Products You May Like

European indices close mixed for the week

The European major indices are closing mostly higher with the Spanish Ibex the exception. The provisional closes are showing:

- German DAX, +0.5%

- France’s CAC, +0.8%

- UK’s FTSE 100, +0.34%

- Spain’s Ibex, -0.4%

- Italy’s FTSE MIB +0.2%

For the week, the indices were mixed with the UK’s FTSE, German DAX, Spain’s Ibex closing lower.

- German DAX, -0.3%

- France’s CAC, +0.1%

- UK’s FTSE 100 -0.3%

- Spain’s Ibex -1.0%

- Italy’s FTSE MIB +0.4%

In other markets as European traders look to exit for the weekend shows:

- Spot gold has given most of its gains that saw the price trade to just below $1814. The price is currently up to dollars and $0.91 or 0.15% at $1785.62

- Spot silver is up $0.10 or 0.41% at $24.24

- WTI crude oil futures are trading at $82.70 that’s up $0.20 or 0.25%

- Bitcoin is trading at $60,700. That is well off it’s all-time high price reached this week at $67,016

In the US stock market, the major indices have turned negative on the back of chair Powell’s comments about inflation:

- Dow industrial average -32.29 points or -0.09% at 35571.90

- S&P index -20.22 points or -0.44% at 4529.76

- NASDAQ index -170.45 points or -1.12% at 15045.12

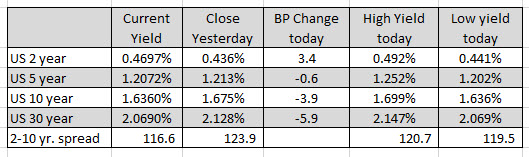

in the US debt market, the yield curve has shifted with the shorter end moving higher and the longer end moving lower in volatile trading. The two year yield is currently up 3.4 basis points at 0.4697%. It did reach 0.492%. The five year traded as high as 1.252% but currently trades at 1.2072% near unchanged on the day:

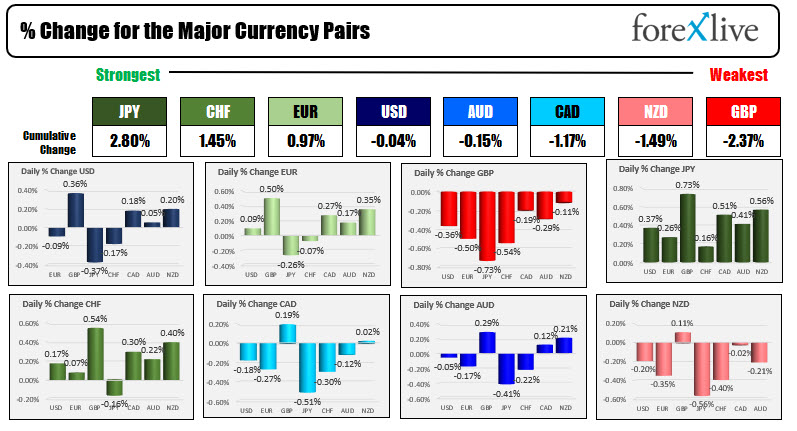

In the forex market, the USD has erased earlier declines and trades more mixed in volatile trading. The JPY is the strongest of the majors, while the GBP is the weakest.