Products You May Like

The Asian markets are generally quiet today, with the expectation in China. The Shanghai SSE reversed earlier losses and surged before the break, with talks of buying by the “national team”. But Yuan’s decline continued and hit another record low. In the forex markets, most major pairs and crosses are bounded inside yesterday’s range. Today’s economic calendar is relatively light, but German Ifo business climate and US consumer confidence could trigger some volatility. Nevertheless, traders might wait for rate decisions of BoC and ECB later in the week before making a committed move.

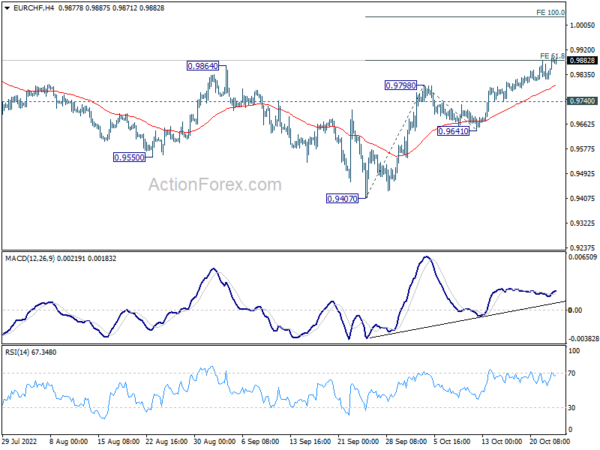

Technically, EUR/CHF is attempting to build up momentum to resume the rally from 0.9407. Sustained trading above 61.8% projection of 0.9407 to 0.9798 from 0.9641 at 0.9883 will solidify the case of medium term bottoming and target 100% projection at 1.0032. The interest there is whether EUR/CHF’s rise, if happens, would result in EUR/USD breaking through 0.9998, or USD/CHF breaking through 1.0146, or both.

In Asia, at the time of writing, Nikkei is up 1.23%. Hong Kong HSI is up 0.87%. China Shanghai SSE is up 0.74%. Singapore Strait Times is up 0.61%. Japan 10-year JGB yield is up 0.0002 at 0.257. Overnight, DOW rose 1.34%. S&P 500 rose 1.19%. NASDAQ rose 0.86%. 10-year yield rose 0.021 to 4.234.

RBNZ Conway hopeful that inflation has peaked

RBNZ Chief Economist Paul Conway said annual inflation rate of 7.2% was “obviously too high”. But, he added, “we expect to see inflationary pressures easing going forward” and “are hopeful that it has peaked.”

The “very rapid tightening in monetary policy” is starting to have an effect and “there are early signs that the economy is starting to cool,” he said.

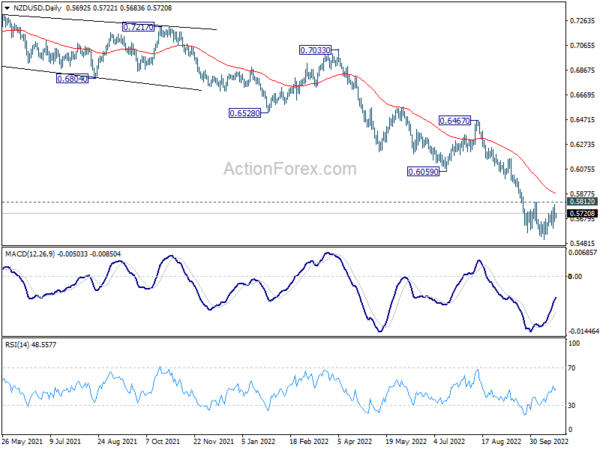

NZD/USD is currently still bounded inside the consolidation pattern from 0.5511. While a breach of 0.5812 resistance cannot be ruled out, upside could be capped by 55 day EMA (now at 0.5876). That is, an eventual downside breakout is expected, sooner or later, through 0.5511 to resume larger down trend.

