Products You May Like

Here is what you need to know on Friday, June 25:

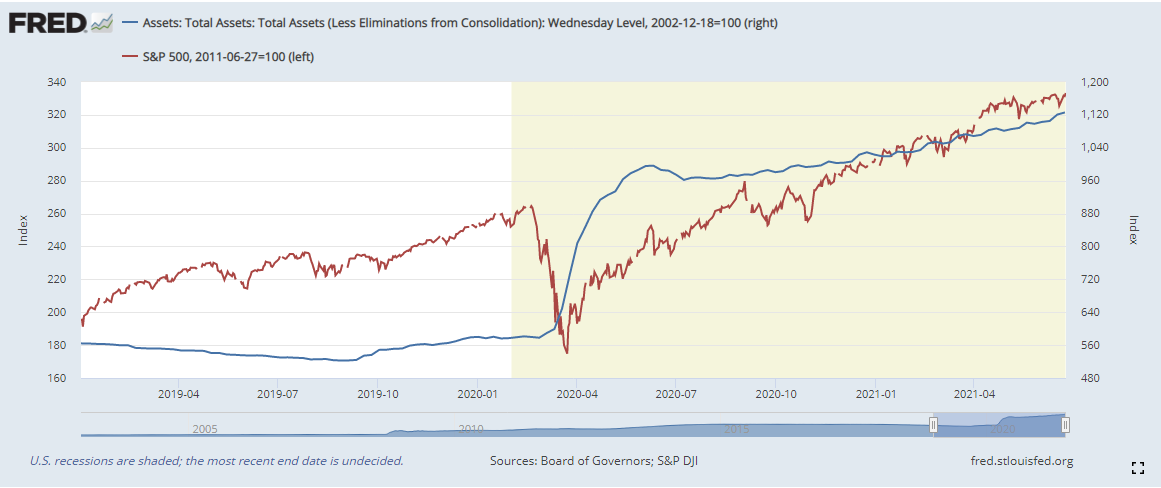

Equity markets continue to set more and more records as 2021 progresses with any dip in danger of being devoured by hungry buyers. The Fed wobble from last Thursday and Friday set up the latest dip and sure enough record highs swiftly followed. The Fed’s balance sheet hit another record high keeping the strong correlation in place, the Fed being the lead indicator. The chart below shows the correlation and note that the Fed balance sheet hit a record high again last week.

Mega tech continues to drive higher with Facebook (FB) and Alphabet (GOOGL) both at or near record highs on Thursday, while Tesla continues its breakout (see more) and Apple also breaks higher, see here.

The dollar remains steady at 1.1950 versus the euro, Oil is flat at $73.30, Bitcoin lower by 4% at $33,200 and Gold is $1,788. The fear guage VIX and yields are lower. The VIX is at 16 while the 10-year yield slumbers at 1.49% despite the high PCE data. PCE Core highest since 2008, PCE index highest since 1990’s!

European markets are mixed but largely around flat, FTSE +0.1%, Dax -0.1% and EuroStoxx -0.2%.

US futures are flat for S&P and Nasdaq, while the Dow is up 0.3%.

Wall street top news

US consumer spending 0.0% versus expected 0.4%.

US PCE Price Index, Core +0.5% versus forecast +0.6%.

University of Michigan Sentiment is due at 1500 GMT/1000 EST.

Delta variant of Covid continues to become the dominant strain as governments and countries ponder delays to reopening strategies. Israel, the world’s most vaccinated country, sees cases quadruple as it reintroducess mask guidance.

US Senate leader Mitch McConnell says he is pessimistic on the infrastructure bill after President Biden’s comments.

Germanys Economic Minister says expected to reach an agreement between EU and US over steel tariffs by end of 2021.

Virgin Galactic (SPCE) looks like being the first stock to the moon (sorry AMC and GameStop) as it receives FAA ok to fly passengers to space. Up 15% premarket.

Nike (NKE) keeps going in premarket after last night’s numbers, up 12% as EPS but in particular guidance beat estimates.

FedEx (FDX) EPS $5.01 just ahead of forecast, revenue also ahead. CEO says can’t find enough workers though so the stock drops 3% in premarket. You’ll hear this a lot.

CarMax (KMX) EPS beats, shares up 6% premarket.

FootLocker (FL) and UnderArmour (UA) up 4% in premarket, most likely dragged up by Nike (NKE).

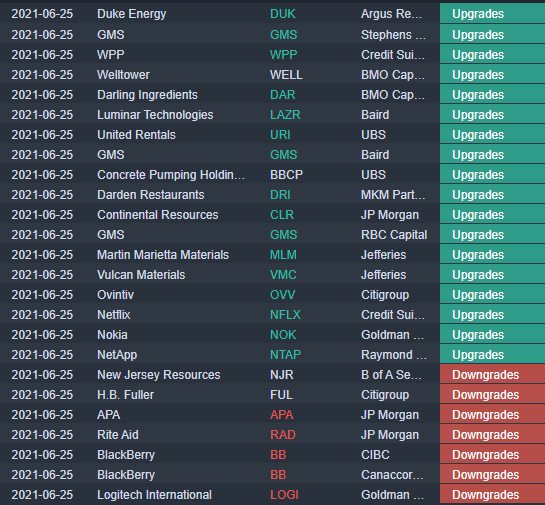

Logitech (LOGI) downgraded by Goldman. Drops 3% premarket.

Netflix (NFLX) upgraded by Credit Suisse. Up 2% premarket.

Blackberry (BB) meme name down 3% premarket as reports better than expected loss and higher revenue than forecast on Thursday but Canaccord and CIBC downgrade on Friday.

Bank stocks (JPM, BAC, C) pass Fed stress tests meaning they can resume buybacks and dividends. CNBC.

Nokia (NOK) Godman upgrades, up 3% premarket.

NetApp (NTAP) Raymond James upgrades, stock up 3% premarket.

Upgrades, downgrades, premarket movers

Source: Benzinga Pro

Economic releases

Like this article? Help us with some feedback by answering this survey:

/stock-market-graph-gm532464153-55981218_Large.jpg)