Products You May Like

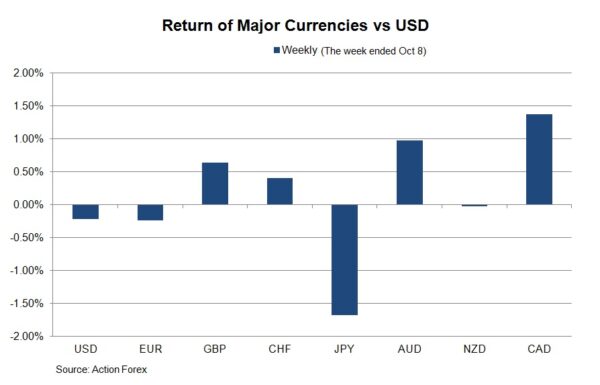

Falling to the weakest level since August, USDCAD was the worst performer amongst majors (CAD best performer against USD). Loonie’s rebound was driven by energy prices and strong job data. Elevated inflation also has again heightened speculations about BOC’s rate hike.

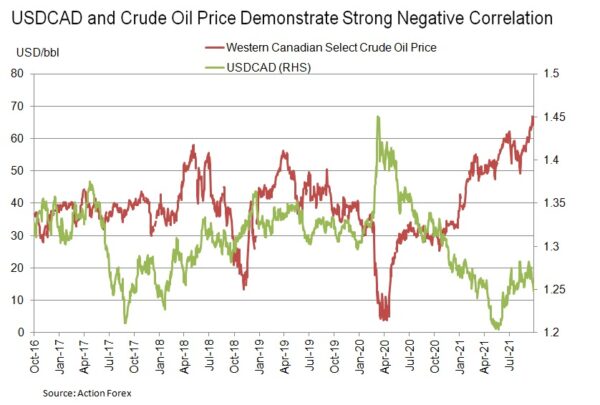

The major driver of loonie’s strength was energy price. Crude oil price rallied as the energy crisis in China, Europe and the UK worsened. The front-month WTI and Brent crude oil futures rallied 5% and +4.95% last week, respectively. The front-month WCS future contract, the benchmark of Canada’s crude oil, also rose +3.3% last week. Higher demand for Canada’s oil exports lifted the Canadian dollar.

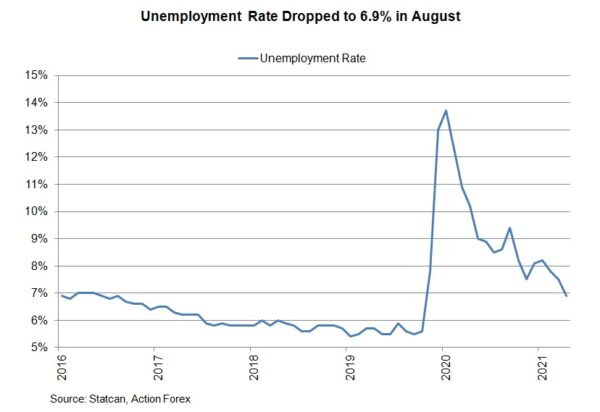

On Canada’s economy, the number of employment soared +157.1K in September, beating consensus of +61.2 K and August’s +90.2K. The unemployment rate slipped -0.2 ppt to 6.9%, in line with expectations and continued to improve to 7.1% in August. This contrasted sharply with the disappointment in US payroll report. The US saw only +194K addition in nonfarm jobs in September, much weaker than consensus of +500K. The August figure was revised higher to an increase of +366K. The unemployment rate, however, fell markedly to 4.8% from 5.2% in August. The market had anticipated a mild drop to 5.1%.

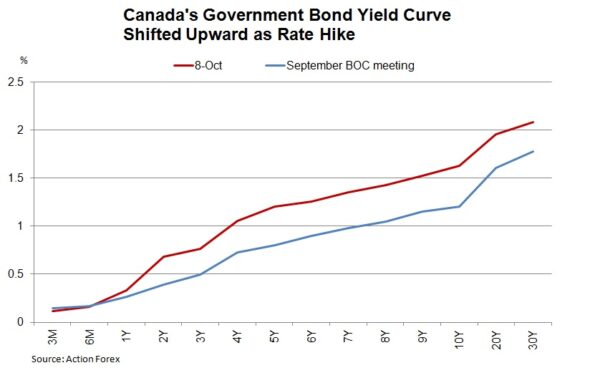

The country’s inflation remained elevated. Headline CPI soared to +4.1% y/y in August, up from +3.7% in the prior month. Gasoline prices, jumping +32.5% from the same period last year, contributed to almost a percentage point to the headline reading. Core CPI also accelerated to +3.5% y/y from +3.3% in July. Moreover, the average of the central bank’s three preferred measures registered at +2.6% y/y, its highest since March 2009, and reflecting the broad-based nature of the price increases. Inflation now appears more persistent than previously anticipated. While it is unlikely that supply constraints could be resolved in the near-term, energy crisis is prone to worsen. Both are expected to put further upward pressure on inflation.

Strong employment and inflation have again raised speculations of a BOC rate hike. Canadian government bond yields increased cross the curve with the 10-year yield reached the highest level since March. We expect the BOC to reduce its QE purchases to CAD 1B/ week at the October meeting, while the first rate hike will arrive in late 2022.