Products You May Like

Economic data is in charge

The market and the Fed are trying to figure out how the economy will develop in the months ahead. We’ve seen some big moves already this month on the CPI and non-farm payrolls data.

This release points to an economy that’s booming. The services PMI was at a record 70.1 compared to 64.4 expected and 64.7 previously. That’s a massive jump.

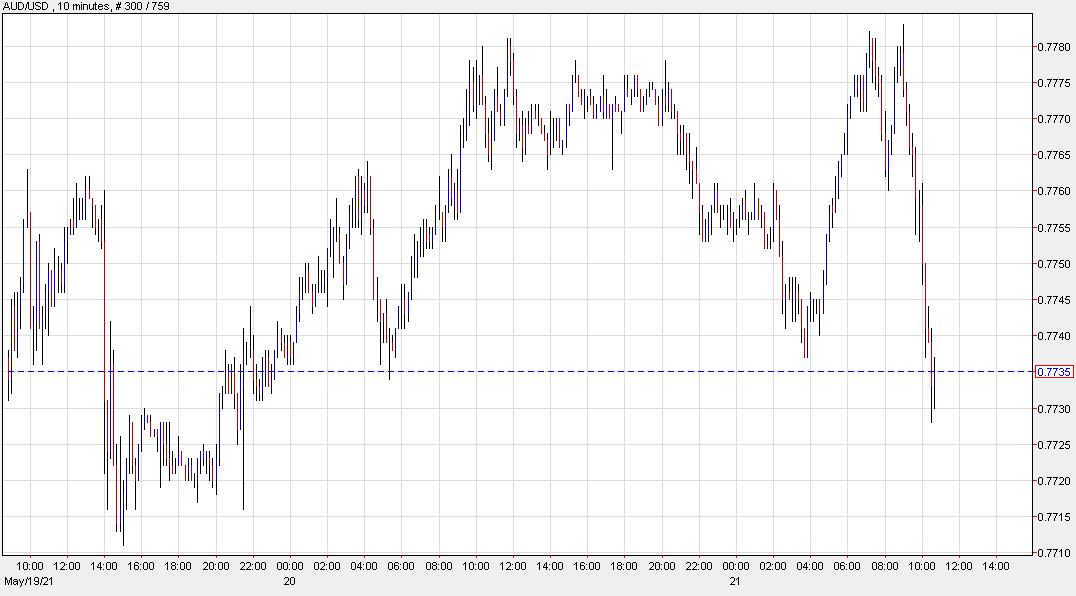

In response, the US dollar is climbing. That’s a market that is back on the taper train. What’s clear is that we’re going to see the back-and-forth on that theme for months to come.

What surprises me here is seeing AUD/USD falling so hard on this. A booming US consumer coming out of the pandemic is not going to be uniquely a US factor and booming demand means booming commodities and a huge US trade deficit.

The thinking is that the Fed will be raising rates first but I’m skeptical. The RBA is more averse to cheap money in the housing market and will see the positive knock-on effects from housing. They’re also a more-nimble central bank, despite all the recent talk about transitory inflation.