Products You May Like

Dollar and Yen are trading slightly softer in Asian session today, as markets are back on full risk-on mode. S&P 500 and NASDAQ hit new record after US President Joe Biden struck an infrastructure deal with a bipartisan group of senators. Asian stocks also trail higher. Commodity currencies rise in general as led by New Zealand Dollar. Focuses will turn to US PCE inflation today, but that’s unlikely to alter the path of the markets much.

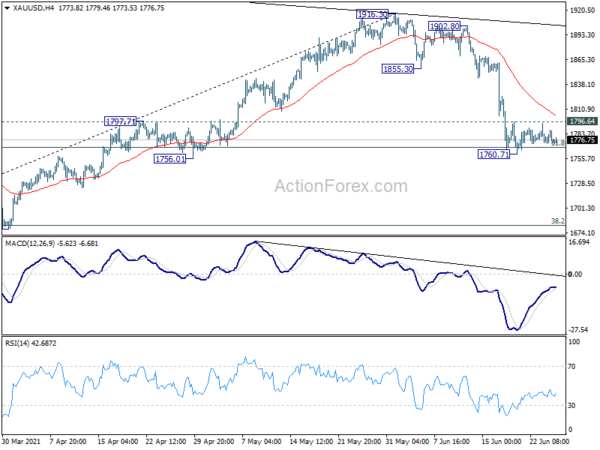

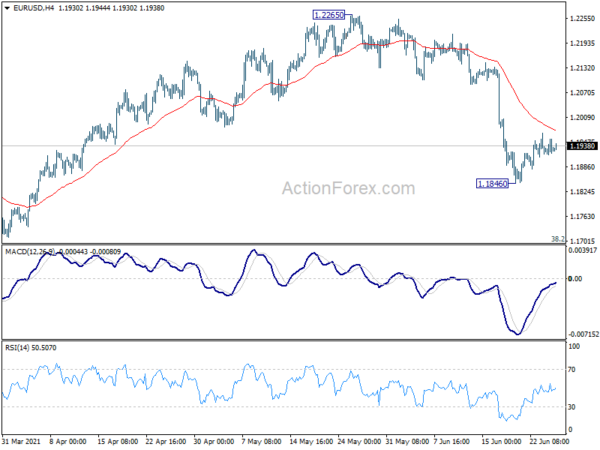

Technically, still, the stage for broad-based Dollar near-term bearish reversal is not set up yet. Focuses stays on 4 hour EMA in some Dollar pairs. The EMAs now sit at 1.1976 in EUR/USD, 1.3970 in GBP/USD, 0.9134 in USD/CHF and 1.2287 in USD/CAD. Also, Gold would need to break through 1796.64 resistance, and preferably 4 hour 55 EMA (now at 1803.61) to held affirm Dollar selloff.

In Asia, at the time of writing, Nikkei is up 0.79%. Hong Kong HSI is up 1.14%. China Shanghai SSE is up 0.79%. Singapore Strait Times is up 0.10%. Japan 10-year JGB yield is down -0.0012 at 0.053. Overnight, DOW rose 0.95%. S&P 500 rose 0.58% to 4266.49, new record. NASDAQ rose 0.69% to 14369.7, also a new record. 10-year yield closed flat at 1.487.

Fed Barkin: Near term inflation pressure to ease into Q4

Richmond Fed President Thomas Barkin said yesterday that “we are in the middle of a temporary adjustment cycle during which workers will return to the workplace and schools open and fiscal payments expire and suppliers catch up with demand.” Near-term inflation pressure is expected to “ease as we go into the fourth quarter,”

“I think the last 30 years of relative price stability has got to outweigh a few months of pressure, but one can never be too careful,” Barkin added. “That is why the Fed has started the process of discussing normalization” of its policy stance.”

Fed Harker: US economy roaring back but jobs still down significantly

Philadelphia Fed President Patrick Harker said in a speech that US economy is “by and large” in good shape overall. GDP has come “roaring back”, consumption, housing, and manufacturing are “extremely healthy”, while workers’ incomes are rising.

However, “even as GDP has almost entirely recouped its losses from last year, employment remains down significantly,” he added. “We still have nearly 7.6 million fewer people working than we did before the pandemic. And if you assume we would have maintained our prepandemic job growth of around 200,000 jobs a month had COVID-19 never arrived, we’re really down around 10.6 million jobs.”

