Products You May Like

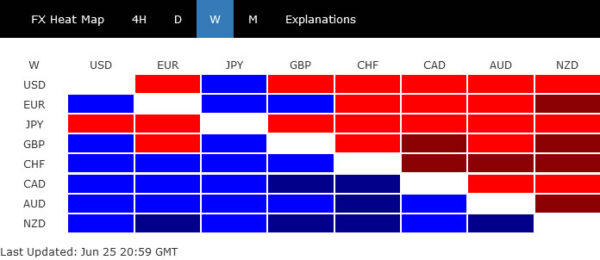

Yen and Dollar ended the week as the worst performing ones, as US stock markets came back with strong rally. Risk-on sentiments pushed commodity currencies broadly higher. Yet, Yen crosses are also held below recent highs despite the rebounds. Dollar’s pull back was also relatively weak. Some more time is needed to determine if they’re both in genuine reversal.

Sterling also dropped notably last week and ended as the worst performing one. From fundamental point of view BoE was just not hawkish enough, but not that dovish. No clear bearishness is warranted. But the technical picture in some crosses suggest that the near term outlook is not looking to well for the Pound.

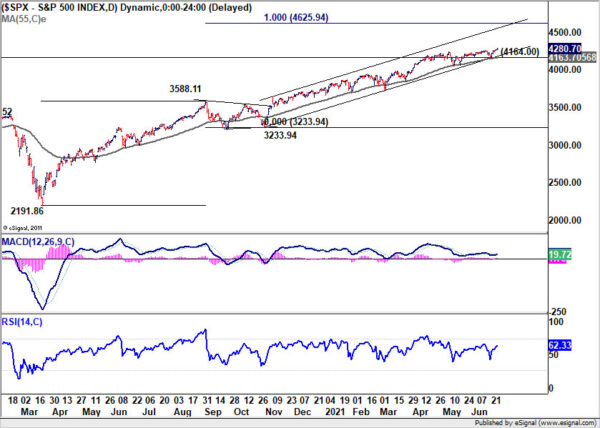

S&P 500 came back and struck new record high

The impressive comeback in US stocks last week caught us by a big surprise. DOW’s deep pull back the prior week proved to be just temporary, while S&P 500 and NASDAQ made new record highs. There was optimism over the bipartisan infrastructure deal, costing USD 1.2T over eight years, with USD 579B in new spending. Friday’s PCE inflation data also suggest that, at least, inflation is not running away from market expectations.

S&P 500 extended the up trend to new record close at 4280.70, after drawing support from 55 day EMA. It’s staying comfortably inside medium term rising channel. Outlook will stay bearish as long as 4164.0 support holds. Next target would be 100% projection of 2191.86 to 3588.11 from 3233.94 at 4625.94.

Dollar retreats mildly, but more upside still in favor

Dollar retreated mildly as markets turned back into risk-on mode. Yet, the selling was so far very weak, with major Dollar pairs struggled to break through 4 hour 55 EMAs decisively. As for Dollar index, we’d still favor more upside as long as 55 day EMA (now at 90.91) holds. Another rise could be seen back to 93.43 resistance and possibly above.

Yet, rise from 89.53 is still seen as the third leg of the consolidation pattern from 89.20. Hence, we’d expect strong resistance from 38.2% retracement of 102.99 to 89.20 at 94.46 at 94.46. to limit upside, at least to extend sideway trading.

Sterling dropped on disappointing BoE and delta concern

Sterling’s selloff last week could be partly attributable to the lack of hawkish surprise from BoE, in particular from the votings. Only chief economist Andy Haldane continued to vote for tapering. The statement set up expectations that the MPC would wait for August Monetary Policy Report to take any policy actions.

At the same time, the pandemic situation in the UK is relatively unclear. Daily cases surged back to above 15k level, due the spread of Delta variant. Yet, death tolls were low at around 20 a day. Vaccination still appeared to be effective in preventing serious cases and deaths. The UK Government also appears to be on track to allow fully vaccinated people to travel without restriction later. But this could still be a concern for traders.

