Products You May Like

Forex markets are staying in relatively tight range on mixed market sentiments. Asian indices turn lower despite a weak recovery in US markets overnight. For the week, Yen and Dollar are still the strongest ones. Euro is the weakest one after ECB indicated some policy recalibration in December. Canadian Dollar is the second weakest on oil prices while Aussie is the third. There are risks of more risk selloff in the US today, as investors further lighten up position ahead of next week’s elections.

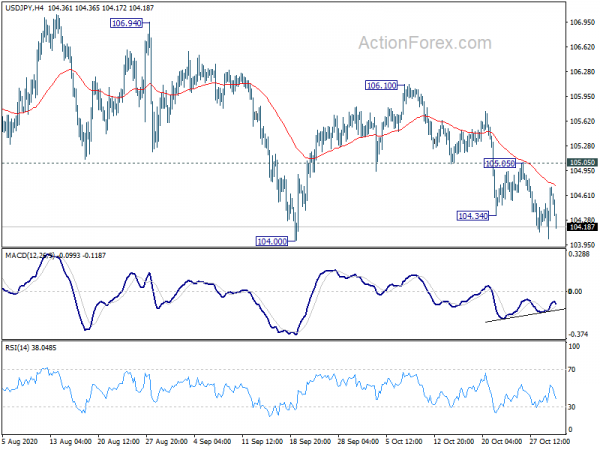

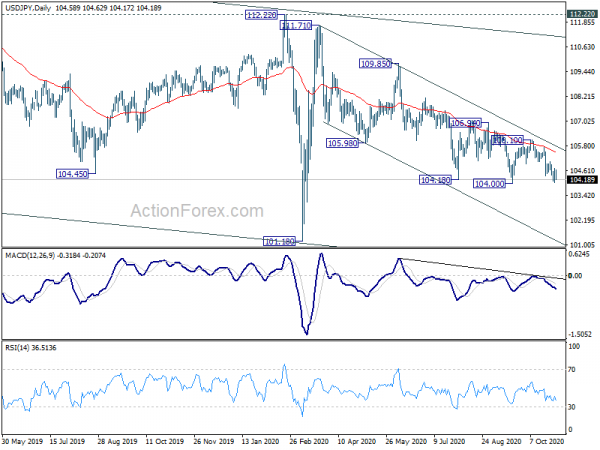

Technically, the cases for stronger near term rise in Dollar and Yen are building up. A question is which one would be stronger. Yen is having an upper hand with mild near term bearishness in USD/JPY. 104.00 support will be a focus for today and break will extend the whole decline form 111.71. That would secure Yen’s position as the best performer for the week.

In Asia, Nikkei is currently down -1.07%. Hong Kong HSI is down -0.52%. China Shanghai SSE is down -0.07%. Singapore Strait Times is down -0.50%. 10-year JGB yield is up 0.0069 at 0.037. Overnight, DOW rose 0.52%. S&P 500 rose 1.19%. NASDAQ rose 1.64%. 10-year yield rose 0.054 to 0.835, back above 0.8 handle.

– advertisement –

Japan industrial production rose 4% mom in Sep, more growth expected ahead

Japan industrial production rose 4.0% mom in September, above expectation of 3.2% mom. That’s the fourth straight month of growth in output. Also, according to survey by the Ministry of Economy, Trade and Industry, production is expected to rise further by 4.5% in October and 1.2% in November.

Unemployment rate was unchanged at 3.0% in September, better than expectation of 3.1%. Jobs-to-applicants ratio dropped to 1.03, hitting the lowest level since December 2013. Housing starts dropped -9.9% yoy in September, worse than expectation of -8.7% yoy.

However, Tokyo CPI core dipped further into negative territory, down -0.5% yoy, versus September’s 0.0% yoy, missed expectation of -0.3% yoy.

Australia private credit rose 0.1%mom in Sep, PPI rose 0.4% qoq in Q3

Australia total private sector credit rose 0.1% mom in September, below expectation of 0.2% mom. Housing credit rose 0.4% mom. Personal credit dropped -0.8% mom. Business credit dropped 0.3% mom. Broad money rose 0.9% mom.

Also released, PPI rose 0.4% qoq in Q3 matched expectations. Over the year, PPI dropped -0.4% yoy.

