Products You May Like

CHF with a big rebound

The theme in markets this month has been retracement and repositioning. Bond yields have been coming back and FX trades that have worked all year are unwinding.

Another example is the turn in the Swiss franc this week. It was the top performing G10 currency and gained every day this week to climb 1.9%.

The same dynamic can be seen in GBP, which has been the second-best performer this year (behind only CAD). This week, it was the laggard.

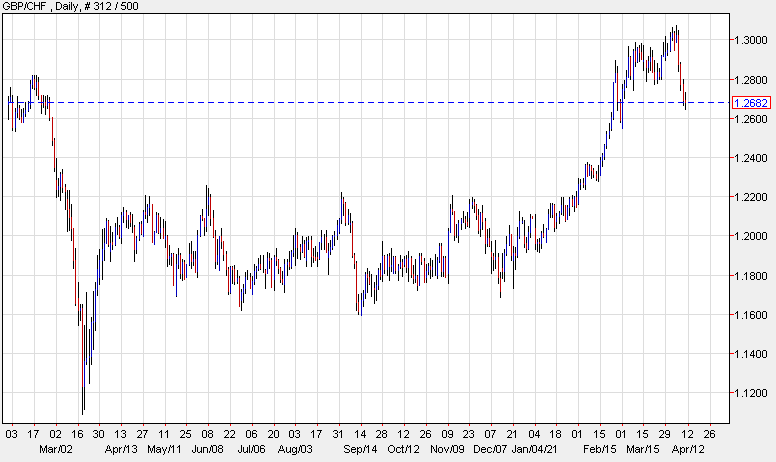

Looking at the GBP/CHF chart, you can see the pandemic unfold, then a long period of consolidation followed by a break higher at the start of the year. Now it’s retraced 3.3% after hitting a cycle high early on Monday.

What’s next?

If this is the start of a larger retracement, the 38.2% give-back of the rally since December is at 1.2543, which is just above the March 1 intraday low. A 50% retracement would scale back to 1.2378.

At this point, I don’t see a great risk-reward on that trade but this does make me wonder what’s going on with the broader risk mood and if we don’t see this kind of hiccup elsewhere.