Products You May Like

This is playing out according to script

The Fed is playing second fiddle to China today.

Whether there’s a taper in November or December doesn’t matter. We get a nod that a taper is coming this year in the statement and that’s about all the hawks could have expected.

The surprise came in the dot plot, which now shows an even split of 9 Fed members forecasting a 2022 hike and 9 forecasting no change. I’d wager that the 9 saying no hike include the core Fed members that matter, especially Powell so tie goes to the home team. Still, there’s a new SEP in December and we’re now one dot away from the majority seeing a hike. The 2023 dots are hawkish as well.

Fed fund futures are now pricing an 80% chance of a hike by Dec 2022 so direct market measures on pricing show it’s hawkish.

So why is the dollar falling? Why are stocks rallying?

So while markets have offered some positive ticks, there’s still a

considerable way to go here. Obviously, there’s going to be some waiting

until after the Fed, but assuming no big hawkish surprise, we’ll see a

flood of buying in risk assets afterwards

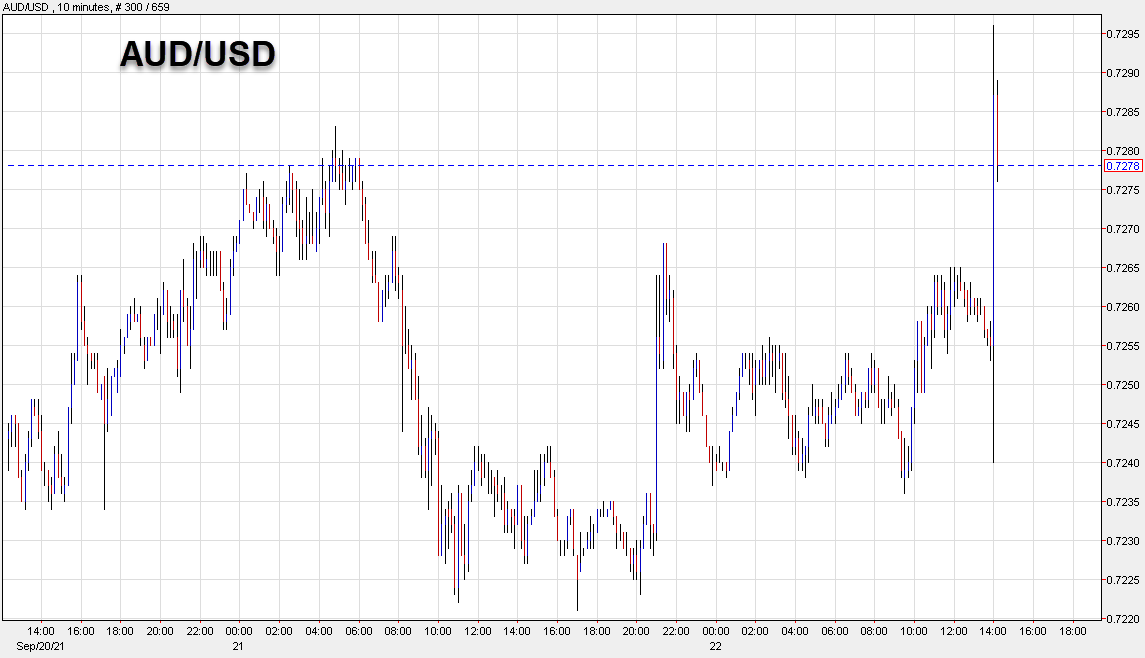

That’s exactly what’s unfolding now.