Products You May Like

Trading in in the currency markets continue to be relatively subdued. Sterling is so far the strongest one for today. But it’s staying below near term resistance against Euro and Dollar so far. It’s also hovering below yesterday’s high against Yen. Yen appears to be recovery, in particular against Dollar. But any extension in treasury yield’s rally would knock it down easily. New Zealand Dollar and Canadian Dollar are the softer ones for today. Dollar continues to trade mixed, shrugging off retail sales data, awaiting breakout.

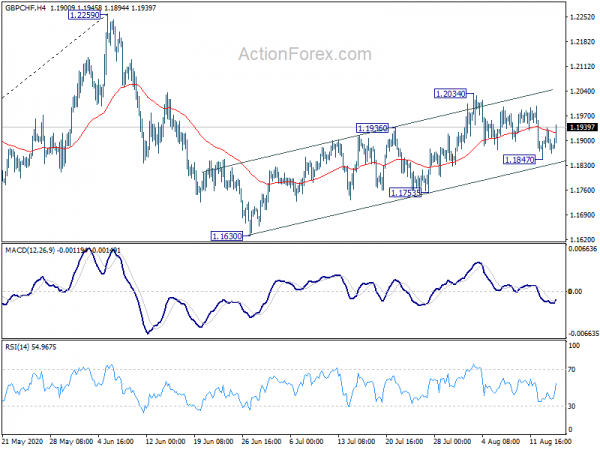

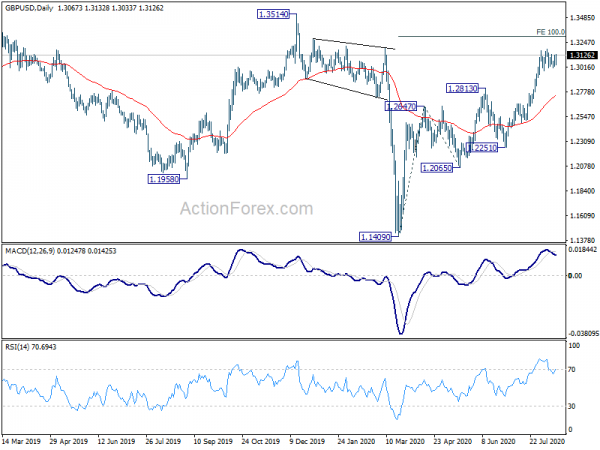

Technically, with today’s rebound, GBP/USD could be eyeing 1.3185 temporary top and break will resume recent rally from 1.1409. GBP/CHF’s break of 4 hour 55 EMA argues that pull back from 1.2034 has completed at 1.1847. Further rise would be seen to 1.2034 and above to resume the choppy rise from 1.1630. As for EUR/GBP, we’re seeing it as in a sideway consolidation from 0.9175. Hence, while deeper fall could be seen as the Pound rises elsewhere, EUR/GBP will likely be contained by 0.8930 support.

– advertisement –

In Europe, currently, FTSE is down -1.36%. DAX is down -0.75%. CAC is down -1.50%. German 10-year yield is down -0.0092 at -0.420, could be failing -0.4 handle. Earlier in Asia, Nikkei rose 0.17%. Hong Kong HSI dropped -0.19%. China Shanghai SSE rose 1.19%. Singapore Strait Times dropped -0.56%. Japan 10-year JGB yield rose 0.0135 to 0.050.

US retail sales rose 1.2% in Jul, ex-auto sales up 1.9%

US retail sales rose 1.2% mom to USD 536.0B in July, below expectation of 1.7% mom. Though, ex-auto sales rose 1.9% mom, above expectation of 1.4% mom. Ex-gasoline sales rose 0.9% mom. Ex-auto and gasoline sales rose 1.5% mom.

Non-farm productivity rose 7.3% in Q2, above expectation of 1.5%. Unit labor costs rose 12.2%, above expectation of 6.5%.

From Canada, manufacturing sales rose 20.7% mom in June, above expectation of 16.4% mom.

Germany expects strong increase in Q3 GDP

Germany’s Economy Ministry said the country is “back on the road to recovery” since tough shutdown was eased since May. Industry’s “rapid catching-up” is continuing, largely driven by automotive sector. But it’s expected to lose momentum due to “weak foreign demand”.

Also, with “somewhat more favorable starting position”, there will be a “strong increase in gross domestic product in the third quarter.”. But the course will depends on the pandemic at home and abroad. Some of Germany’s trading partners are “still heavily impacted by the pandemic”.

“For this reason alone, after the first stronger recovery in May and June, the further recovery process of the German economy will only progress slowly and take a long time to complete.”

Eurozone GDP contracted -12.1% in Q2, EU down -11.7%

GDP contracted -12.1% in Eurozone in Q2, -11.7% qoq in EU. Both were sharpest declines since the series began in 1995. Annually, GDP contracted -15.0% yoy in Eurozone, -14.1% in EU, also worst on record. Employment in Eurozone dropped record -2.8% qoq, and -2.6% in EU.

Also released, Eurozone trade surplus widened to EUR 17.1B in June, up from EUR 8.0B, but smaller than expectation of EUR 18.0B. Swiss PPI came in at 0.1% mom, -3.3% yoy.

