Products You May Like

- USD/CHF wavers around the lowest since January 2015.

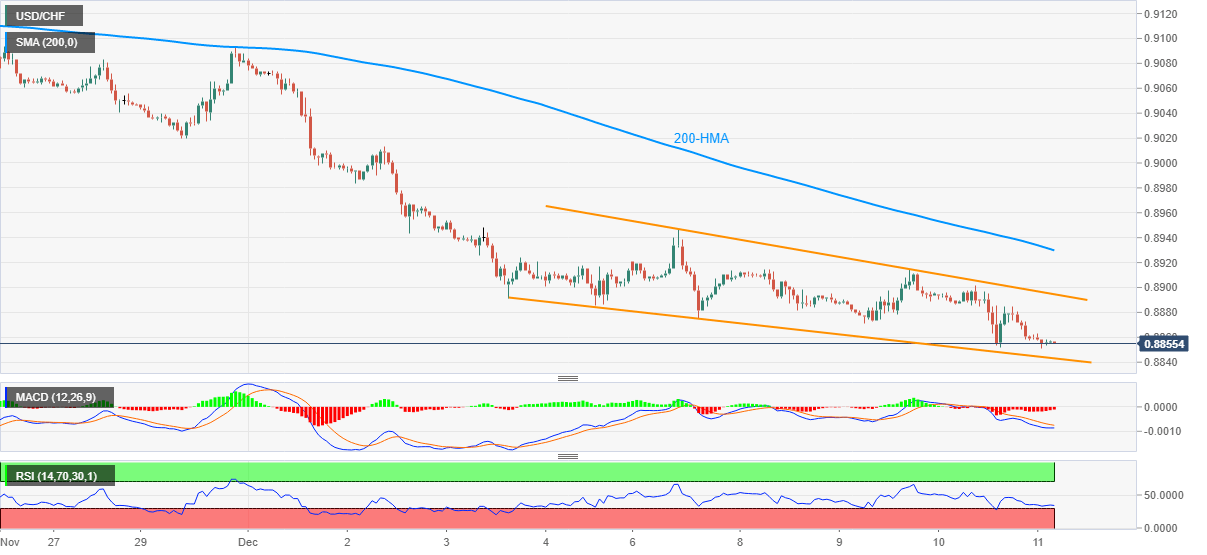

- Nearly overbought RSI conditions suggest pullback inside bearish chart pattern.

- May 2014 low can lure the bears during further downside.

Following its drop to the fresh multi-month low of 0.8851, USD/CHF seesaws near 0.8855, down 0.15% intraday, ahead of Friday’s European session.

In doing so, the quote stays depressed inside a descending trend channel formation established since November 03. However, oversold RSI conditions battle the receding strength of bearish MACD to indicate corrective recovery.

During the bounce 0.8875 and the channel resistance around 0.8895 will precede the 0.8900 threshold to challenge the USD/CHF bulls.

If at all the USD/CHF bulls manage to dominate past-0.8900, the 200-HMA level of 0.8930 will be important to watch.

On the downside, the mentioned channel’s support near 0.8843 can challenge the south-run, failing to do so can direct USD/CHF bears towards May 2014 bottom surrounding 0.8700.

USD/CHF hourly chart

Trend: Pullback expected