Products You May Like

Daily thread to exchange ideas and to share your thoughts

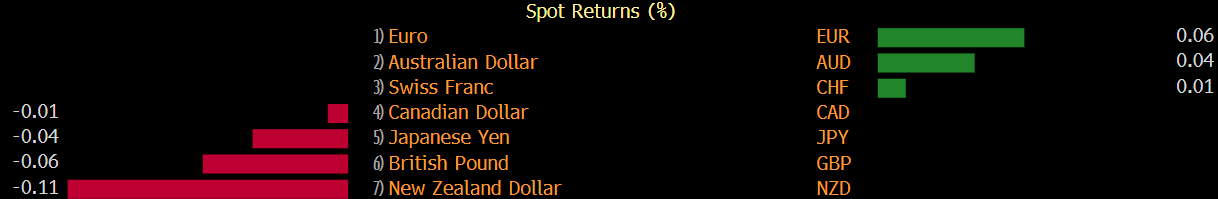

Major currencies are little changed on the day but dollar sentiment remains one of the key themes to watch in the market at this point in time.

The greenback capitalised on better US retail sales data yesterday and posted a modest bounce and is keeping those gains ahead of European trading today.

Of note, GBP/USD is pushed down to 1.3850 and is trading in between its key hourly moving averages with the lows yesterday bouncing off its 200-hour moving average while the highs earlier today were capped by its 100-hour moving average.

EUR/USD is also settling in a lower range around 1.2040-50 for now, bouncing off some swing region support around 1.2020-25 overnight.

Sellers are in near-term control and still weighing up the potential for a push towards 1.2000 and perhaps the 100-day moving average @ 1.1992.

Meanwhile, USD/JPY continues to linger around 106.00 after a break of its 200-day moving average earlier in the week.

Elsewhere, gold is looking tepid as it keeps below $1,800 and neared a test of its 30 November low @ $1,764.80 yesterday. Buyers are still hanging on but I’m still not liking what I see on the chart for gold at this point in time.

In fact, silver continues to be the more resilient of the two as it managed to bounce off a push just below $27 again, though gains are still rather elusive as well around $27.50.

Plenty of focus remains on the reflation narrative and if that is going to be the big picture theme in the market moving forward, I would argue that short yen (on higher yields) and short franc (on better risk sentiment) are two favourable plays in the FX space.

Other than that, there should be subtle portfolio rebalancing to value stocks and that is likely to see the likes of the Dow and Russell 2000 outperform.

That said, all of that is also dependent on how quick is the pace of the moves by the market in chasing the reflation narrative. Again, these will be long-term trades of course.

What are your views on the market right now? Share your thoughts/ideas with the ForexLive community here.