Products You May Like

By Casey Wagner and Vildana Hajric

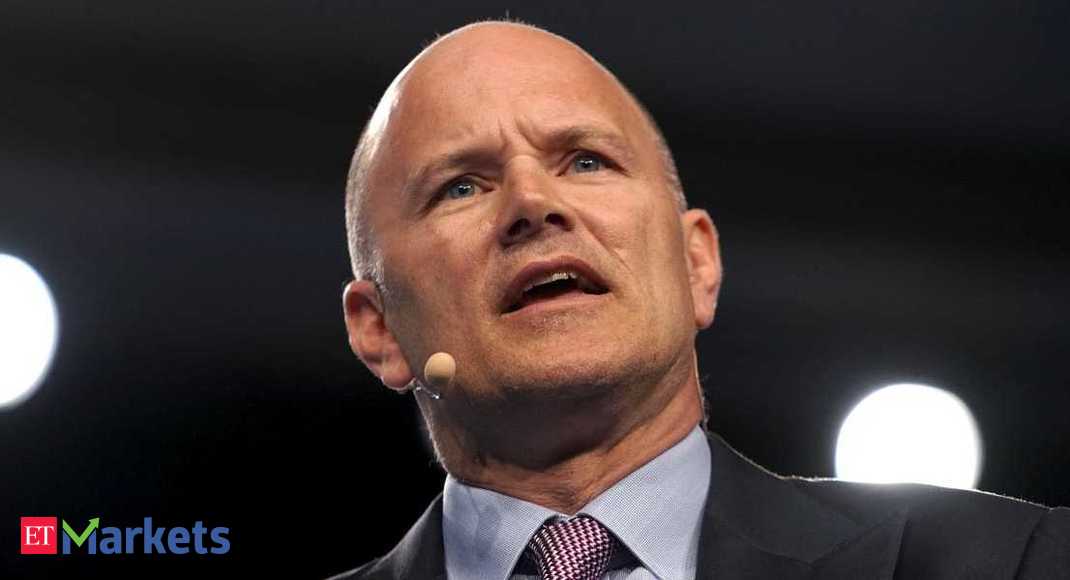

Billionaire investor Mike Novogratz is doubling down on a call Bitcoin serves as digital gold.

“I don’t think Bitcoin is going to be used as a transactional currency anytime in the next five years,” Novogratz, founder and chief executive officer of Galaxy Investment Partners, said in an interview with Bloomberg TV and Radio. “Bitcoin is being used as a store of value.”

Crypto fans have seized on that argument while raising concerns about central bank money printing during the pandemic and the potential for inflation to shoot higher. They point out that global central banks are looking into creating their own digital assets, while China is already testing a digital yuan.

“And so Bitcoin as a gold, as digital gold is just going to keep going higher,” said Novogratz. “More and more people are going to want it as some portion of their portfolio.”

Bloomberg

BloombergBitcoin has rallied more than 13% this week, climbing beyond $13,000 on Wednesday for the first time in more than a year after PayPal Holdings Inc. said it will allow customers to use cryptocurrencies. Bitcoin dropped about 1.8% to $12,882 on Friday, the first decline in a week.

Novogratz and many crypto fans heralded the news as game-changing, citing PayPal’s large user base. Customers on the platform can buy, sell and hold cryptocurrencies including Bitcoin, Ether, Bitcoin Cash and Litecoin from digital wallets, as well as use the virtual money to shop at the 26 million merchants on its network.

Novogratz forecast that companies including E*Trade Financial, Visa Inc., Mastercard Inc. and American Express Co. will follow suit “within a year” to offer platforms where their merchants will be able to transact in stablecoins and cryptocurrencies.

“It’s no longer a debate if crypto is a thing, if Bitcoin is an asset, if the blockchain is going to be part of the financial infrastructure,” said Novogratz. “It’s not if, it’s when, and so every single company has to have a plan now.”