Looking ahead

The economic calendar is very busy today. France, Germany and Eurozone will release Q3 GDP. Eurozone will release CPI and unemployment. Swiss will release KOF leading indicator. Later in the day, Canada wil release GDP, IPPI and RMPI. US will release personal income and spending with PCE inflatoin, employment cost index and Chicago PMI.

USD/JPY Daily Outlook

Daily Pivots: (S1) 104.19; (P) 104.46; (R1) 104.89; More...

Intraday bias in USD/JPY remains neutral and further fall is expected with 105.05 resistance intact. On the downside, firm break of 104.00 will resume larger decline from 111.71, towards 101.18 key support. However, firm break of 105.05 will indicate short term bottoming and turn bias back to the upside for 106.10 resistance.

In the bigger picture, USD/JPY is still staying in long term falling channel that started back in 118.65 (Dec. 2016). Hence, there is no clear indication of trend reversal yet. The down trend could still extend through 101.18 low. However, sustained break of 112.22 resistance should confirm completion of the down trend and turn outlook bullish for 118.65 and above.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:30 | JPY | Tokyo CPI Core Y/Y Oct | -0.50% | -0.30% | 0.00% | |

| 23:50 | JPY | Industrial Production M/M Sep P | 4.00% | 3.20% | 1.00% | |

| 23:50 | JPY | Unemployment Rate Sep | 3.00% | 3.10% | 3.00% | |

| 00:30 | AUD | Private Sector Credit M/M Sep | 0.10% | 0.20% | 0.00% | |

| 00:30 | AUD | PPI Q/Q Q3 | 0.40% | 0.40% | -1.20% | |

| 00:30 | AUD | PPI Y/Y Q3 | -0.40% | -0.80% | -0.40% | |

| 05:00 | JPY | Housing Starts Y/Y Sep | -9.90% | -8.70% | -9.10% | |

| 06:30 | EUR | France GDP Q/Q Q3 P | 15.00% | -13.80% | ||

| 07:00 | EUR | Germany Retail Sales M/M Sep | -0.50% | 3.10% | ||

| 07:00 | EUR | Germany GDP Q/Q Q3 | 7.10% | -9.70% | ||

| 07:30 | CHF | Real Retail Sales Y/Y Sep | 2.80% | 2.50% | ||

| 07:45 | EUR | France CPI M/M Oct P | -0.20% | -0.60% | ||

| 07:45 | EUR | France CPI Y/Y Oct P | 0.10% | 0.00% | ||

| 08:00 | CHF | KOF Leading Indicator Oct | 107 | 113.8 | ||

| 09:00 | EUR | Italy Unemployment Sep | 10.10% | 9.70% | ||

| 10:00 | EUR | Eurozone GDP Q/Q Q3 P | 9.00% | -11.80% | ||

| 10:00 | EUR | Eurozone Unemployment Rate Sep | 8.30% | 8.10% | ||

| 10:00 | EUR | Eurozone CPI Y/Y Oct P | -0.30% | -0.30% | ||

| 10:00 | EUR | Eurozone CPI Core Y/Y Oct P | 0.20% | 0.20% | ||

| 12:30 | CAD | GDP M/M Aug | 3.30% | 3.00% | ||

| 12:30 | CAD | Industrial Product Price M/M Sep | 0.30% | |||

| 12:30 | CAD | Raw Material Price Index Sep | 3.20% | |||

| 12:30 | USD | Personal Income M/M Sep | 0.50% | -2.70% | ||

| 12:30 | USD | Personal Spending Sep | 1.00% | 1.00% | ||

| 12:30 | USD | PCE Price Index M/M Sep | 0.10% | 0.30% | ||

| 12:30 | USD | PCE Price Index Y/Y Sep | 1.30% | 1.40% | ||

| 12:30 | USD | PCE Core Price Index M/M Sep | 0.10% | 0.30% | ||

| 12:30 | USD | PCE Core Price Index Y/Y Sep | 1.40% | 1.60% | ||

| 12:30 | USD | Employment Cost Index Q3 | 0.50% | 0.50% | ||

| 13:45 | USD | Chicago PMI Oct | 56.9 | 62.4 | ||

| 14:00 | USD | Michigan Consumer Sentiment Index Oct F | 81.2 | 81.2 |