Products You May Like

Here is what you need to know on Monday, July 19:

Equity markets are in doom-and-gloom mode on Monday as continued fears over the Delta strain of COVID-19 hit markets. While the UK continues with its plan to fully lift all restrictions, investors are taking a more cautious approach as statistics across Europe and the US continue to trend in the wrong direction.

Investor optimism has been put on hold as book closing ahead of a busy earnings season seems to be the trade of choice. Investment banks’ impressive run of earnings last week could not stop all main indices from posting negative performance, but given the strong ascent so far in 2021, something had to give.

Next week, big tech will provide some data for bulls and bears to pour over to see if the Roaring 20s bull market can continue.

Oil prices slide to under $70 as OPEC+ agrees to end supply cuts. The dollar remains strong at 1.1786 versus the euro, while Gold is at $1,806. Bitcoin is lower by 3% at just over $30,000.

European markets are all lower with the Dax -2.8%, FTSE -2% and EuroStoxx -2%.

US markets are also lower: Nasdaq -1%, Dow -1.4% and S&P -1.1%.

Wall Street top news

OPEC+ agrees to end production cuts, oil drops.

UK ends covid restrictions.

AutoNation (AN) EPS smashes forecasts $4.83 v $2.81.

Cal Maine Foods (CALM) EPS -$0.09 versus $0.18 forecast.

Zoom (ZM) to buy Five9 (FIVN) for $14.7 billion in stock.

Meme stocks suffer again as AMC down 7% premarket, GME -3%.

Cruise stocks suffer on appealed court ruling: CCL -5%, CUK -6%, NCLH -5%.

Oil stocks lower on OPEC+ agreement: OXY, COP, MPC, MRO, DVN, HAL.

Airline stocks suffering on Delta covid concerns: AAL -5%, LUV -4%, UAL -5%.

Pershing Square Tontine Holdings (PSTH) drops plans to buy 10% of Universal Music.

XPEV prices new model at $24,700, undercutting new TSLA Model 3 model.

Upgrades, downgrades, premarket movers

Source: Benzinga Pro

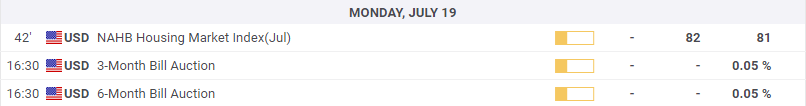

Economic releases

Like this article? Help us with some feedback by answering this survey: