Products You May Like

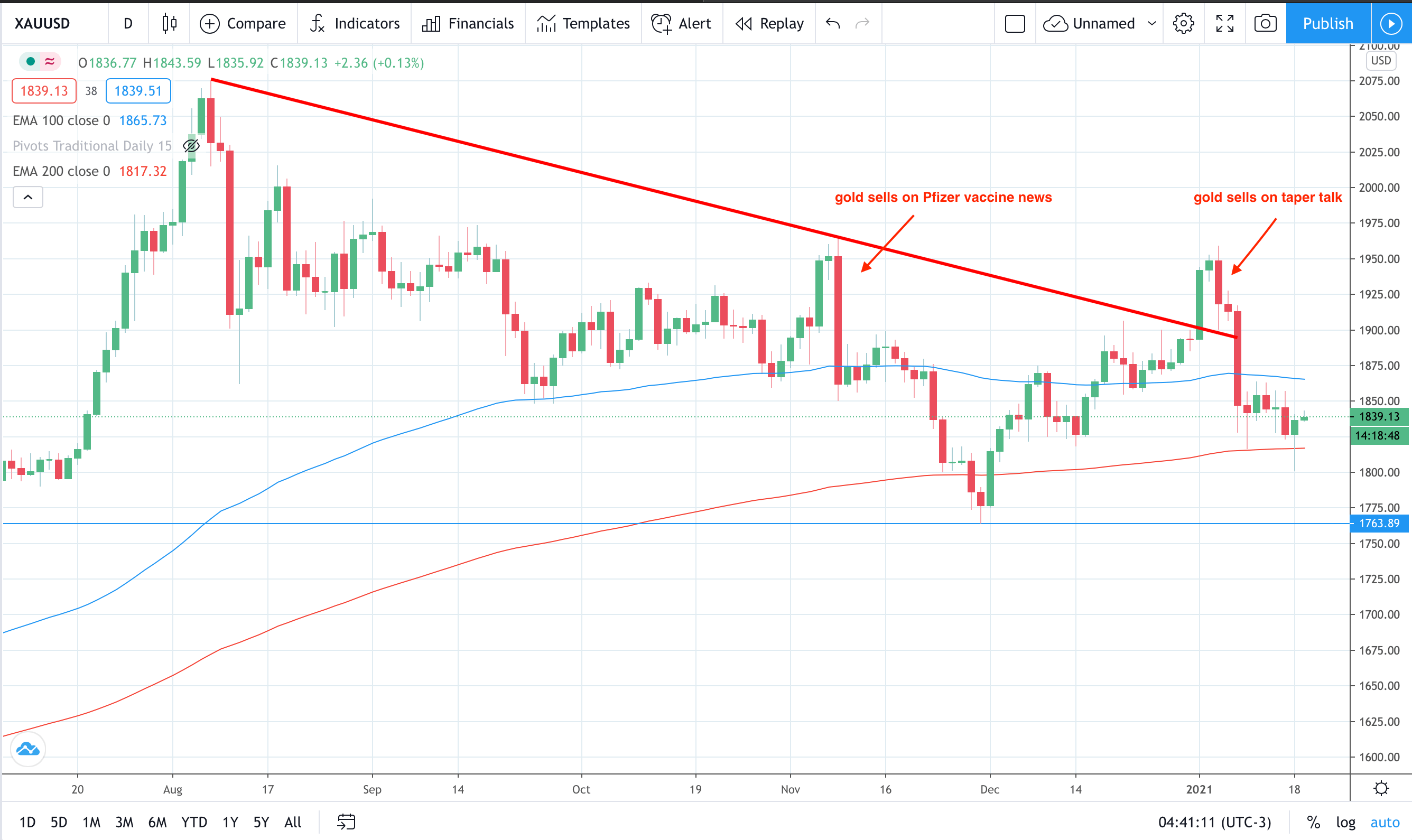

Is gold weakness set to stay?

Gold normally has a great start to the year on Chinese gold buying for the Lunar New year celebrations. In fact, over the last 10 years gold has risen in eight years out of ten during the month of January. 2012 saw a large rise of 9.14%. 2011 recorded a -6.74% loss. Despite the normal strong seasonals (see chart below) this year gold has been struggling during the month. So, is this the end of the strong fundamentals for gold buying?

The last fall in gold occurred in 2013 when gold saw -1.71%. During the rest of 2013 prices fell around 28% at one point according to Bloomberg. Two days in April 2013 saw around half of that drop lower alone. So, what was the reason? It was rising real rates on the Fed’s tapering. This triggered a sell off in Exchange Traded Funds (ETFs). So any talk of more tapering will sent jitters down gold bulls remembering 2013. Read more…

Gold Price Analysis: XAU/USD sits near one-week tops, above $1850 level

Gold continued scaling higher through the early European session and climbed to near one-week tops, around the $1857 region in the last hour.

Following the previous day’s range-bound price action, the precious metal caught some fresh bids on Wednesday and built on this week’s goodish rebound from the vicinity of the $1800 mark. The US dollar fell for the third consecutive session on Wednesday, which, in turn, benefitted the dollar-denominated commodity. Read more…

Gold Price Analysis: Acceptance above 200-DMA at $1846 is critical for XAU/USD

Gold (XAU/USD) settled higher around $1840 on Tuesday, as the US dollar remained on the back foot amid prospects of additional stimulus. The yellow metal has recaptured the 200-daily moving average (DMA) at $1846 on Biden’s inauguration day and daily closing above this critical hurdle is needed to negate the near-term downside bias, FXStreet’s Dhwani Mehta reports.

“On Wednesday, Joe Biden will take the Presidential office and his inaugural speech will be closely eyed for fresh hints on the fiscal stimulus and the next direction in gold. In the meantime, the yellow metal will continue to cheer the calls for more fiscal spending under the Biden administration and growing covid cases in the US. Read more…