Products You May Like

France’s CAC continues to move toward its all-time high price from 2000

The major European indices are closing higher. The German Dax closed at a new all-time high. The France’s CAC also closed at a 2021 new high and works closer to its 2000 all time high.

The provisional closes are showing:

- German DAX, +0.3%

- France’s CAC, +0.5%

- UK’s FTSE 100, +0.8%

- Spain’s Ibex, +0.9%

- Italy’s FTSE MIB, +1.0%

In other markets as European traders look to exit:

- Spot gold is trading up $20.20 or 1.17% at $1749.29.

- Spot silver is up $0.16 or 0.69% $23.49

- WTI crude oil futures are trading down $0.79 or -1.16% at $67.66

- Bitcoin is trading up $1000 at $46,637

In the US stock market, the Dow and S&P traded to a new all-time highs and remain on track for a record close today. The NASDAQ index continues its slide as investors rotate out of the big cap tech into cyclicals.

- Dow, up 164 points or 0.47% at 35429

- S&P up 2.55 points or 0.06% at 4440

- NASDAQ index down 68 points or -0.46% at 14719

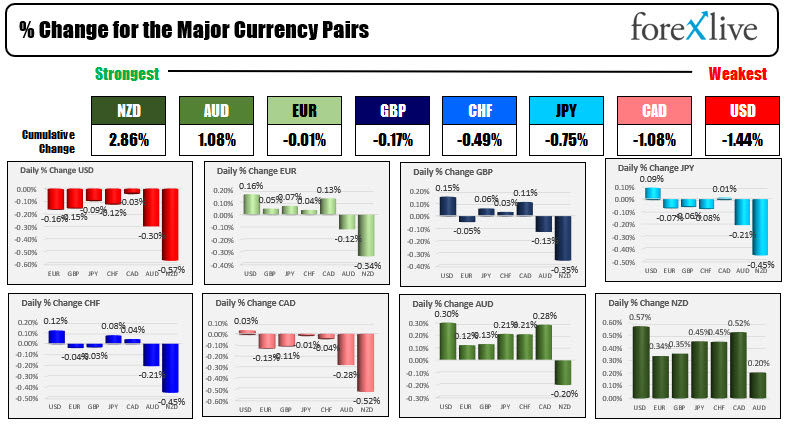

In the forex, the NZD and the AUD are the strongest of the majors, while the USD and CAD are the weakest. The USD has corrected lower today after the recent run to the upside. Although CPI inflation came in more or less as expected, the market is hopeful that the peak is in place (time will tell). The fall in the dollar may also be attributed to a technical correction after some key targets were reached.