Products You May Like

PM Trudeau calls COVID 19 situation critical.

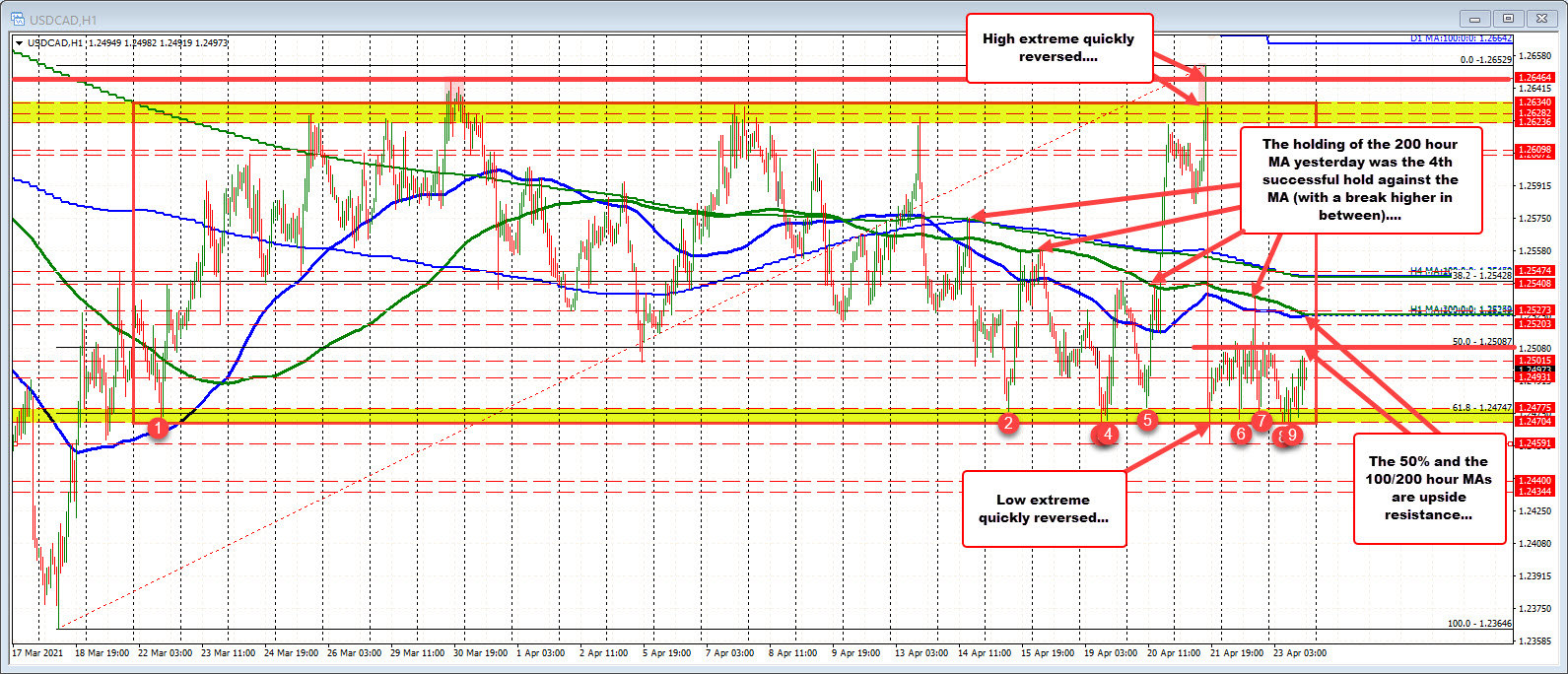

The USDCAD will sharply lower on Wednesday after the Bank of Canada announced that they would start to trim QE. The pair moved from the week’s high (just before the rate decision on a squeeze higher) at 1.26529, to the week’s low two hours later at 1.24591. Since then the price has been consolidating, but below resistance levels.

Looking at the hourly chart above, the swing high (just before the rate decision) did break above the highest high going back to March 10 (by about 8 pips). The move to the low took out the lowest low, going back to March 18 (by about 11 pips). Each were quickly reversed.

Having said that, the pairs correction off the failed break lower moved up to test the 100/200 hour MAs on Thursday and found leaning sellers. Holding the 200 hour MA was the 4th successful since April 15. Bearish. There was one break above (which took the price to the high), but reestablishing the MA as resistance on Thursday increases that levels importance now and going into next week’s trading. Putting it another way, it will take a move above the 200 hour MA to change the bias for the technicals in the USDCAD to more positive. Absent that and the sellers remain in control.

A closer risk area for the pair might be at the 50% of the range since the March 18 low. That level comes in at 1.25087. Holding below that level would be more bearish for the pair in the short term. A move above does not hurt the “stay below the 200 hour MA bias defining idea” but it could lead to more covering toward that key level above.

Another break below the 1.24704 and then the low for the week at 1.24591, opens the downside for more selling.

PS PM Trudeau was on the wires earlier saying that Covid-19 situation is critical and people must reduce personal contact. He did sign a deal with Pfizer for 35M booster doses for 2022 and 30M for 2023. The Bank of Canada is not as concerned given the taper this week but the risks remain.