Products You May Like

Dollar and Yen lost their position as the strongest ones as US stocks staged another day of massive rebound overnight, together with treasury yields. On the other hand, Canadian Dollar is currently the best performer for the week, helped by WTI crude oil’s reclaim of 70 handle. But Aussie and Kiwi remain the weakest at this point. Euro is mixed, as markets await ECB’s new forward guidance and press conference.

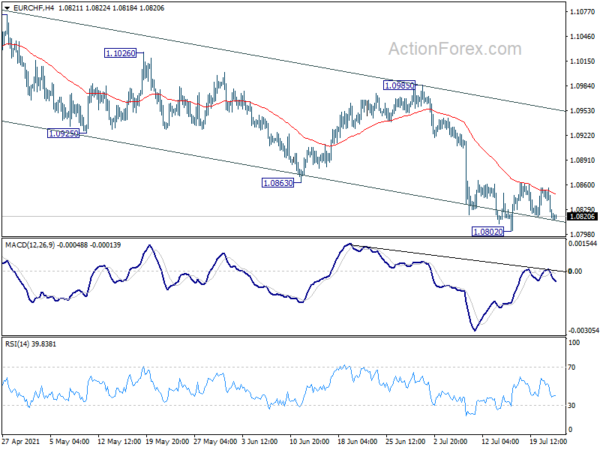

Technically, we’d pay some attention to EUR/CHF to guide the assessment on Euro’s next move. It was rejected twice by 4 hour 55 EMA, affirming near term bearishness. Break of 1.0802 temporary low will resume larger fall from 1.1149 towards 1.0737 support. That could also drag EUR/USD down in spite of its own weak downside momentum.

In Asia, Japan is on holiday. Hong Kong HSI is up 1.76% at the time of writing. China Shanghai SSE is up 0.25%. Singapore Strait Times is up 1.40%. Overnight, DOW rose 0.83%. S&P 500 rose 0.82%. NASDAQ rose 0.92%. 10-year yield rose 0.071 to 1.280.

Australia goods exports rose to record 41.3B in Jun

Australia exports of goods rose 8% mom or AUD 2.9B to AUD 41.3B in June. Imports of goods rose 7% mom or AUD 2.1B to AUD 28.0B. Goods trade surplus widened to record AUD 13.3B, up slightly from AUD 12.5B. Exports to top five destinations rose, including China (8%), Japan (21%), South Korea (24%), Taiwan (9%), USA (7%).

Head of International Statistics at the ABS Andrew Tomadini said: “June 2021 recorded a monthly export value above $40 billion. Exports increased 8 per cent to $41.3 billion, with significant increases in metalliferous ores, coal, non-monetary gold, and gas”.

Australia NAB business confidence dropped to 17 in Q2, but condition rose sharply to 32

Australia NAB business confidence dropped from 19 to 17 in Q2. Current business condition rose from 20 to 32. Business conditions for the next 3 months rose from 28 to 36. Business conditions for the next 12 months rose from 31 to 33. Capex plans for the next 12 months rose from 34 to 37.

Looking at some more details, trading conditions rose from 26 to 38. Profitability rose from 22 to 32. Employment rose from 13 to 23. Forward orders rose from 14 to 23. Stocks rose from 5 to 11. Exports also improved from -1 to 0.

According to Alan Oster, NAB Group Chief Economist “Business conditions were still in negative territory in Q3 2020, and now, three quarters later, they were at a record high, a testament to how rapid the recovery has been from last year’s recession”.

“A pleasing aspect of the survey is how broad-based the strength in conditions and confidence was – whether you look by industry or by state they are all above average, and in many cases well above.”

EUR/USD lost downside momentum as new ECB forward guidance awaited

ECB policy decision and press conference are the main focuses for today, even though no policy change is expected. After the conclusion of the strategic review on July 8, officials are clear that they’re going to adjust the forward guidance to align with the new symmetric 2% inflation target, which allows a temporary overshoot. Overall reactions could, however, be rather muted.

Here are some previews:

