Products You May Like

Finds support buyers…

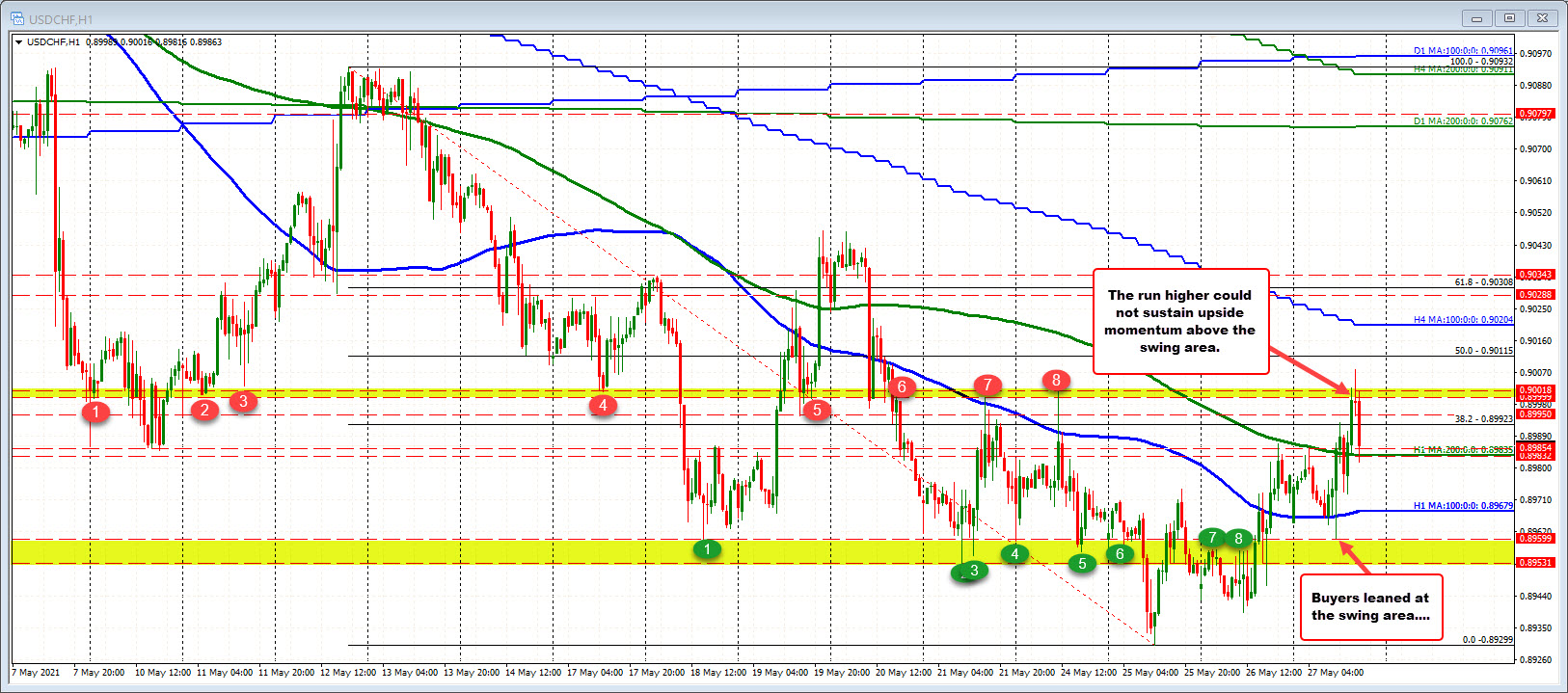

The USDCHF in the Asian session found resistance sellers against its 200 hour moving average (green line). The subsequent fall saw the price move below the 100 hour moving average before finding support against a lower swing area between 0.8953 and 0.89599. The upper end of that range stalled the fall, and the price action returned back to the upside.

After breaking above its 200 hour moving average, the price did stall near the 38.2% retracement at 0.89923. Consolidative trading above and below the 200 hour moving average ensued, before breaking to new highs.

The run higher did extend above the swing highs from last Friday and Monday (and other swing levels in that area going back to May 7), but found sellers.

The price is now back down retesting the 200 hour moving average at 0.8983 (the price is just trading back below that level).

The time is ticking toward the London fixing at 11 AM ET/4 PM in London. That may influence trading in the short term as tomorrow is the Friday before a 3 day weekend in London and the US and Monday is a holiday in both countries. So there may be some flows that may influence the market for now.

However, traders will be watching the 200 hour moving average for clues to the bullish/bearish bias. If the price can stay above, that would be bullish. A break below and a return back to the 100 hour moving average at 0.89679 can not be ruled out.