UK Gfk consumer confidence unchanged at -9, upwards trajectory still on track

UK Gfk consumer confidence was unchanged at -9 in June, below expectation of -7. Joe Staton, Client Strategy Director GfK, says: “While the shifting sands of an end to lockdown might be the closest most of us get to a summer beach holiday, consumer confidence remains stable at -9 after 16 months of a COVID-induced roller-coaster. A repetition of last month’s score doesn’t mean confidence is about to nose-dive. The upwards trajectory for the Index since the dark days at the start of the pandemic is currently still on track.”

New Zealand exports rose 8.5% yoy in May, imports jumped 31% yoy

New Zealand goods exports rose NZD 461m, or 8.5% yoy, to NZD 5.9B in May. Goods imports rose NZD 1.3B, or 31% yoy, to NZD 5.4B. Trade surplus came in at NZD 469m, up from NZD 414m.

Imports from all top trading partners were up, including China (+9.4% yoy), EU (+28% yoy), Australia (+23% yoy), USA (+34% yoy), and Japan (+103% yoy. Exports to all top trading partners were up expect Australia, including China (+25% yoy), Australia (-13% yoy), USA (+11% yoy), EU (+22% yoy), and Japan (+3.5% yoy).

Elsewhere

Japan Tokyo CPI core improved to 0.0% yoy in June, up from -0.2% yoy, above expectation of -0.1% yoy. Looking ahead, Germany Gfk consumer confidence and Eurozone M3 money supply will be released. Later in the day, US will release personal income and spending, together with PCE inflation.

EUR/USD Daily Outlook

Daily Pivots: (S1) 1.1914; (P) 1.1935; (R1) 1.1952; More…

EUR/USD is staying in consolidation from 1.1846 and intraday bias remains neutral first. On the downside, break of 1.1846 will resume the fall from 1.2265, as the third leg of the consolidation pattern from 1.2348, to 1.1703 support. On the upside, sustained break of 4 hour 55 EMA (now at 1.1976) will bring stronger rise back to 1.2265 resistance instead.

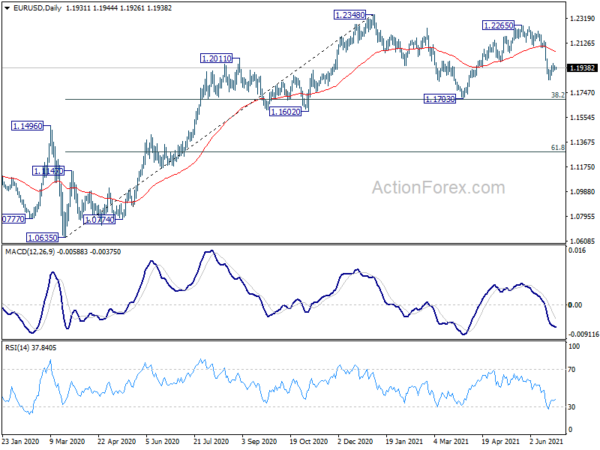

In the bigger picture, rise from 1.0635 is seen as the third leg of the pattern from 1.0339 (2017 low). Further rally could be seen to cluster resistance at 1.2555 next, (38.2% retracement of 1.6039 to 1.0339 at 1.2516). This will remain the favored case as long as 1.1602 support holds. Reaction from 1.2555 should reveal underlying long term momentum in the pair. However sustained break of 1.1602 will argue that the rise from 1.0635 is over, and turn medium term outlook bearish again.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:45 | NZD | Trade Balance (NZD) May | 469M | 388M | 414M | |

| 23:01 | GBP | GfK Consumer Confidence Jun | -9 | -7 | -9 | |

| 23:30 | JPY | Tokyo CPI core Y/Y Jun | 0.00% | -0.10% | -0.20% | |

| 6:00 | EUR | Germany Gfk Consumer Confidence Jul | -4 | -7 | ||

| 8:00 | EUR | Eurozone M3 Money Supply Y/Y May | 8.50% | 9.20% | ||

| 12:30 | USD | Personal Income M/M May | -2.00% | -13.10% | ||

| 12:30 | USD | Personal Spending M/M May | 0.40% | 0.50% | ||

| 12:30 | USD | PCE Price Index M/M May | 0.30% | 0.60% | ||

| 12:30 | USD | PCE Price Index Y/Y May | 4.00% | 3.60% | ||

| 12:30 | USD | Core PCE Price Index M/M May | 0.60% | 0.70% | ||

| 12:30 | USD | Core PCE Price Index Y/Y May | 3.50% | 3.10% | ||

| 14:00 | USD | Michigan Consumer Sentiment Index Jun | 86.4 | 86.4 |