Products You May Like

- NASDAQ:LCID shed ground, but may soon come back.

- Lucid rival Tesla begins to look outside of the electric vehicle industry.

- A new EV maker backed by Amazon for its IPO at a staggering valuation.

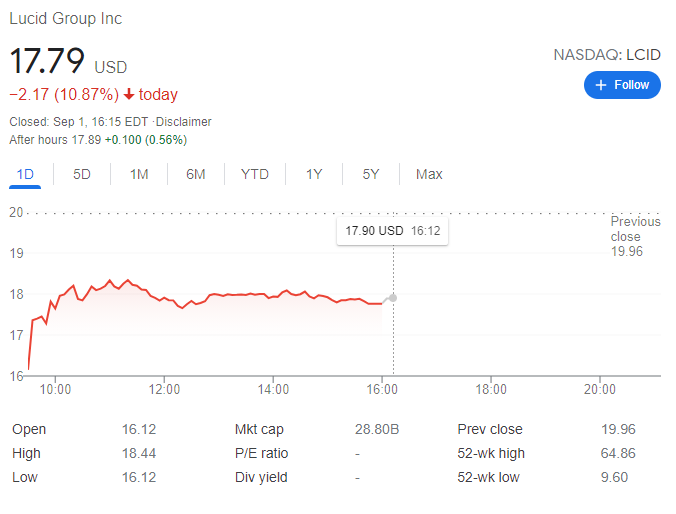

Update: Sept 1: NASDAQ:LCID shed 10.87% on Wednesday to finish the day at $17.79 per share. Wall Street was torn between softer-than-expected US employment figures, and hopes for another delay in tapering. The US ADP survey showed that the private sector added just 374K new jobs in August, while the ISM Manufacturing PMI employment sub-component contracted to 49 from 52.9. Such figures are hinting at a weak Nonfarm Payroll report. US stocks plummeted at the opening, although the three majors indeed managed to bounce ahead of the close, with the Nasdaq Composite adding 50 points. Shares may bounce back once market participants realize easy money will keep coming.

Previous update: Was it all just a PIPE dream. The PIPE transaction was done at $15 and the lock-up period expired today meaning investors in that deal are free to sell from today. There is no evidence of this but none the less the shares have collapsed to $15.53 for a 22% loss in the premarket. Meme stocks are volatile so perhaps some switching is going on with AMC up (see here), PLTR breaking out (see here) and SKLZ up 16% now in the premarket (see here).

NASDAQ:LCID is hitting a slippery slope, as the recently merged EV SPAC continues to decline. Shares of LCID fell a further 4.5% this week, and nearly 13% over the past month. On Friday, Lucid dipped a further 2.09% to close the trading week at $21.03. Lucid Group is fresh off a review from MotorTrend that called its Air Dream Sedan a serious threat to brands like Tesla (NASDAQ:TSLA). Despite the glowing review, shares of Lucid have continued to slide as investors seem more interested in hearing about a concrete delivery date.

Stay up to speed with hot stocks’ news!

Speaking of Tesla, the industry leader for electric vehicles continues to branch out its operations into other industries. On Friday, the company officially applied to the Texas Public Utility Commission to sell electricity to Texans. The move comes as Tesla began construction of a 100 megawatt energy storage system just outside of Houston. Earlier this year a cold snap left millions of Texans without power for days, so Tesla could be trying to take advantage of a vulnerable system. Shares of Tesla were up 1.53% during Friday’s session.

LCID stock price forecast

Electric truck and vehicle maker Rivian has officially filed for it U.S. IPO. The company, which is backed by Amazon (NASDAQ:AMZN), is seeking an $80 billion valuation, which is 350 times the valuation that Tesla had in its IPO back in 2010. Compared to Lucid, Rivian is nearly ready to deliver its first shipment of vehicles, and is working on electric delivery vans that will be used almost exclusively by Amazon.

Like this article? Help us with some feedback by answering this survey: