Products You May Like

German DAX pressures that the all-time high but backs off

The German Dax move to a intraday high today of 15808.24. That was just short of the July 44 high of 15810.68. The inability to make a new high led to some rotation back to the downside. Nevertheless, the German DAX index is closing marginally higher on the day (as are other European indices).

The provisional closes are showing:

- German DAX, +0.1%

- France’s CAC, +0.6%

- UK’s FTSE 100, +0.1%

- Spain’s Ibex, +0.5%

- Italy’s FTSE MIB, +1.2%

For the week, the major ended sees are showing solid gains:

- German DAX, +1.4%

- France’s CAC, +3.1%

- UK’s FTSE 100 +1.3%

- Spain’s Ibex +2.3%

- Italy’s FTSE MIB +2.4%

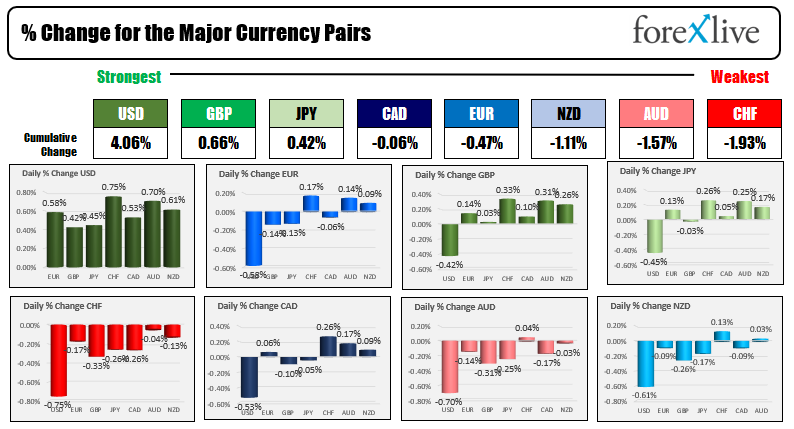

Looking at the forex market as London/European traders look to exit, the USD remains the runway strongest. The CHF and the AUD are the weakest.

In other markets:

- Spot gold is down $43 or -2.4% at $1761.51.

- Spot silver is down $0.87 or -3.47% at $24.26

- WTI crude oil futures are down $1.07 or -1.54% at $68.07

- Bitcoinn is up near $1000 of $41,884

In the US stock market, the major indices are mixed:

- Dow is up 117 points or 0.34% 35,181.88. That is off from the intraday high of +182.54 points at 35246.79 (a new all time intraday high for the Dow).

- S&P index is up 3.48 points or 0.08% at 4432.58. The positive close will be a new record. The S&P index reached a new all-time intraday high of 4440.20.

- Nasdaq is down to minus 75.49 points or -0.51% at 14819.61. The NASDAQ index has been negative all day with the high at -4.9 points. The NASDAQ closed at a record level yesterday

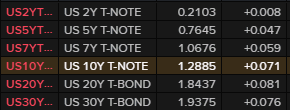

In the US debt market, yields are higher after the stronger jobs report with the tenure up 7.1 basis points at 1.288%. The two year yield is up about one basis point.