Products You May Like

New Zealand Dollar is the star winner in Asian session today on RBNZ rate speculations. The Kiwi has taken Aussie higher today, but the latter lost some steam after unsurprising RBA policy decision. Though, Aussie is still maintaining most of gains, together with Sterling. On the other hand, Dollar, Yen and Euro are the weakest ones.

Technically, EUR/AUD’s break of 1.5699 support is the first sign of near term bearish reversal. Deeper fall could be seen back to 1.5418 support next. The question is whether that would be accompanied by break of 0.7615 resistance in AUD/USD to indicate Aussie strength. Or break of 0.8529 support in EUR/GBP to indicate Euro weakness. We’ll see.

In Asia, at the time of writing, Nikkei is up 0.33%. Hong Kong HSI is down -0.58%. China Shanghai SSE is down -0.53%. Singapore Strait Times is up 1.18%. Japan 10-year JGB yield is up 0.0092 at 0.045.

RBA moves to AUD 4B per week bond purchase, until at least mid-Nov

RBA decided to keep cash rate target at 0.10% as widely expected. The central bank will continue with bond purchase program after the current one ends in September. But the purchase target will be changed to AUD 4B per week, until at least mid-November. April 2024 bond is kept as the bond for yield target at 0.10%.

The central bank said the expectation that condition for rate hike “will not be met before 2024”. This could be seen as slightly more optimism than “this is unlikely to be until 2024 at the earliest.” Still, “meeting it will require the labour market to be tight enough to generate wages growth that is materially higher than it is currently.”

NZD/JPY jumps as markets now sees Nov RBNZ hike

New Zealand Dollar jumps broadly today as economists pull head their expectation on RBNZ rate hike. The change in forecasts came after strong NZIER Quarterly Survey of Business Opinion, which shows a sharp improvement in both business confidence and demand in firms’ own business.

General business confidence jumped to 10.1 in Q2, from Q1’s -7.9. Trading activity in the past three months rose to 25.6, from -0.4. Trading activity for the next three months rose to 27.6, from 7.8.

ASB Bank now predicts a rate hike from historical low at 0.25% in November. BNZ quickly followed in expecting a hike this November. Markets are indeed now pricing in 70% chance of that happening.

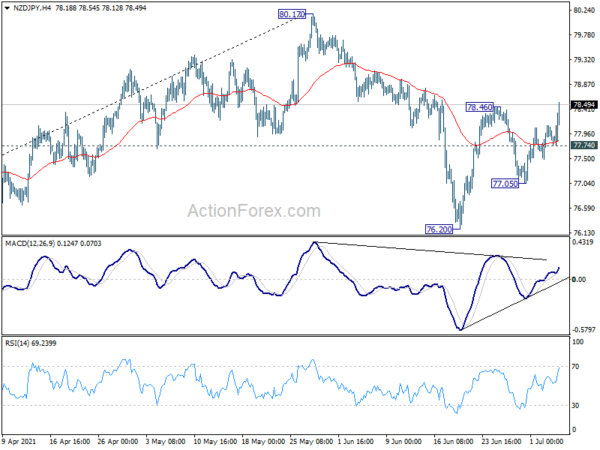

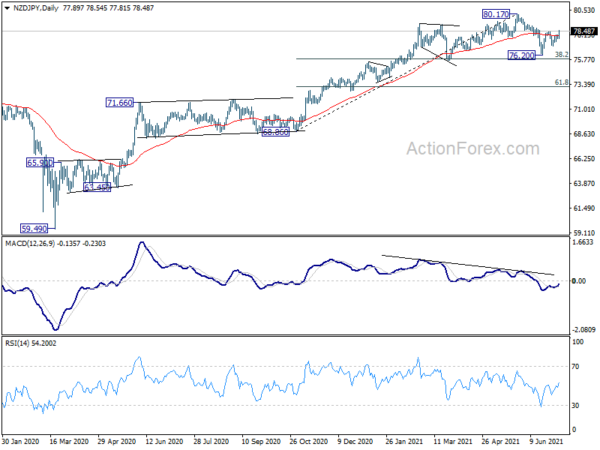

NZD/JPY’s break of 78.46 resistance now suggests that rebound from 76.20 is resuming. Further rise should be seen as long as 77.74 support holds, to retest 80.17 high. At this point, we’re not expecting a firm break of 80.17 to resume the up trend from 59.49 low yet. Consolidation pattern from 80.17 could still extend with another falling leg. We’ll keep an eye on the upside momentum to assess it again later.

