Products You May Like

Trading continue to be relatively subdued this week so far. While Dollar weakened overnight, losses were very limited. The greenback is indeed recovering mildly in Asian session. Australian Dollar also received little lift from strong business conditions data. Gold breached 1900 handle, but lacks the conviction to extend near term rebound. WTI crude oil also struggles to get through 70 handle.

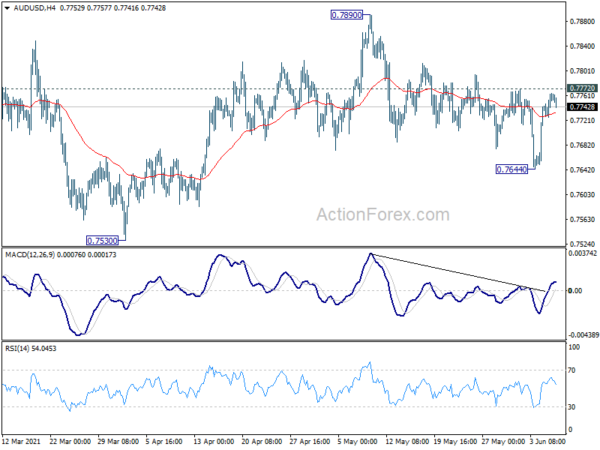

Technically, current development suggests that Dollar’s down trend is still intact, and should resume sooner or later. But some near term levels need to be taken out first. The levels include 1.2269 resistance in EUR/USD, 0.7772 resistance in AUD/USD, 1.4248 resistance in GBP/USD, 0.8929 support in USD/CHF and 1.2005 support in USD/CAD. Preferably, we’d also want to see break of 108.55 in USD/JPY to confirm broad based weakness in Dollar, when the selloff resumes.

In Asia, at the time of writing, Nikkei is down -0.06%. Hong Kong HSI is down -0.35%. China Shanghai SSE is down -0.51%. Singapore Strait Times is down -0.28%. Japan 10-year JGB yield is down -0.003 at 0.077. Overnight, DOW dropped -0.36%. S&P 500 dropped -0.08%. NASDAQ rose 0.49%. 10-year yield rose 0.009 to 1.569.

Australia NAB business conditions rose to record 37, entering growth period after rapid rebound

Australia NAB business conditions rose from 32 to 37, setting another record high. Trading conditions rose from 41 to 47. Profitability conditions rose from 34 to 40. Employment conditions rose from 20 to 25. All three sub-components also reset last month’s highs. Business confidence dropped from 23 to 20 in May.

NAB said: “Overall, this was another very strong read for the business sector – and forward indicators point to ongoing strength in the near-term. This is a pleasing result coming after last week’s national accounts which showed that the economy has now surpassed its pre-COVID level. The economy now appears to be entering a new period of growth after a very rapid rebound”.

Japan Q1 GDP finalized at -1.0% qoq, -3.9% annualized

Japan Q1 GDP contraction was finalized at -1.0% qoq, revised up from -1.3% qoq. Annualized rate was finalized at -3.9%. Capital expenditure shrank -1.2% qoq, revised up from -1.4% qoq. Government consumption dropped -1.1%, revised up from -1.8% qoq. Private consumption contracted -1.5% qoq, revised down from -1.4% qoq. External demand contracted -0.2% qoq. GDP deflator was finalized at -0.1%.

Economy Minister Yasutoshi Nishimura said after the release that consumption spending is expected to return ahead. “If infections subside, there’ll be pent-up demand from not having been able to go eating out or travelling,” he said.

Also released, labor cash earnings rose 1.6% yoy in April, above expectation of 0.8% yoy. Current account surplus narrowed to JPY 1.55T in April, versus expectation of JPY 1.60T. Bank lending rose 2.9% yoy in May, below expectation of 5.6% yoy.