But anyway, the technically development in Sterling is not too encouraging. Except versus Yen, there is prospect of deeper selloff in crosses in the near term at least.

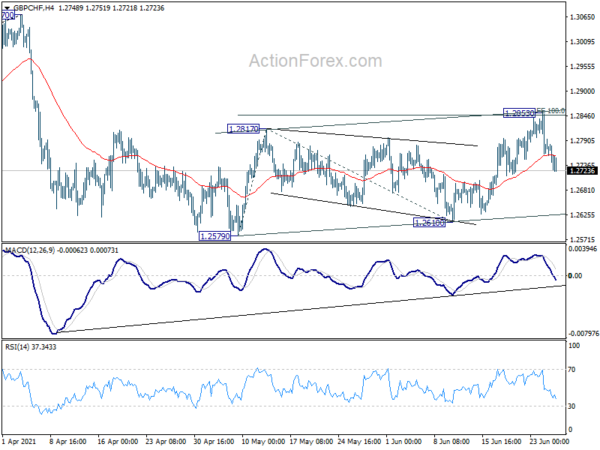

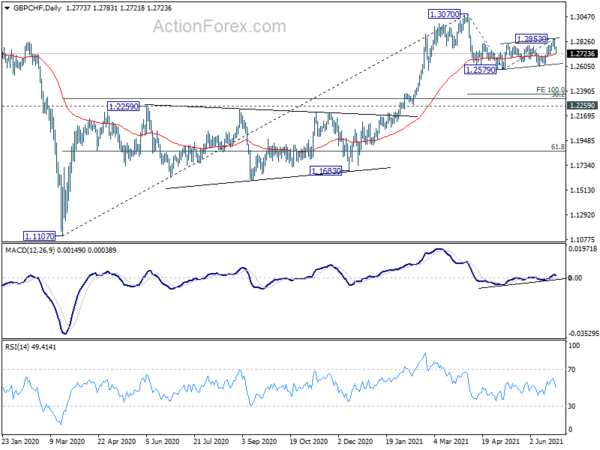

GBP/CHF completed sideway consolidation, might extend fall from 1.3070

GBP/CHF’s decline towards the end of the week argues that rise from 1.2610 has disappointingly finished at 1.2853 already. More importantly, the pattern from 1.2579 might has completed in three-wave form after hitting 100% projection of 1.2579 to 1.2817 from 1.2610. The corrective nature argues that fall from 1.3070 might be resuming.

Near term focus will now turn 55 day EMA (now at 1.2711). Sustained trading below there will affirm this bearish case. Further break of 1.2579 will target 100% projection of 1.3070 to 1.2579 from 1.2853 at 1.2362. Still overall outlook will be neutral at worst as long as 1.2259 key long term resistance turned support holds.

