will be next on buyers’ radars.

Here is how it looks on the tool

About Technical Confluences Detector

The TCD (Technical Confluences Detector) is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. If you are a short-term trader, you will find entry points for counter-trend strategies and hunt a few points at a time. If you are a medium-to-long-term trader, this tool will allow you to know in advance the price levels where a medium-to-long-term trend may stop and rest, where to unwind positions, or where to increase your position size.