RBA Lowe: Cash rate highly likely to stay at 0.25% for some years

RBA Governor Philip Lowe reiterated the Board’s commitment on not raising interest rate until progress is made towards full employment, with confidence that inflation could sustain in 2-3% target range. He added that “, these conditions are not likely to be met for at least three years”. Hence, it’s “highly likely” that cash rate will be at the current 0.25% level “for some years”. The 3-year yield target of 0.25% also “reinforces this message”.

Lowe also note again that the negative interest rates are not justified by the cost benefits. He added, “in a world that is so uncertain and fluid, I don’t think it is prudent to rule it out”. But as seen in some European countries and Japan, “negative interest rates also encourage people to save more, not spend more”. So, “negative interest rates can become contractionary”.

He also noted that Australian Dollar’s exchange rate is not overvalued even though he’ like it to be lower. Huge amount of intervention is needed to push the Aussie down and it wouldn’t be a successful strategy.

New Zealand BusinessNZ PMI rose to 58.8, but employment stays in contraction

New Zealand BusinessNZ Performance of Manufacturing Index rose to 58.8 in July, slightly up from 56.2. Looking at some details, productions rose from 58.4 to 61.4. New orders rose from 58.2 to 67.4. However, employment dropped from 48.5 to 46.5. Employment remained weak and stayed in contraction for the 5th straight month.

BusinessNZ’s executive director for manufacturing Catherine Beard warned: “we should be careful not to interpret this as a new dawn for the sector, rather a catch-up for many trying to get back to a new sense of normality.”

BNZ Senior Economist, Doug Steel said that “July’s PMI had firmly set up the idea that manufacturing GDP would bounce back strongly in Q3 after what was surely a very large decline in Q2. The latest virus outbreak calls that into question and adds to the reservations that we already had for growth in Q4.”

China retail sales unexpectedly contracted in July

The batch of economic data released from China is mixed. In particular, retail sales contracted -1.1% yoy in July, versus expectation of 0.3% yoy. That showed vulnerability in domestic demand. Nevertheless, industrial production rose 4.8% yoy in July, slightly above expectation of 4.7% yoy. Fixed asset investment dropped -1.6% ytd yoy in July, above expectation of -3.3% ytd yoy.

Suggested reading on China: China’s Retail Sales Shrank Further, Evidencing Weak Domestic Demand

GBP/USD Mid-Day Outlook

Daily Pivots: (S1) 1.3024; (P) 1.3074; (R1) 1.3116; More….

GBP/USD recovers notably after drawing support from 4 hour 55 EMA. But it’s still staying below 1.3185 resistance and intraday bias remains neutral. Overall, further rally is expected with 1.2982 support intact. On the upside, break of 1.3184 will resume larger rise to 100% projection of 1.1409 to 1.2647 from 1.2065 at 1.3303. However, break of 1.2982 support should confirm short term topping. Intraday bias will be turned back to the downside for 1.2813 resistance turned support.

In the bigger picture, while the rebound from 1.1409 is strong, there is not enough evidence for trend reversal yet. Down trend from 2.1161 (2007 high) should still resume sooner or later. However, decisive break of 1.3514 should at least confirm medium term bottoming and turn outlook bullish for 1.4376 resistance first.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:30 | NZD | BusinessNZ PMI Jul | 58.8 | 56.3 | 56.2 | |

| 02:00 | CNY | Retail Sales Y/Y Jul | -1.10% | 0.30% | -1.80% | |

| 02:00 | CNY | Industrial Production Y/Y Jul | 4.80% | 4.70% | 4.80% | |

| 02:00 | CNY | Fixed Asset Investment (YTD) Y/Y Jul | -1.60% | -3.30% | -3.10% | |

| 04:30 | JPY | Tertiary Industry Index M/M Jun | 7.90% | -2.10% | -2.90% | |

| 06:30 | CHF | Producer and Import Prices M/M Jul | 0.10% | 0.50% | ||

| 06:30 | CHF | Producer and Import Prices Y/Y Jul | -3.30% | -3.50% | ||

| 09:00 | EUR | Eurozone Trade Balance (EUR) Jun | 17.1B | 18.0B | 8.0B | 8.6B |

| 09:00 | EUR | Eurozone GDP Q/Q Q2 P | -12.10% | -12.10% | -12.10% | |

| 09:00 | EUR | Eurozone Employment Change Q/Q Q2 P | -2.80% | -1.70% | -0.20% | |

| 12:30 | CAD | Manufacturing Sales M/M Jun | 20.70% | 16.40% | 10.70% | |

| 12:30 | USD | Retail Sales M/M Jul | 1.20% | 1.70% | 7.50% | 8.40% |

| 12:30 | USD | Retail Sales ex Autos M/M Jul | 1.90% | 1.40% | 7.30% | 8.30% |

| 12:30 | USD | Nonfarm Productivity Q2 P | 7.30% | 1.50% | -0.90% | |

| 12:30 | USD | Unit Labor Costs Q2 P | 12.20% | 6.50% | 5.10% | |

| 13:15 | USD | Industrial Production M/M Jul | 3.30% | 5.40% | ||

| 13:15 | USD | Capacity Utilization Jul | 70.30% | 68.60% | ||

| 14:00 | USD | Michigan Consumer Sentiment Index Aug P | 71.5 | 72.5 | ||

| 14:00 | USD | Business Inventories Jun | -1.20% | -2.30% |