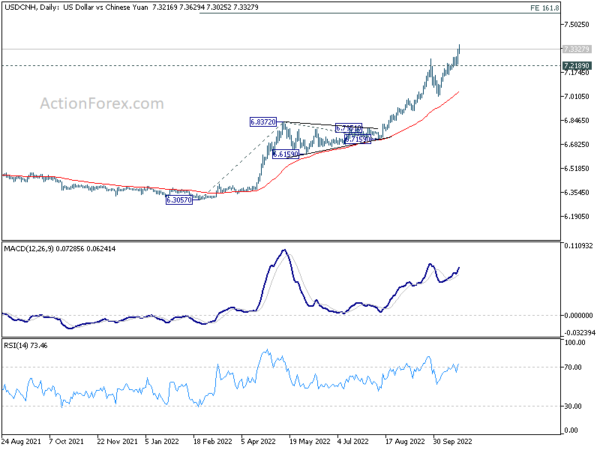

Offshore Chinese Yuan hits new record low

Offshore Chinese Yuan hit a new record low against Dollar today, recent depreciation continued. That’s second straight session of decline after President Xi Jinping secured a tradition-breaking third consecutive leadership term on Sunday, unveiled a new cabinet stacked with his loyalists.

In response to the decline in exchange rate, PBOC raises the cross-border macro prudential adjustment ratio for corporates and financial institutions to 1.25 from 1. The central bank said, it will “increase the sources of cross-border funds for enterprises and financial institutions, and guide them to optimize the asset-liability structure.”

Purely technically, near term outlook in USD/CNH will stay bullish as long as 7.2189 support holds. Current up trend should target 161.8% projection of 6.3057 to 3.8372 from 6.7159 at 7.5759. But of course, the government could intervene any time.

Looking ahead

Germany Ifo business climate is the main focus in European session. US consumer confidence will take center stage later in the day, and house price index will be featured too.

USD/CAD Daily Outlook

Daily Pivots: (S1) 1.3617; (P) 1.3696; (R1) 1.3785; More…

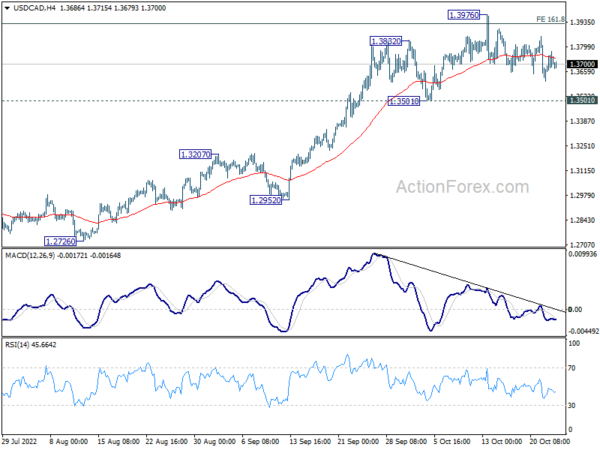

USD/CAD is still engaging in the consolidation pattern from 1.3976 and intraday bias remains neutral. Deeper retreat might be seen but downside should be contained by 1.3501 support. On the upside, firm break of 1.3976 will target 200% projection of 1.2005 to 1.2947 from 1.2401 at 1.4285. However, firm break of 1.3501 will bring deeper correction to 55 day EMA (now at 1.3426) and possibly below.

In the bigger picture, up trend from 1.2005 (2021 low) is still in progress. Based on current impulsive momentum, it could be resuming long term up trend from 0.9056 (2007 low). Whether it is or it isn’t, retest of 1.4689 (2016 high) should be seen next. This will now remain the favored case as long as 1.3222 resistance turned support holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 08:00 | EUR | Germany IFO Business Climate Oct | 84 | 84.3 | ||

| 08:00 | EUR | Germany IFO Current Assessment Oct | 92.5 | 94.5 | ||

| 08:00 | EUR | Germany IFO Expectations Oct | 74.9 | 75.2 | ||

| 13:00 | USD | S&P/Case-Shiller Home Price Indices Y/Y Aug | 15.40% | 16.10% | ||

| 13:00 | USD | Housing Price Index M/M Aug | -0.30% | -0.60% | ||

| 14:00 | USD | Consumer Confidence Oct | 105.6 | 108 |