Products You May Like

Latest data released by Markit/CIPS – 23 July 2021

- Prior 62.4

- Manufacturing PMI 60.4 vs 62.5 expected

- Prior 63.9

- Composite PMI 57.7

- Prior 62.2

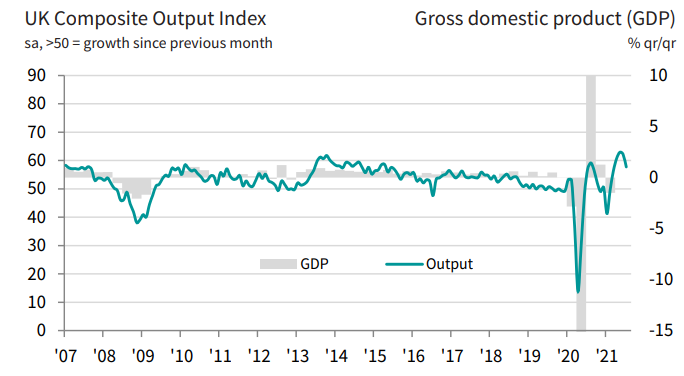

UK business activity miss on expectations and decline quite considerably from June as firms widely report that staff and raw materials shortages dampened conditions, hindering the recovery pace after the reopening in April.

This is certainly a spot to watch now for the UK and will likely dampen any hopes of a more hawkish tilt by the BOE as we look towards the August meeting.

Markit notes that:

“July saw the UK economy’s recent growth spurt stifled by

the rising wave of virus infections, which subdued customer

demand, disrupted supply chains and caused widespread

staff shortages, and also cast a darkening shadow over the

outlook.“Although business activity continued to grow, aided by

the easing of lockdown restrictions to the lowest since the

pandemic began, the rate of expansion slowed sharply to the

weakest since March.“Transport, hospitality and other consumer-facing services

companies were the hardest hit, though manufacturing also

saw growth weaken markedly during the month.“Although the July flash survey only covered three days of the

full easing of covid restrictions, any imminent re-acceleration

of growth in August looks unlikely due to a steep slowing in

overall new order growth recorded during July.“Concerns over the Delta variant have meanwhile

overshadowed the passing of “freedom day”, and were a key

factor alongside Brexit and rising costs behind a sharp slide in

business expectations for the year ahead, which slumped to

the lowest since last October.“The PMI indicates that GDP growth will likely have slowed

in the third quarter, after having rebounded sharply in the

second quarter.“Firms’ costs rose at a rate unprecedented in over 20 years

of survey history as supply shortages pushed up the price of

goods, suppliers of services hiked prices and employee pay

continued to rise.”