Products You May Like

The USD is mixed ahead of the US employment report

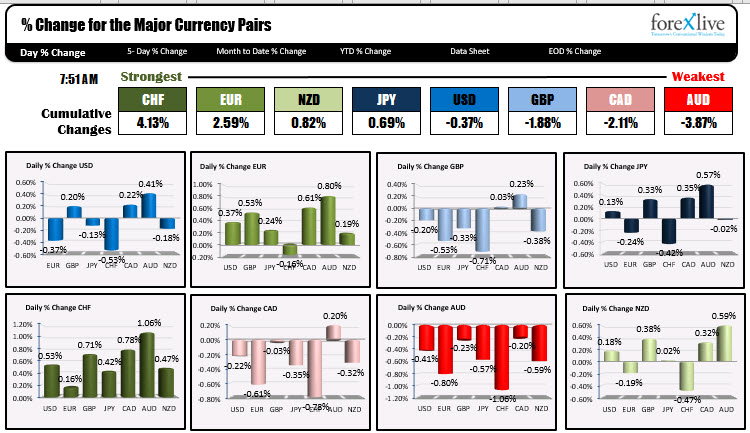

The CHF is the strongest and the AUD is the weakest as the NA session begins. The USD is mixed ahead of the US jobs report which is expected to show a gain of 593K. That has trended a bit lower after the ADP jobs estimate report on Wednesday which showed a gain of 365K. Canada will also release their jobs report at 8:30 AM ET/1330 GMT with a change in employment of 75K expected. The CAD is mostly lower ahead of the report. The US election summary, has Biden taking a slim lead in Georgia (1.1K). Pres. Trump is holding onto a 18K gain in Pennsylvania. In Arizona and Nevada Biden holds onto gains (+47K and +11-12K respectively). In NC, Trump holds onto a comfortable gain. The claims of fraud and legal challenges continue from the President. Needless to say, there is enough “stuff” with jobs, votes and chaos to stir the pot on a Friday into a weekend. Stocks are correcting lower in pre-market trading after 4 straight solid days of buying

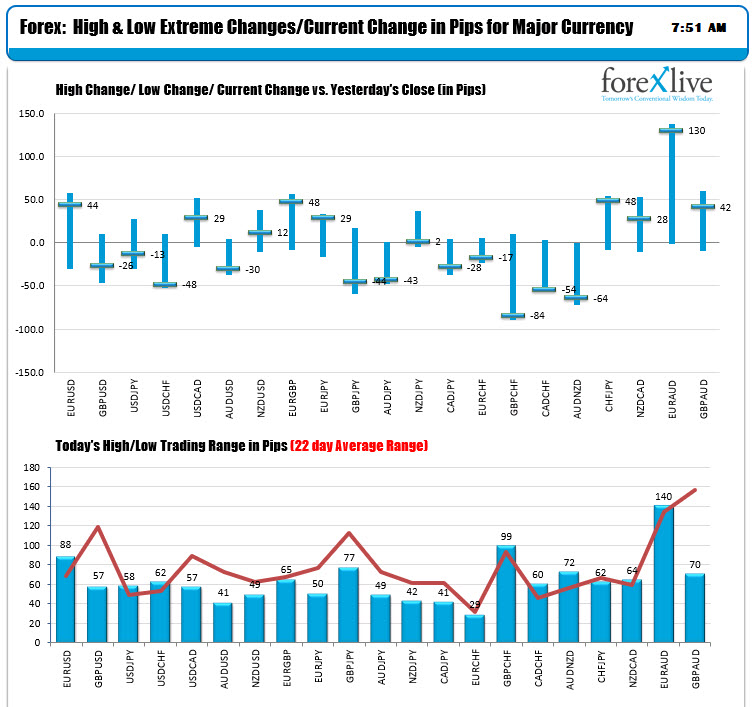

The ranges and changes are showing more modest price action in relation to the last few days at this time. The EURUSD is leading the USD pairs with a range of 88 pips. The pair is trading up 44 pips (and near the session high). The USDCHF has been trending lower today and is down -48 pips at the session lows in the morning snapshot. The AUDUSD and NZDUSD are taking a different view with the AUDUSD lower, while the NZDUSD is marginally higher. With the USD mixed the markets are mixed too and waiting for the jobs report.

In other markets:

- Spot gold is trading up $3.50 or 0.18% at $1953

- Spot silver is trading up $0.28 or 1.13% at $25.66

- WTI crude oil futures are trading down -$1.12 or -2.89% at $37.67

In the pre-market for US stocks, the major indices futures markets are implying a lower opening:

- Dow industrial average -224 points. It gained 542.52 points yesterday.

- S&P index -33 points. It gained 67.01 points yesterday.

- NASDAQ index -130 points. It gained 300 points yesterday

In the European equity markets, they are also lower after 4 days of solid gains:

- German DAX, -1.2%

- France’s CAC, -1%

- UK’s FTSE 100, -0.22%

- Spain’s Ibex, -0.9%

- Italy’s FTSE MIB, -0.7%

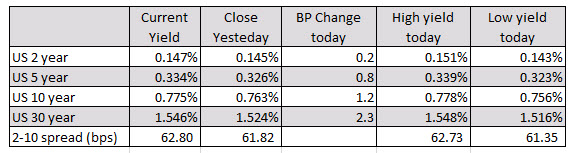

In the US debt market, yields are higher with a steeper yield curve:

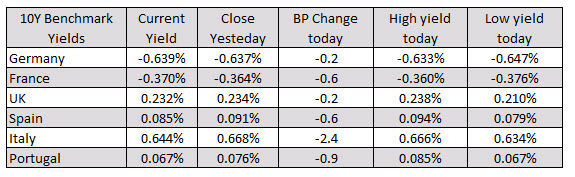

In the European debt market, yields are marginally lower across the board in the benchmark 10 year yields: