Products You May Like

It’s not about the absolute level of inventories

Henry Hub natural gas prices are up another 4.3% today to $5.15, which is a fresh 8-year high and a 14-year high for this time of year.

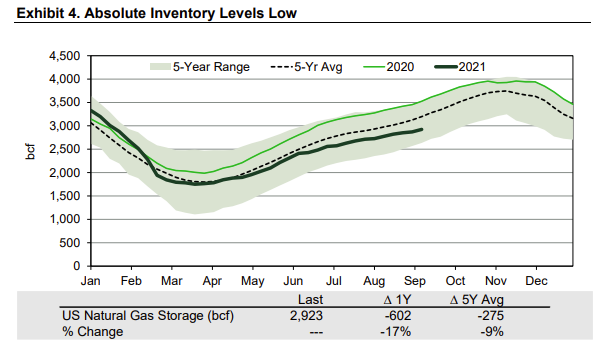

The bears point to absolute inventory levels as a reason not to worry about a spike higher in prices. They’re just 9% below the five-year average for this time of year.

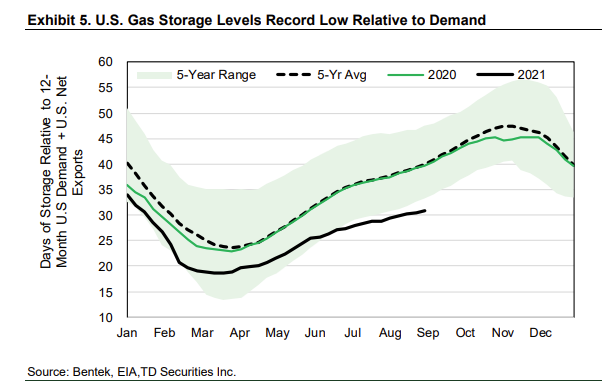

What that ignores is that demand for natural gas has grown considerably in the past five years. The construction of many LNG facilities, the conversion of coal-fired power plants to natural gas and pipelines to Mexico all mean that larger inventories are needed.

TD argues that a better way to measure US natural gas in storage is days of storage available compared to demand. By that measure, they say US natural gas inventories are at record lows.

What’s especially worrisome is that there are no signs of increased drilling.

Oil and gas companies have been hammered for years and are overlevered and beaten down. Share prices are pricing in much lower gas prices than the strip is showing. Wall Street no longer wants to fund these companies so they’re shifting to a model of ultra-lean balance sheets and return of capital. That will take time but in the meantime, ‘drill baby, drill’ is dead; even at $5.15 natural gas.