Products You May Like

GBPUSD trades to highest level since September 7th

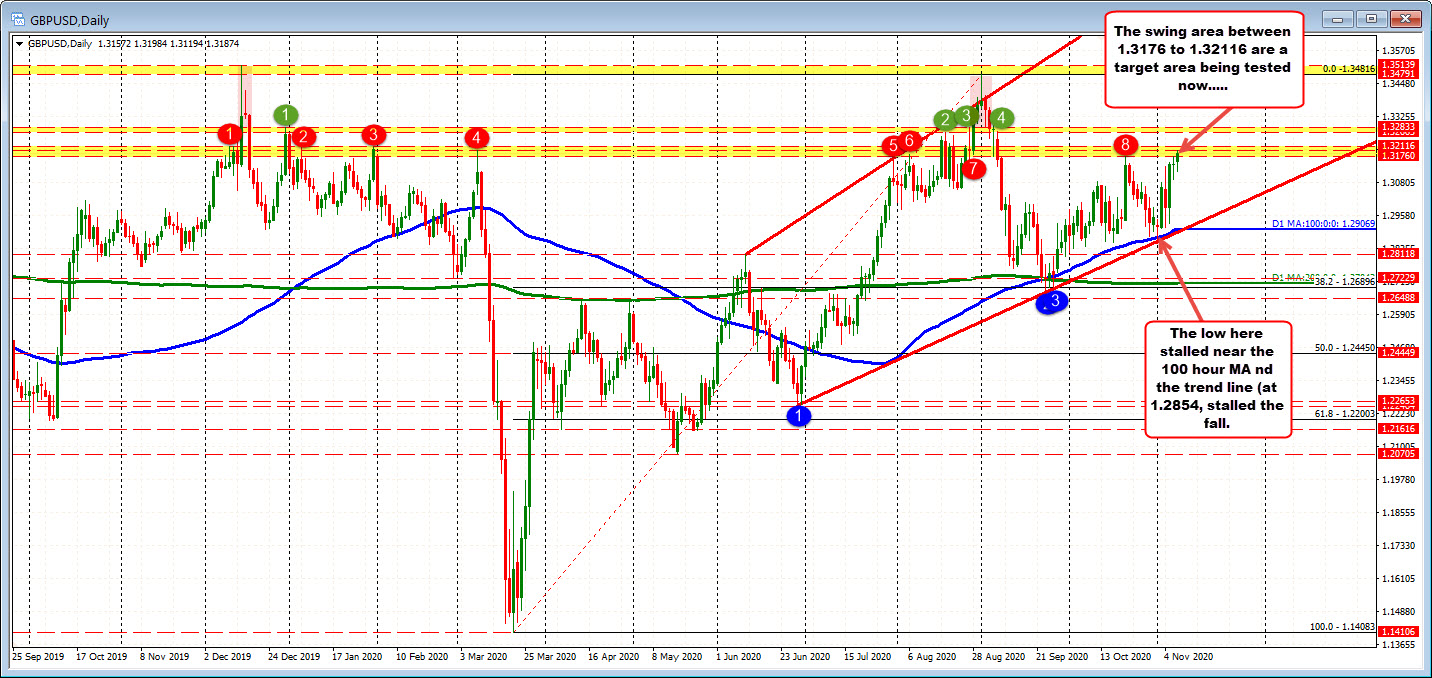

The GBPUSD has chopped down and back up and near the highs, the pair has moved into a swing area on the daily chart between 1.3176-1.32116 (see red circles on the daily chart below). The current price is at 1.3190. If the pair can stay in the area and move above, that would be more bullish with 1.3266 to 1.32833 as the next target area (see green numbered circles). The price is trading at the highest level since September 7th.

