Products You May Like

Australian Dollar surged broadly today following RBA’s decision to leave interest rates unchanged at 4.35%, as widely expected. What caught the market’s attention was RBA’s continued focus on inflation risks, making it clear that the central bank is not considering a rate cut anytime soon. During the post-meeting press conference, Governor Michele Bullock downplayed the significance of tomorrow’s monthly CPI data, describing them as volatile and less reflective of the underlying inflation trend. Nevertheless, she clarified that the board did not explicitly consider a rate hike at this meeting, signaling a steady approach for now

The broader market mood was lifted by China’s announcement of an unexpectedly large stimulus package. The package includes a forthcoming 50 bps reduction in the reserve requirement ratio for banks, along with a cut in the seven-day reverse repurchase rate from 1.7% to 1.5%. Furthermore, PBoC indicated an intention to cut loan prime rates by 20 to 25 basis points, although the timeline for these moves remains unclear, and the details remain sparse. Additional measures were announced, such as reduced down payments for second homes, aimed at stimulating the property market. This is seen as China’s most significant stimulus move since the pandemic’s onset, but skepticism remains over whether the new measures will be sufficient to fully revitalize the struggling economy.

Overall in the currency markets, Australian Dollar continues to lead the pack, buoyed by both RBA’s stance and positive risk sentiment from China’s stimulus actions. New Zealand Dollar and Canadian Dollar also posted gains, reflecting broader risk-on sentiment. Meanwhile, Euro has fallen to the bottom of the performance chart after disappointing PMI data fueled speculation of a ECB rate cut as early as October. Japanese Yen and Dollar are also struggling, weighed down by a lack of safe-haven demand. Sterling and Swiss Franc sit in the middle of the currency performance spectrum.

Technically, USD/CNH is now eyeing an important fibonacci level as down trend from 7.3745 (2023 high) extended. Some support could be seen from 100% projection of 7.3679 to 7.0870 from 7.3111 at 7.0302 to bring rebound. But firm break of 7.1364 resistance is needed to confirm short term bottoming. Otherwise, rise will stay on the downside. Decisive break of 7.0302 could prompt downside acceleration to 161.8% projection at 6.8566, even if fall from 7.3679 is just the third leg of the long term pattern from 7.3745.

In Asia, at the time of writing, Nikkei is up 0.83%. Hong Kong HSI is up 3.58%. China Shanghai SSE is up 3.55%. Singapore Strait Times is up 0.31%. Japan 10-year JGB yield is down -0.0421 at 0.822. Overnight, DOW rose 0.15%. S&P 500 rose 0.28%. NASDAQ rose 0.14%. 10-year yeild rose 0.011 to 3.739.

RBA holds rates at 4.35%, remains vigilant on inflation risks

RBA kept the cash rate target unchanged at 4.35% today, as widely anticipated by markets. The central bank stated that data since the August Statement on Monetary Policy have “reinforced the need to remain vigilant to upside risks to inflation.” Maintaining its stance of “not ruling anything in or out,” RBA emphasized its determination to return inflation to target levels and affirmed it will “do what is necessary.”

Regarding the inflation outlook, RBA noted that headline inflation is expected to “fall further temporarily” due to federal and state cost-of-living relief measures. However, it does not foresee inflation returning sustainably to the 2–3% target range until 2026. This suggests that while short-term relief is expected, underlying inflationary pressures remain a concern over the medium term.

Japan’s PMI manufacturing dips to 49.6, services rises to 53.9

Japan’s PMI manufacturing index ticked down from 49.8 to 49.6, marking its third consecutive month in negative territory. On the other hand, services sector offered some relief as its PMI edged higher, rising from 53.7 to 53.9. Composite PMI slipped from 52.9 to 52.5, indicating a slight softening in growth momentum.

Usamah Bhatti, Economist at S&P Global Market Intelligence, noted that Japan’s private sector expansion carried on through Q3, though at a slower pace. The expansion remained services-led, with the sector showing its strongest growth in five months, while manufacturing output fell back into contraction for the second time in three months.

Bhatti also highlighted that input cost inflation has eased to a six-month low, with both manufacturing and services firms reporting softer cost pressures. However, service providers are increasingly passing higher costs onto customers, as output price inflation ticked up slightly in September. Confidence in the future remains positive, but the overall sentiment has weakened to its lowest level since April 2022.

Fed’s Goolsbee signals multiple rate cuts ahead as focus shifts to employment

Chicago Fed President Austan Goolsbee suggested at an event overnight that Fed will likely implement “many more rate cuts over the next year” as it shifts its focus from inflation to employment concerns.

Goolsbee further noted that a proactive approach is necessary to avoid potential disruptions in the labor market. “It’s just not realistic to wait until problems show up,” he said, highlighting the need for Fed to avoid being “behind the curve” in managing economic risks.

While the timing of the initial rate cut may be less critical, Goolsbee stressed the importance of a “longer-arc view” to ensure favorable conditions for both inflation and employment. He pointed out that “rates need to come down significantly going forward” to maintain economic stability.

Looking ahead

Germany Ifo business climate is the main feature in European session. Later in the day, US will release house price index and consumer confidence.

EUR/AUD Daily Outlook

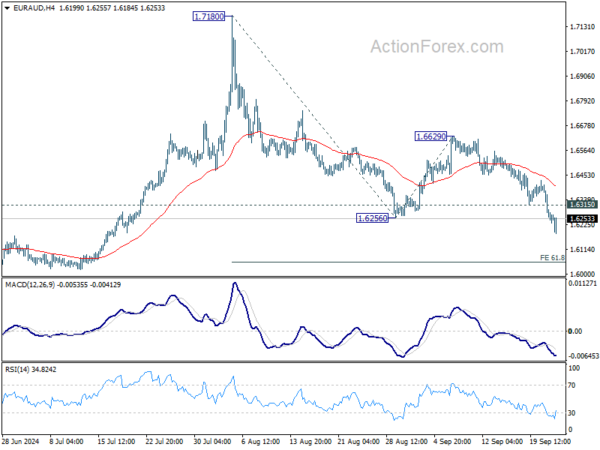

Daily Pivots: (S1) 1.6182; (P) 1.6302; (R1) 1.6370; More…

EUR/AUD’s fall from 1.7180 resumed by breaking through 1.6256 support. Intraday bias stays on the downside for 61.8% projection of 1.7180 to 1.6256 from 1.6629 at 1.6058, which is close to 1.5996 key support level. On the upside, above 1.6315 minor resistance will turn intraday bias neutral first. But outlook will remains bearish as long as 1.6629 resistance holds.

In the bigger picture, outlook is mixed up by the deeper than expected fall from 1.7180. Yet as long as 1.5996 support holds, up trend from 1.4281 (2022 low) is still in favor to resume at a later stage. Firm break of 1.7180 will pave the way to 61.8% projection of 1.4281 to 1.7062 from 1.5996 at 1.7715.

Economic Indicators Update

| GMT | CCY | EVENTS | ACT | F/C | PP | REV |

|---|---|---|---|---|---|---|

| 00:30 | JPY | Manufacturing PMI Sep P | 49.6 | 49.9 | 49.8 | |

| 00:30 | JPY | Services PMI Sep P | 53.9 | 53.7 | ||

| 04:30 | AUD | RBA Interest Rate Decision | 4.35% | 4.35% | 4.35% | |

| 05:30 | AUD | RBA Press Conference | ||||

| 08:00 | EUR | Germany IFO Business Climate Sep | 86.1 | 86.6 | ||

| 08:00 | EUR | Germany IFO Current Assessment Sep | 86 | 86.5 | ||

| 08:00 | EUR | Germany IFO Expectations Sep | 86.3 | 86.8 | ||

| 13:00 | USD | S&P/CS Composite-20 HPI Y/Y Jul | 5.90% | 6.50% | ||

| 13:00 | USD | Housing Price Index M/M Jul | 0.20% | -0.10% | ||

| 14:00 | USD | Consumer Confidence Sep | 103.5 | 103.3 |