Products You May Like

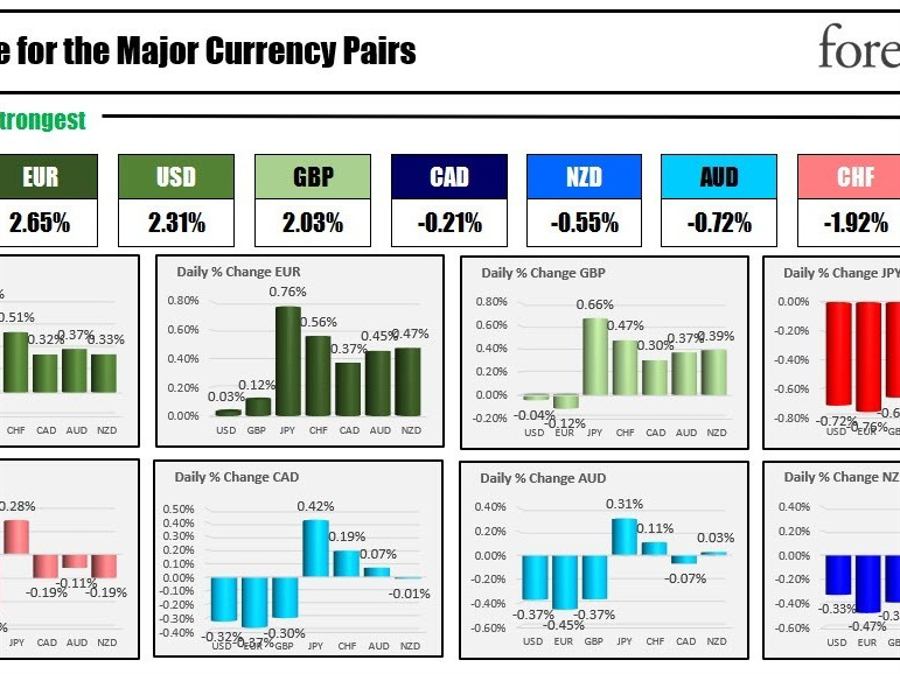

The strongest to weakest of the major currencies

The EURUSD is the strongest of the major currencies and the JPY is the weakest. The EUR strength comes one day after yields moved lower on a less hawkish 75 bp hike by the ECB led to a wander to the downside in the EURUSD. The price moved below the 100 hour MA and the swing low from July at 0.99515, but preliminary CPI inflation data out of the EU today showed inflation is not near dead with France CPI up 1.0% and Italy CPI up 3.5% for the month. German CPI was also higher than expected at 0.9% (vs 0.6% est). Ouch. The German 10 year which fell back below 2% yesterday is trading at 2.115% in early NA trading.

The BOJ may have shown some acknowledgement of a tilt after they kept rates unchanged by saying:

But, BOJs Kuroda poured some water on that comment by saying later:

- Will not hesitate to ease monetary policy even further if needed

In other news,

- Elon Musk takes twitter private and promptly fired the CEO and CFO announcing “The bird is freed”. Here we go.

- US stocks are mixed after Amazon disappointed. It’s shares are down over -$15 or -13.58% but it was worse in after-hours trading. Apple earnings were better and its shares are up about $1.00 in pre-market trading Exxon announced recod earnings with less than expected revenues. HMMMM. Chevron reported both higher earnings and revenues

- US core PCE price index will be released at 8:30 AM with expectations of 0.5% increase vs. 0.6% last month. The urine year is characterized 5.2% from 4.9%. Personal income and personal spending will also be released at 8:30 AM. Canada GDP, pending home sales, and University of Michigan final consumer sentiment are also on the schedule today.

A current look around the markets shows:

- Spot gold is down -$13.44 or -0.81% at $1648.96

- spot silver is down -$0.31 or -1.56% at $19.28

- WTI crude oil is trading down -$0.88 at $88.20

- Bitcoin is a touch lower at $20,161

In the premarket for US stocks, the major indices are lower:

- Dow industrial average -10.28 points after yesterdays 194.17 point rise. The Dow is on a 2 day win streak

- S&P index is down 21 points after yesterdays -23.3 point decline. The S&P is on a 2 day losing streak

- NASDAQ index -118 points after yesterdays -178.32 point decline. The NASDAQ index is also on a 2 day losing streak

In the European equity markets, the major indices are all trading lower:

- German DAX -0.56%

- France’s CAC -0.18%

- UK’s FTSE 100 -0.47%

- Spain’s Ibex -0.91%

- Italy’s FTSE MIB -0.92%

In the US debt market, yields are higher

US yields are higher

In the European debt market, the benchmark 10 year yields are also trading higher after better-than-expected preliminary him him him inflation data:

European yields are higher