Products You May Like

France’s CAC moves closer to its all-time high at 6944.77 from September 2000

The European shares are closing mostly higher with the one exception of the UK FTSE 100. The German DAX, Euro Stoxx and France’s CAC reached closed at new highs for the year with the German DAX and Stoxx index at record highs. The France’s CAC is getting closer to its September 2000 all time high.

Looking at the provisional closes:

- German DAX, +0.8%

- France’s CAC, +0.4%

- UK’s FTSE 100, -0.4%

- Spain’s Ibex, +0.1%

- Italy’s FTSE MIB, +0.4%

Looking at the weekly chart of the France’s CAC, the high price today reached a 6891.30. That is within 53 points of the all-time high price from September 2000 at 6944.77.

In other markets as European/London traders look to exit:

- Spot gold is trading down $0.13 or -0.01% at $1749.70.

- Spot silver is down $0.36 or -1.55% at $23.17.

- WTI crude oil futures are down $0.27 or -0.39% $69.05

- Bitcoin is trading down $1265 and $44,273

In the US stock market, the NASDAQ index has reversed earlier declines and currently trades up around 24 points or 0.17%. The Dow industrial average was higher earlier but is now trading lower while the S&P is near unchanged:

- NASDAQ index up 24.36 points or 0.16% at 14789.47

- S&P index +1.51 points or 0.03% at 4449.23

- Dow industrial average -95 points or -0.27% at 35389.80

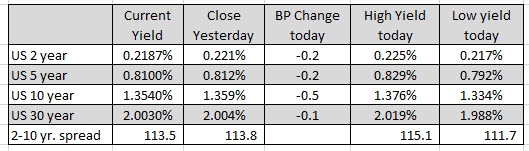

in the US debt market, the yields along the curb are down marginally. The 30 year is down -0.1 basis points at 2.003% ahead of treasuries auction of $27 billion of 30 year bonds.

The benchmark 10 year yields in Europe were mostly lower:

The benchmark 10 year yields in Europe were mostly lower:- Germany -0.463%, -0.3 basis points

- France -0.129%, -0.2 basis point

- UK 0.595%, +2.2 basis point

- Spain 0.22%, -0.5 basis points

- Italy 0.542%, -0.4 basis points

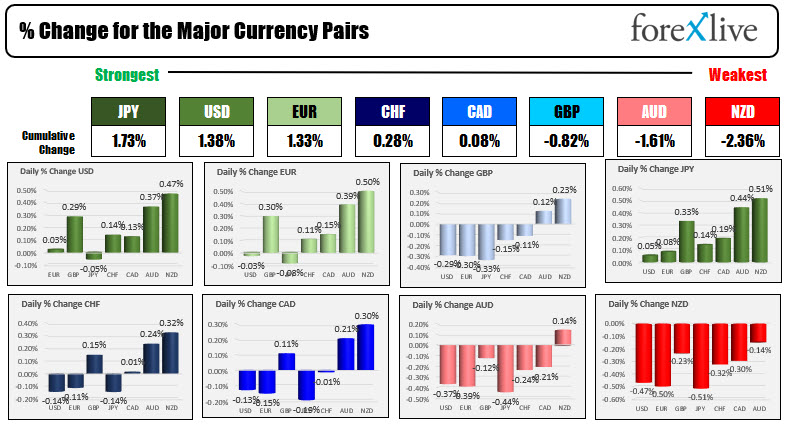

In the forex market, the JPY is the strongest and the NZD is the weakest. The USD has come off it’s high level but is just below the JPY for the strongest of the majors.

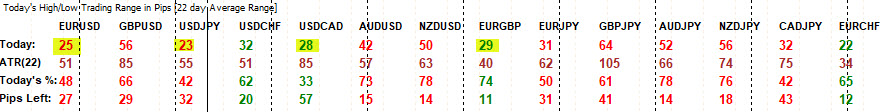

The trading activity is a very light with the EURUSD, USDJPY, USDCAD and EURGBP all having low to high trading ranges of less than 30 pips. All the major pairs have ranges that are less than 78% of the average over the last month of trading. The USDCAD range is only 33% of what is normal, while the EURUSD, USDJPY have ranges that are less than 50% of what is normal over the last month.

The PPI data today was higher than expectations. The jobless claims came was as expected at 375K. That is still better than the +400,000 of a few weeks ago.