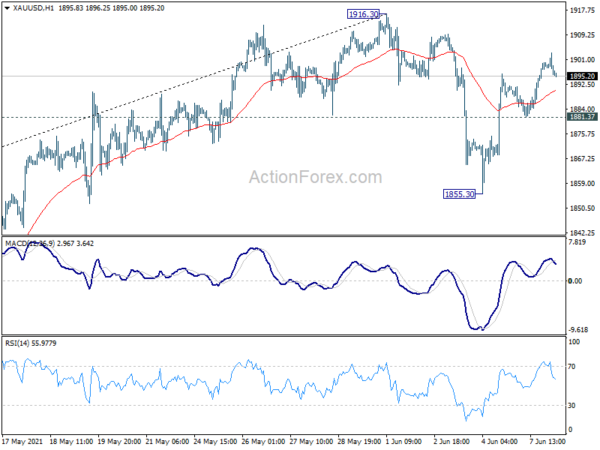

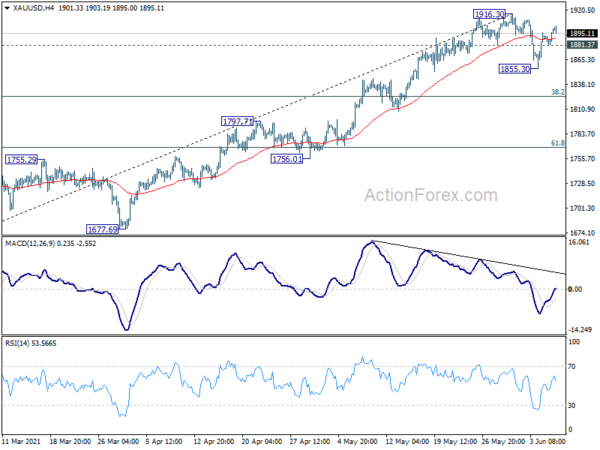

Gold breached 1900, but struggles to stay above again

Gold’s rebound from 1855.30 resumed overnight and edged higher to 1903.19. But for now, it struggles to stay above 1900 handle again and retreated. Upside momentum is also a bit unconvincing. While further rise is in favor as long as 1881.37 minor support holds, current momentum doesn’t warrant a firm break of 1916.30 high yet.

Instead, it looks like consolidation pattern from 1916.30 is going to extending with one more falling leg before completion. Break of 1881.37 will bring another fall back towards 1855.30 support to continue the consolidation pattern. Up trend would resume at a later stage.

Looking ahead

German ZEW economic sentiment will be the main focus in European session. Germany industrial production, France trade balance and Italy retail sales will be featured too. Eurozone will release Q1 GDP revision. Later in the day, US and Canada will release trade balance.

AUD/USD Daily Report

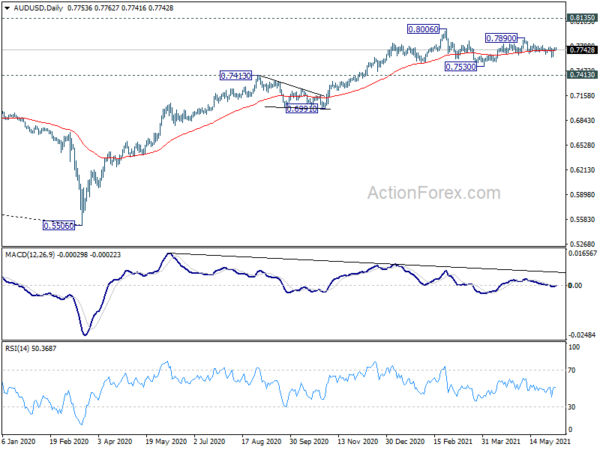

Daily Pivots: (S1) 0.7733; (P) 0.7750; (R1) 0.7772; More…

AUD/USD is staying in range below 0.7772 resistance and intraday bias remains neutral at this point. On the upside, break of 0.7772 resistance will suggest that pull back from 0.7890 has completed. Intraday bias will be turned back to the upside for 0.7890 resistance next. On the downside, though, break of 0.7664 will resume the fall from 0.7890 to 0.7530 support.

In the bigger picture, whole down trend from 1.1079 (2001 high) should have completed at 0.5506 (2020 low) already. Rise from 0.5506 could either be the start of a long term up trend, or a corrective rise. Reactions to 0.8135 key resistance will reveal which case it is. But in any case, medium term rally is expected to continue as long as 0.7413 resistance turned support holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:01 | GBP | BRC Like-For-Like Retail Sales Y/Y May | 18.50% | 39.60% | ||

| 23:30 | JPY | Labor Cash Earnings Y/Y Apr | 1.60% | 0.80% | 0.20% | 0.60% |

| 23:50 | JPY | Bank Lending Y/Y May | 2.90% | 5.60% | 4.80% | |

| 23:50 | JPY | GDP Q/Q Q1 | -1.00% | -1.20% | -1.30% | |

| 23:50 | JPY | GDP Deflator Y/Y Q1 | -0.10% | -0.20% | -0.20% | |

| 23:50 | JPY | Current Account (JPY) Apr | 1.55T | 1.60T | 1.70T | |

| 1:30 | AUD | NAB Business Confidence May | 20 | 26 | 23 | |

| 1:30 | AUD | NAB Business Conditions May | 37 | 32 | ||

| 5:00 | JPY | Eco Watchers Survey: Current May | 33.9 | 39.1 | ||

| 6:00 | EUR | Germany Industrial Production M/M Apr | 0.70% | 2.50% | ||

| 6:45 | EUR | France Trade Balance (EUR) Apr | -5.3B | -6.1B | ||

| 8:00 | EUR | Italy Retail Sales M/M Apr | 0.20% | -0.10% | ||

| 9:00 | EUR | Eurozone GDP Q/Q Q1 | -0.60% | -0.60% | ||

| 9:00 | EUR | Eurozone Employment Change Q/Q Q1 F | -0.30% | -0.30% | ||

| 9:00 | EUR | Germany ZEW Economic Sentiment Jun | 85.3 | 84.4 | ||

| 9:00 | EUR | Germany ZEW Current Situation Jun | -28 | -40.1 | ||

| 9:00 | EUR | Eurozone ZEW Economic Sentiment Jun | 85.5 | 84 | ||

| 10:00 | USD | NFIB Business Optimism Index May | 99.8 | |||

| 12:30 | USD | Trade Balance (USD) Apr | -68.9B | -74.4B | ||

| 12:30 | CAD | Trade Balance (CAD) Apr | -0.5B | -1.1B |