Products You May Like

Forex news for North American trading on April 6, 2021

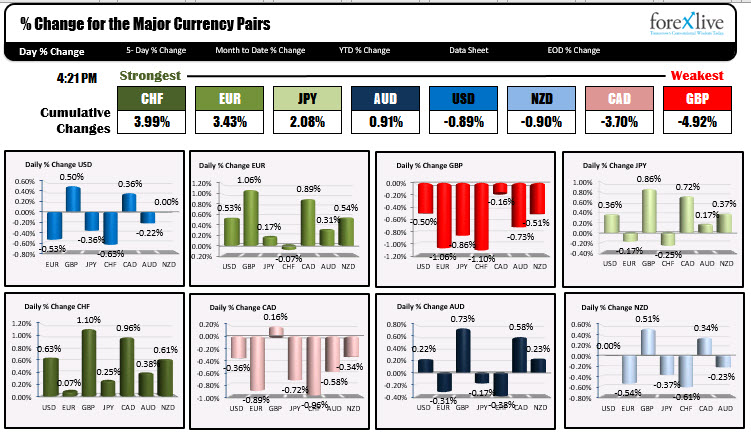

The dollar started the session as the strongest of the major currencies after being the weakest at the end of day yesterday. However, the move higher into the NY session found sellers early on and in the process is ending mixed but with a downward tilt. The dollar is still higher vs the GBP and CAD, but was lower vs the other currencies with the the decline vs the CHF (-0.63%) and the EUR (-0.53%) as the largest declines.

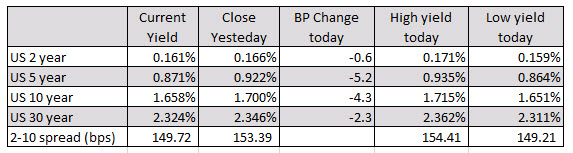

Contributing to the dollars decline was lower rates. The 10 year yield is down for the 3rd day in a row and the 4th decline in the 5 trading days. Over that time, the yield has moved down from a high on March 30 at 1.774% to the low of 1.651% today. The current yield is trading at 1.658%.

In the process, the 10 year yield is now below the 100 and 200 hour MAs at 1.711% and 1.683% respectively. Stay below, will keep the technical bias more to the downside for the 10 year yields.

Looking at some of the major currency pairs from a technical perpective:

- EURUSD: The EURUSD is closing near the high for teh day at 1.1878. The price high ticked just above its 200 day moving average 1.18762. In the new trading day, the the day moving average will be the key barometer for the buyers and sellers. Move above the biases more bullish. Stay below and the sellers remain in play. Coming into the New York session, the range and the euro was a very modest 27 pips. The pair has trended higher for most of the New York session however and is ending the day with an 83 PIP trading range. That is above the 69 PIP average over the last 22 days. Marginally higher will back below 1.1864 (the swing low from March 22), and 1.18459 (the 50% midpoint of the range since March 18) is needed to take the bullish bias out of the pair.

- USDJPY: The USDJPY rallied into the NY open and tested its 100 hour moving average at 110.547 (the high reached 110.546). Sellers against that moving average took the price down to the 200 hour MA at 110.142 where the pair initially stalled. However, after the price fell below, the buyers turned sellers in the price moved sharply to the 50% retracement of the move up from the March 23 low at 109.679 (low reached 109.662) where sellers took profits/dip buyers stalled the fall. The pair corrected marginally higher to 109.913 before heading back toward the midpoint level. At the close, the USDJPY is trading just above the 50% retracement at 109.72 (the 50% is 109.679). A move below will be more bearish in the new trading day. Key level for buyers and sellers.

- GBPUSD: The GBPUSD is ending the session with the price between the 100 hour moving average and 50% retracement above at 1.3835 (of the move down from the March 18 high) and the 200 hour moving average below at 1.3800. The pair is trading between those levels at 1.38214. In the new day, getting outside one of those extremes should help determine the next defining bias for the pair.

- AUDUSD: The AUDUSD is trying to extend above the 10 day high price of 0.76632. The price in the last few hours of trading reached a high price or 0.7667, but has backed off a bit into the new trading day. Earlier today, the price moved from above its 100 day moving average to below its 100 day moving average and then back above. That moving averages at 0.76382 in the new trading day. If the buyers can’t push back above the March 30 high of 0.7663, a rotation back toward the 100 day moving average would yet again test buyers and sellers against the level. If the price can trade above 0.7663, the next target would be up at the 50% midpoint of the move down from the March 18 high at 0.76901.

Good fortune with your trading.