Products You May Like

Mizuho outlines the conditions for USD/JPY to rise

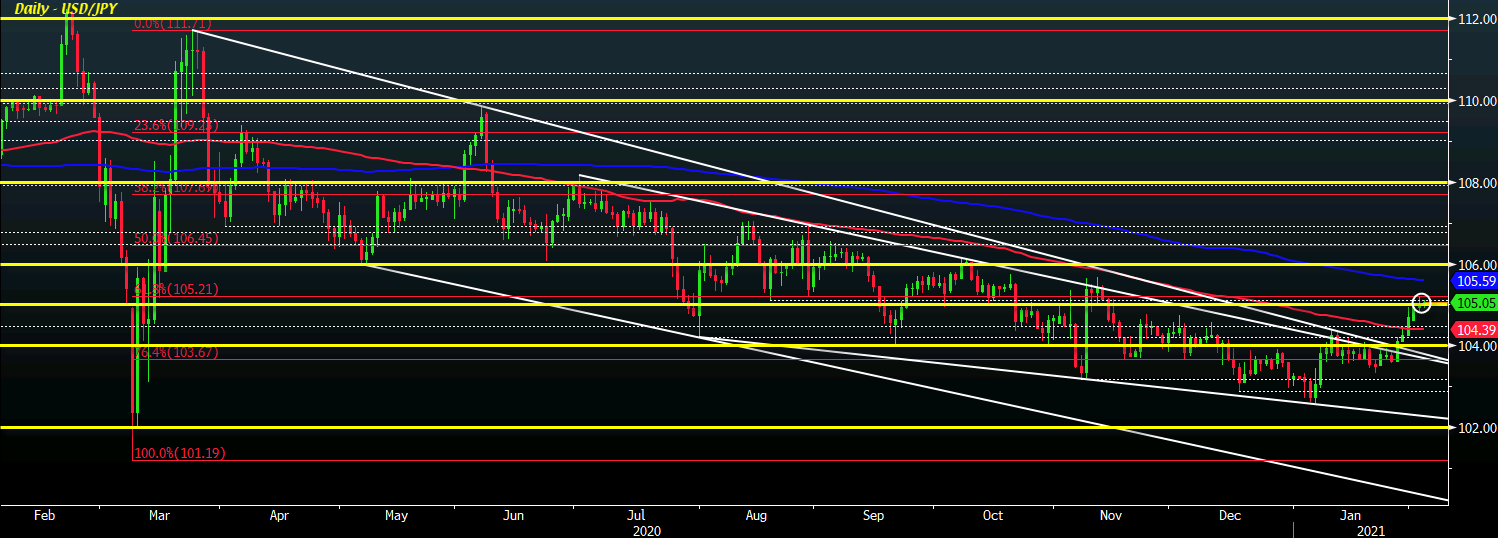

The firm says that the market isn’t seeing a significant yen weakening trend at the moment but will feel more comfortable about USD/JPY going back to the 105-110 range if 10-year Treasury yields climb more significantly from hereon.

Adding that many exporters are seen putting USD/JPY at 105 for internal rates, meaning that there are likely to be sell orders around that level that may cap any advance.

That said, the firm also argues that downside risks to USD/JPY are also receding as many who had taken on a structural long view in EUR/JPY and AUD/JPY appear to be shifting to long USD/JPY positions instead.

The headline view is a rather no brainer considering how USD/JPY has largely correlated with 10-year Treasury yields over time, though it comes with a big if.

The fact that if there is a significant jump to 1.50% would mean a major focus on the reflation narrative and that may inadvertently bolster the dollar too, as such a push also factors into the Fed being less dovish sooner or later.

For now though, USD/JPY is still caught attempting a larger breakout above 105.00 but unless buyers can pull away from the figure handle and towards the 200-day moving average (blue line) @ 105.59, the momentum may stall for a bit.