Products You May Like

Forex news from the European trading session – 24 February 2021

Headlines:

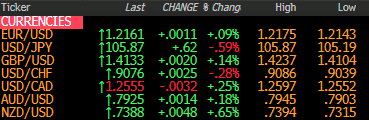

Markets:

- NZD leads, JPY lags on the day

- European equities higher; E-minis up 0.4%

- US 10-year yields up 3.2 bps to 1.374%

- Gold up 0.1% to $1,807.51

- WTI up 1.0% to $62.26

- Bitcoin up 6.2% to $50,922

It was a largely quiet session dominated by risk fluctuations with the market starting on a softer note as we saw the Hang Seng fall 3% after Hong Kong announced its first stamp duty increase on stock trades since 1993.

That prompted an exodus of Chinese investments and left a more sour tone towards the end of Asian trading. But since then, investors have been quick to move on and we are seeing risk tones ramp higher as US futures turn losses into gains on the session.

In turn, that is putting the pressure on the likes of the yen and franc still while the dollar is also among the laggards in European morning trade.

EUR/USD kept a little higher around 1.2160-70 levels as it continues to flirt with some resistance between here and 1.2195 for the time being.

Cable held up after an early spike above 1.4200 but saw gains gradually fade from 1.4190 to 1.4130-40 levels with EUR/GBP creeping back towards 0.8600.

USD/JPY moved higher from 105.50 to 105.85 as the yen is the major laggard on the risk improvement as well as yields keeping higher on the session.

The kiwi leads gains after rebounding following the RBNZ decision earlier, with NZD/USD trading closer towards 0.7400 with AUD/NZD falling from 1.0800 to its 200-day moving average @ 1.0720 – where it is challenging the key level at the moment.

The Fed put continues to reassure the market that there is no change to the status quo and investors look to be taking added comfort in that following the turnaround yesterday. It looks like greed is back on the menu today as well so let’s see if the next round of Fedspeak can keep the appetite flowing in the session ahead.