Elsewhere

Japan labor cash earnings rose 1.9% yoy in May, below expectation of 2.1% yoy. Household spending rose 11.6% yoy, above expectation of 10.9% yoy.

Looking ahead, Germany factory orders and ZEW economic sentiment, Eurozone retail sales, and UK PMI construction will be released in European session. US will release ISM services.

AUD/USD Daily Report

Daily Pivots: (S1) 0.7513; (P) 0.7525; (R1) 0.7541; More…

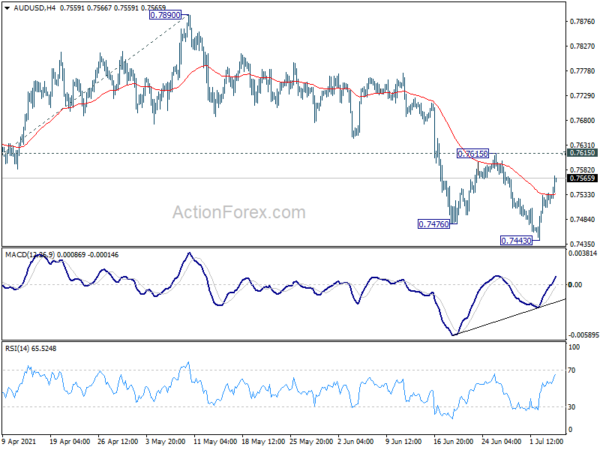

AUD/USD’s rebound from 0.7443 continues today but stays below 0.7615 resistance. Intraday bias remains neutral first. On the upside, break of 0.7615 will argue that corrective pattern from 0.8006 has completed already. Further rise should then be seen back to 0.7890.8006 resistance zone. On the downside, break of 0.7443 will resume the whole corrective pattern from 0.8006. But we’d expect strong support from 100% projection of 0.8006 to 0.7530 from 0.7890 at 0.7414 to bring rebound.

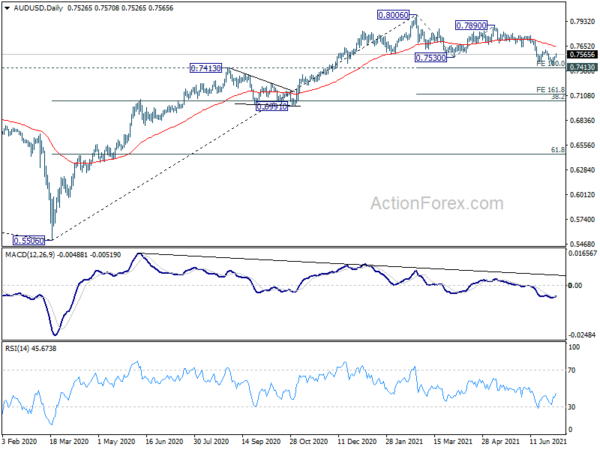

In the bigger picture, rise from 0.5506 medium term bottom could either be the start of a long term up trend, or a corrective rise. Reactions to 0.8135 key resistance will reveal which case it is. Rejection by 0.8135 key resistance, followed by firm break of 0.7413 resistance turned support, will favors the latter case. Deeper decline would be seen to 38.2% retracement of 0.5506 to 0.8006 at 0.7051 first.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:30 | JPY | Labor Cash Earnings Y/Y May | 1.90% | 2.10% | 1.40% | |

| 23:30 | JPY | Overall Household Spending Y/Y May | 11.60% | 10.90% | 13.00% | |

| 4:30 | AUD | RBA Rate Decision | 0.10% | 0.10% | 0.10% | |

| 6:00 | EUR | Germany Factory Orders M/M May | 1.30% | -0.20% | ||

| 8:30 | GBP | Construction PMI Jun | 63.5 | 64.2 | ||

| 9:00 | EUR | Germany ZEW Economic Sentiment Jul | 75.4 | 79.8 | ||

| 9:00 | EUR | Germany ZEW Current Situation Jul | 5 | -9.1 | ||

| 9:00 | EUR | Eurozone ZEW Economic Sentiment Jul | 84.4 | 81.3 | ||

| 9:00 | EUR | Eurozone Retail Sales M/M May | 4.10% | -3.10% | ||

| 13:45 | USD | Services PMI Jun F | 64.8 | 64.8 | ||

| 14:00 | USD | ISM Services PMI Jun | 63.5 | 64 |