Products You May Like

Provisional closes are higher today

The major European indices fell sharply yesterday some falling over 2% on the day. Today there has been a retracement of some of those declines.

Looking at the provisional closes:

- German Dax, +0.44%

- France’s CAC, +0.82%

- UK’s FTSE 100, +0.66%

- Spain’s Ibex, +0.85%

- Italy’s FTSE MIB, +0.3%

in other markets as European/London traders look to exit:

- Spot gold is up $15.32 or 0.86% at $1794.15. That is near the high of $1797.71. The low was at $1776.39.

- Spot silver is up $0.60 or 2.34% $26.44

- WTI crude oil futures for June delivery are down $0.65 or -1.05% at $62.01

- bitcoin is recovering some of its sharp losses and trades down $700 or -1.27% at 56,072

in the US stock market, the major indices have climbed into positive territory with the NASDAQ index now leading the way higher:

- S&P index up 21.49 points or 0.52% at 4156.49

- NASDAQ index up 85 points or 0.62% at 13871.27

- Dow up 164 points or 0.49% at 33987

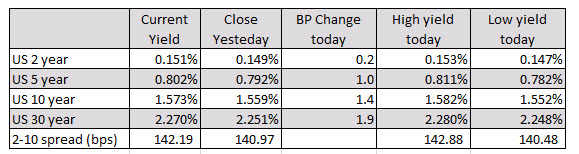

in the US that market, yields have tilted back to the upside. The U.S. Treasury will auction off 20 year notes at 1 PM today:

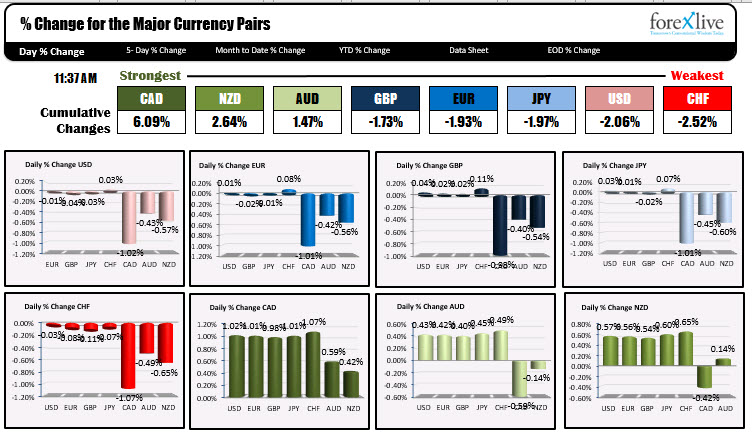

In the Forex, the flow of funds have pushed into the CAD after the more hawkish BOC rate statement and economic projections. The CAD is runway strongest of the majors with gains of close to 1% or more vs the USD, EUR, GBP, JPY, CHF. The AUD and NZD have also been dragged higher on risk on flows. The CHF, USD and JPY are the weakest as investors exit the relative safety of those currencies.