Products You May Like

USD/JPY falls to its lowest level since 22 September, just below 105.00

Dollar weakness is the major theme in the currencies market today and it is apparent that a lot of that is riding on the back of hopes of a stimulus deal coming – one way or another.

While short-term headlines may still bring about some pessimism and a pre-election deal is certainly not going to happen, that isn’t stopping bond investors from pricing in a stimulus package as evident by the move in Treasury yields so far today.

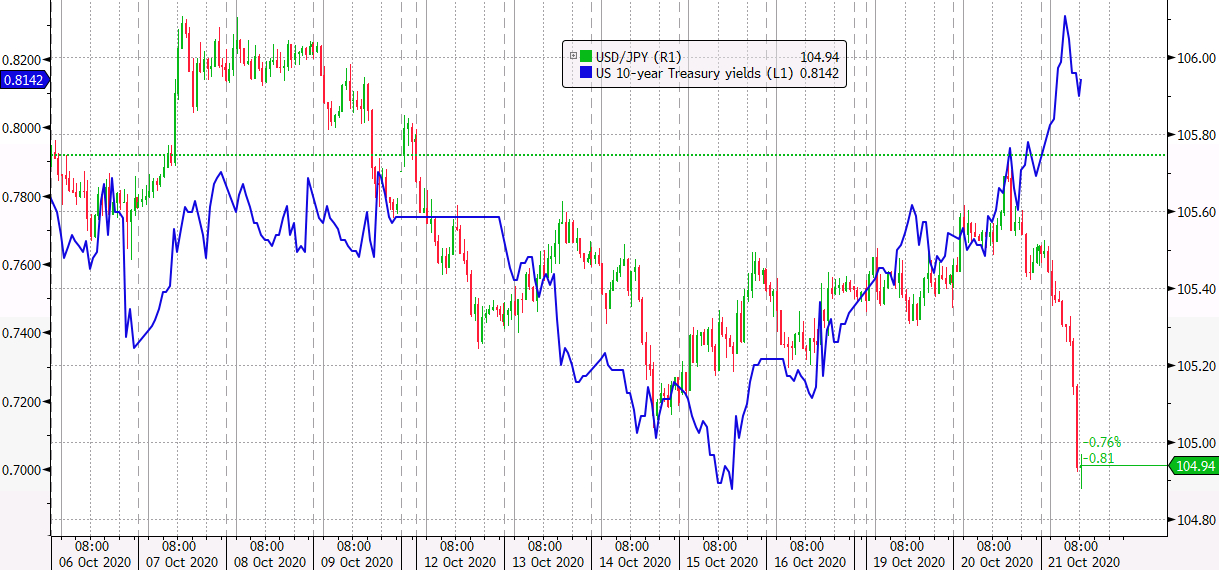

Despite that, USD/JPY is down 0.5% to levels just under 105.00 as price action signals a break from the typical yields correlation that we are used to seeing in the pair.

In a sense, the divergence here tells us that what is happening in the market now is more than just a “risk” move. It is more to do with stimulus pricing (reflation trade narrative) and possibly US election odds pricing as well i.e. a ‘blue sweep’ anticipated.