Products You May Like

Traders await US retail sales at the bottom of the hour

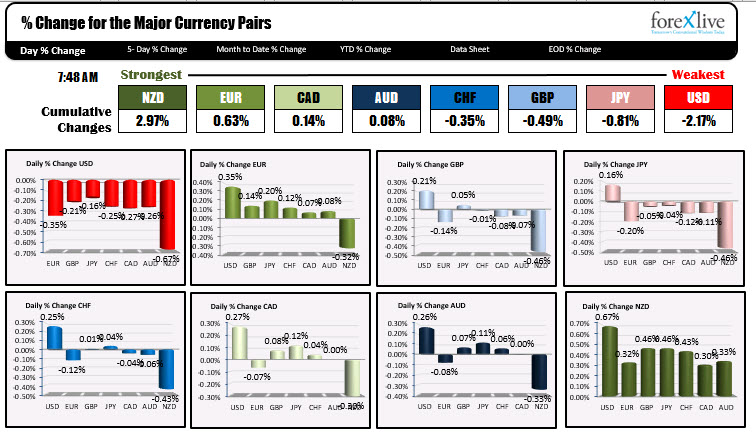

As North American traders enter for the day the NZD is the strongest and the USD is the weakest ahead of April Retail sales (are expected to show a stimulus check induced rise of 1% for the headline number). Industrial production, Capacity Utilization, Businesss inventories and Univ. of Michigan Preliminary consumer sentiment for May are also on the schedule to end the trading week. Stocks are higher in pre-market futures trading. Commodities are higher as a key transportation bridge across the Mississippi is closed in both directions in Memphis because of a crack in a steel beam (when it rains it pours). US yields are lower with the 30 year down -2.9 basis points. Yesterday the U.S. Treasury completed its main refunding for the month with the sale of 30 year bonds. The auction did not go swimmingly as there was a 1.7 basis point tail, but yields are now lower despite the lack of the demand. In a week where fears were that the 10 year would move toward 2% if the 1.70% level could be broken, the 10 yield is trading down to 1.642% currently

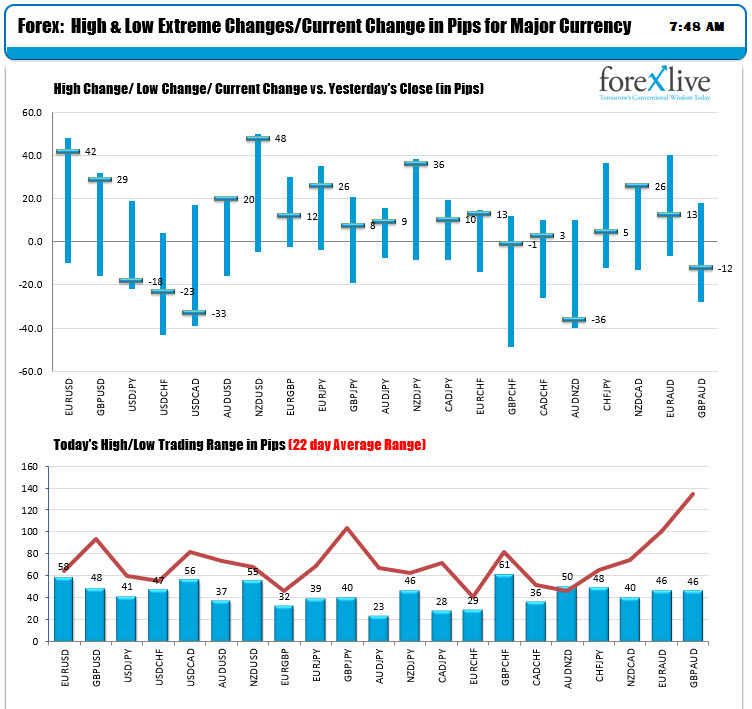

Looking at the ranges and changes, the USD is trading near session highs versus most of the currency pairs (the exception might be the USDCHF which is lower but off the lows of -42 pips). The NZDUSD is the biggest mover with a 48 pip gain on the day. That currency pair is moving above both its 200 and 100 hour moving averages near 0.7220 as I type (trading at 0.7226). The pair based near its 100 day moving average at 0.7172 before moving higher. The AUDUSD is also moving away from its hundred day moving average at 0.77189 where it based earlier this morning. It’s 100 and 200 hour moving averages are still the head at 0.7774/0.77837.

In other markets:

- Spot gold is trading down $9.72 or +0.53% at $1836.40

- spot silver is up $0.19 or 0.73% $27.29

- WTI crude oil futures are rebounding $0.78 or 1.22% at $64.59. Yesterday the price of crude oil fell $-2.31 or -3.48% (near the close of the day).

- The price of bitcoin is rebounding $1254 or 2.54% at $50,586. Elon Musk said that he is helping dogecoin with their energy consumption. Yesterday Musk sent the market down sharply after saying Tesla would not accept Bitcoin for payment because the mining of coins is energy inefficient.

- Ethereum it is also sharply higher and back above the $4000 level. It is currently trading up $287 or 7.72% at $4005.91.

In the the premarket for US stocks, the major indices are higher for the second consecutive day (after three days of the declines). The major indices are still on pace to decline for the week. The futures are implying gains (although retail sales will be of importance):

- Dow, +180 points. The index gained 433.79 points yesterday

- S&P , +28 point. The index gained 49.45 points yesterday

- NASDAQ +140 points. The index gained 93.31 points yesterday

IN the European equity markets, the major indices are also trading higher:

- German DAX, +0.67% after yesterday’s 0.33% gain

- France’s CAC +0.93%. Yesterday the index rose 0.14%

- UK’s FTSE 100 +0.75%. Yesterday the index fell -0.59%

- Spain’s Ibex, +1% after yesterday’s -0.46% decline

- Italy’s FTSE MIB, +0.58% after yesterday’s gain of 0.14%

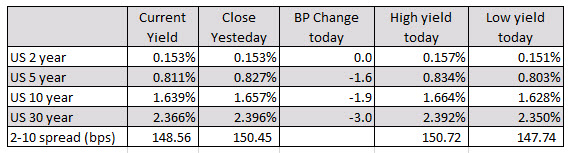

in the US debt market yields are lower with the yield curve flatter. The 2-10 US spread is down to 148.56 from 150.45 at the close yesterday:

In the European debt market, the benchmark 10 year yields are mixed with UK and Germany yields lower, while France, Spain, Italy, and Portugal higher.