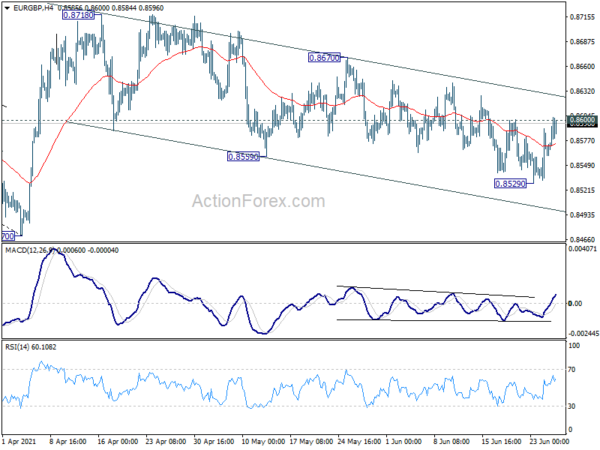

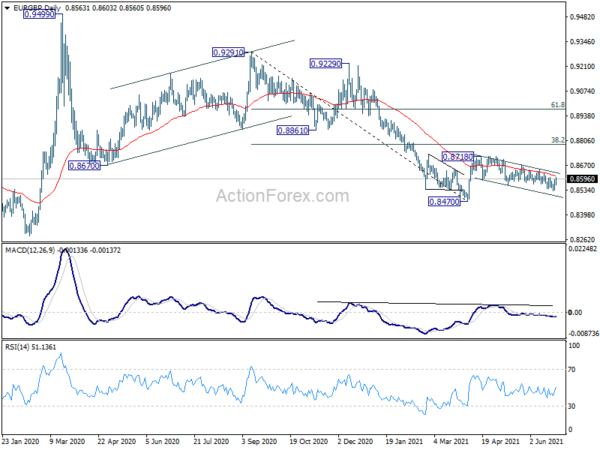

EUR/GBP’s corrective fall from 0.8718 finished, ready to resume rebound?

EUR/GBP recovered notably after edging lower to 0.8529 last week. Price actions from 0.8718 are very corrective, suggesting that rebound from 0.8470 would resume sooner or later. With breach of 0.8600 resistance, further rise is mildly in favor this week to 0.8670 resistance next.

Break of 0.8670 will affirm this bullish case and bring stronger rise through 0.8718 resistance. Next target will be 38.2% retracement of 0.9291 to 0.8470 at 0.8784.

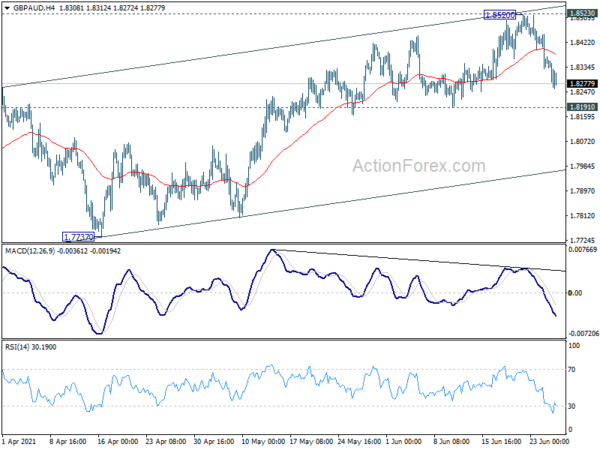

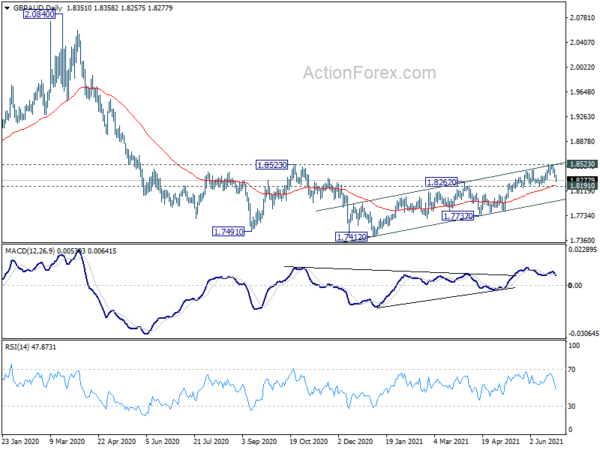

GBP/AUD rejected by 1.8253 resistance, eye on 1.8191 support next

GBP/AUD also faced strong rejection from 1.8523 resistance and dropped notably last week. Immediate focus will now be back on 1.8191 support. Break there will raise the chance that whole corrective rise from 1.7412 has completed. With 1.8523 resistance intact, medium term outlook will remain bearish for another fall through 1.7412, to resume the whole down trend from 2.0840.