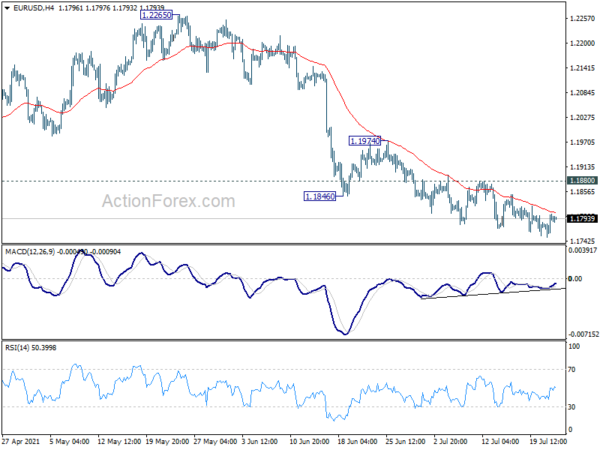

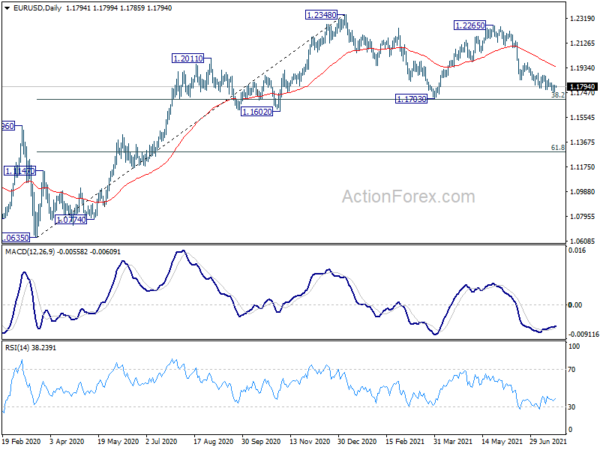

Euro is currently rather mixed in general. EUR/USD is clearly losing downside momentum as seen in 4 hour MACD. But current fall from 1.2265, as the third leg of the pattern from 1.2348, could still extend towards 1.1703 support and even below. Nevertheless, break of 1.1880 resistance would be a sign of near term reversal and bring stronger rebound through 1.1974 resistance.

Elsewhere

US will release jobless claims and existing home sales. Eurozone will release consumer confidence.

USD/CAD Daily Outlook

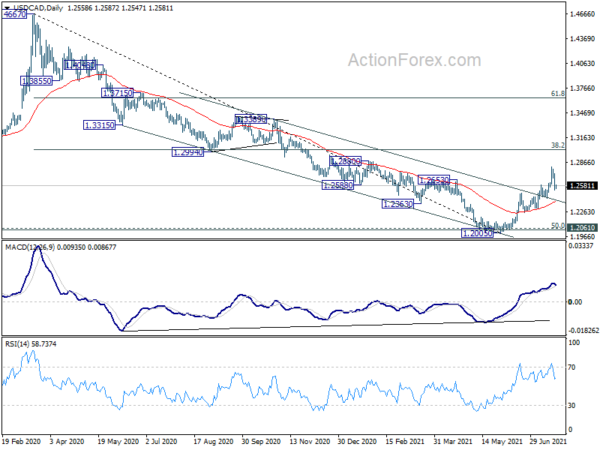

Daily Pivots: (S1) 1.2481; (P) 1.2606; (R1) 1.2685; More…

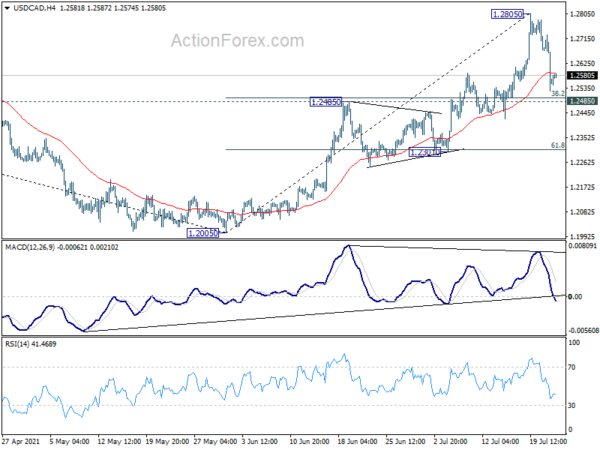

USD/CAD’s pull back from 1.2805 extends lower but stays above 1.2485 resistance turned support. Intraday bias remains neutral first. Further rise is still in favor. Break of 1.2805 will extend the rise from 1.2005 to 1.3022 medium term fibonacci level next. On the downside, however, break of 1.2485 will bring deeper fall back to next cluster support at 1.2301 (61.8% retracement of 1.2005 to 1.2805 at 1.2311).

In the bigger picture, fall from 1.4667 is seen as the third leg of the corrective pattern from 1.4689 (2016 high). It should have completed after hitting 1.2061 (2017 low) and 50% retracement of 0.9406 to 1.4689 at 1.2048. Sustained break of 38.2% retracement of 1.4667 to 1.2005 at 1.3022 will pave the way to 61.8% retracement at 1.3650 and above. Overall, medium term outlook remains neutral at worst with 1.2048/61 support zone intact.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 1:30 | AUD | NAB Business Confidence Q2 | 17 | 17 | 19 | |

| 11:45 | EUR | Eurozone ECB Interest Rate Decision | 0.00% | 0.00% | ||

| 12:30 | EUR | ECB Press Conference | ||||

| 12:30 | USD | Initial Jobless Claims (Jul 16) | 350K | 360K | ||

| 14:00 | USD | Existing Home Sales Jun | 5.95M | 5.80M | ||

| 14:00 | EUR | Eurozone Consumer Confidence Jul P | -3 | -3 | ||

| 14:30 | USD | Natural Gas Storage | 55B |