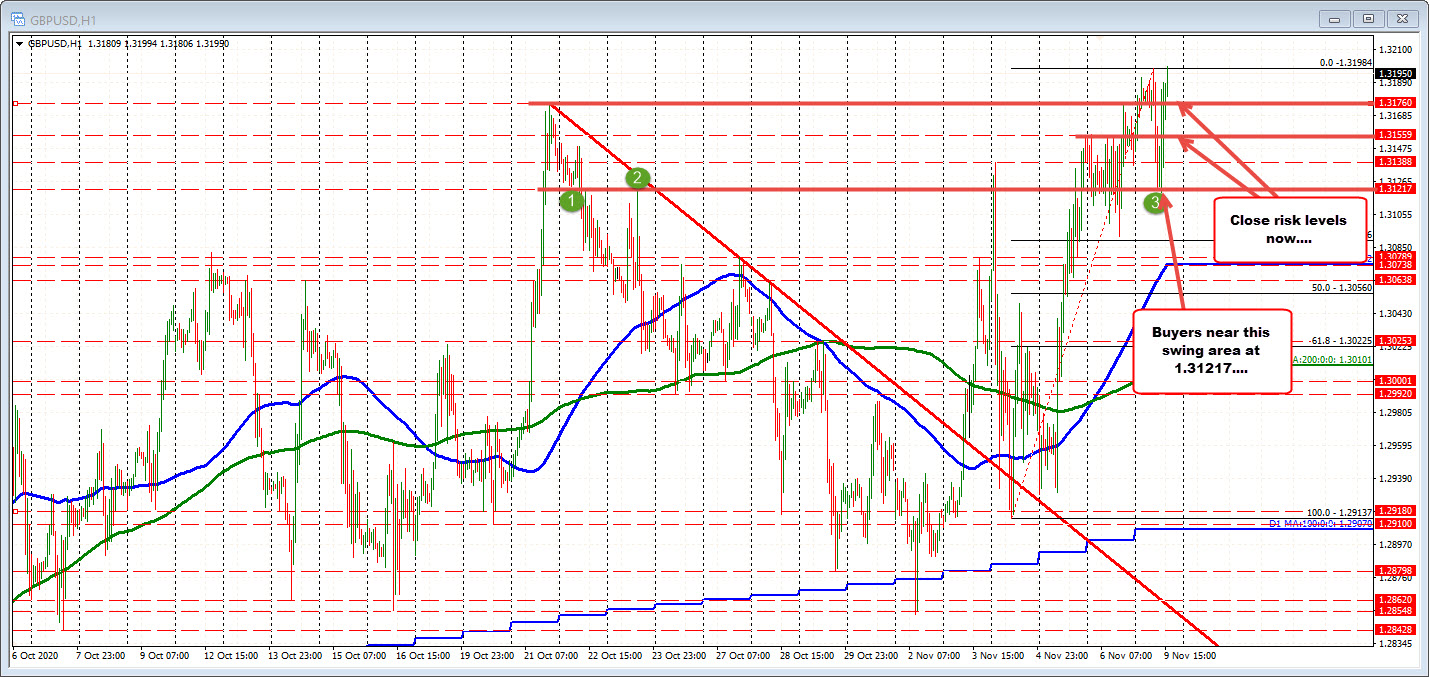

The daily chart may seem orderly, but the hourly chart below shows a lot of choppy price action. Friday’s trade moved up to test the October 21 high (at 1.3176) but backed off. The initial run higher today, extended up toward the 1.3200 level. The high reached 1.31983 before reversing lower. The run to the downside stalled near the swing high from October 23rd at 1.31217 and the buying restarted.

The current price is back above the 1.3176 level (at 1.3192 now). That is close risk. A lower risk level would be 1.31559 which was a high area on Thursday and Friday before the Non-farm payroll volatility. That will be another level to think as a barometer for buyers and sellers going forward (stay above more bullish, move below is more bearish).

Brexit news continues to be a story and can help contribute to volatile price action as the market moves from story to story.

Other stories include the impact of Covid but that is being helped by the vaccine news today but will be a country by country story and the world can’t all get vaccinated at the same time.

BOE Haldane is on the wires just saying

- BOE aims to keep borrowing costs at rock-bottom levels for as long as necessary to get economy moving

- Financial markets point to a lengthy period of very low interest rates