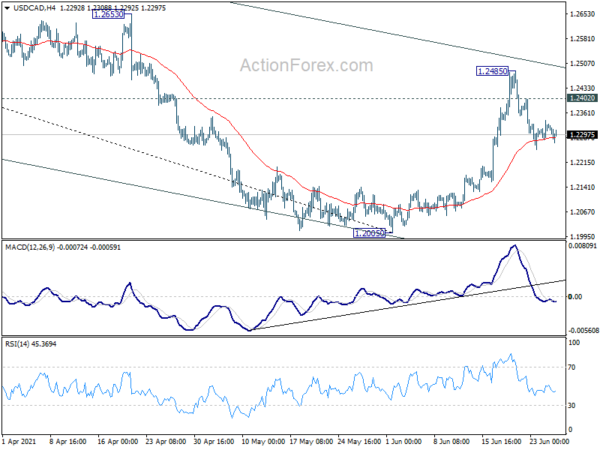

USD/CAD edged slightly higher to 1.2485 last week but retreated sharply since then. Downside is so far support by 4 hour 55 EMA (now at 1.2288). Initial bias stays neutral this week first. On the downside, sustained trading below 4 hour 5 EMA will argue that rebound from 1.2005 has completed after failing medium term channel resistance. Intraday bias will be back on the downside for retesting 1.2005. On the upside, above 1.2402 minor resistance will resume the rebound from 1.2005 towards 1.2653 key structural resistance.

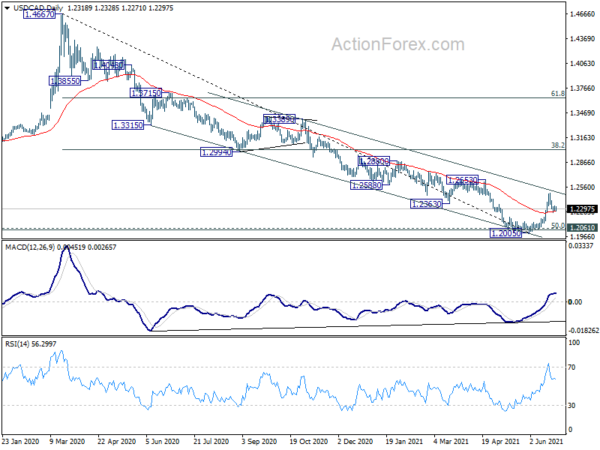

In the bigger picture, fall from 1.4667 is seen as the third leg of the corrective pattern from 1.4689 (2016 high). It might have completed after hitting 1.2061 (2017 low) and 50% retracement of 0.9406 to 1.4689 at 1.2048. Sustained break of 38.2% retracement of 1.4667 to 1.2005 at 1.3022 will pave the way to 61.8% retracement at 1.3650. Overall, medium term outlook remains neutral at worst with 1.2048/61 support zone intact.

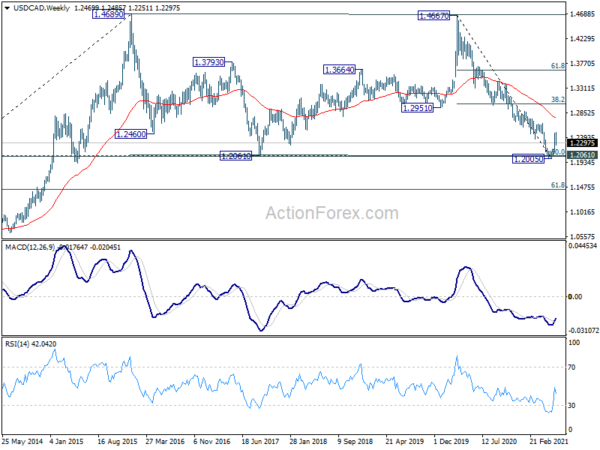

In the longer term picture, we’re viewing price actions from 1.4689 as a consolidation pattern. Thus, up trend from 0.9506 (2007 low) is still expected to resume at a later stay. This will remain the favored case as long as 1.2061 support holds, which is close to 50% retracement of 0.9406 to 1.4689 at 1.2048. However, sustained break of 1.2061 will be a sign of long term bearishness. Deeper fall would be seen to 61.8% retracement at 1.1424 and below.