Products You May Like

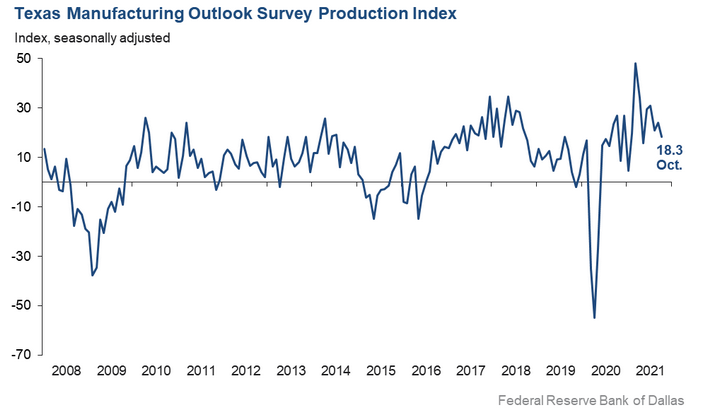

Dallas Fed survey of manufacturers for October:

- Prior was +4.6

- Production index at +18.3 vs 24.2 prior

- New orders +14.9 vs 9.5 prior

- Prices paid +76.3 vs 80.4 prior

- Wages and benefits +44.1 vs 42.7 prior

- Future index +2.4 vs -2.8 prior

Selected comments:

- We are unable to secure enough raw materials to meet our growth demand from customers.

- Prices for raw materials have increased over the last six months. The

rate of increase has slowed. The uncertainty over being able to purchase

steel and cement is making our decisions more difficult. - Problems continue to increase. We can’t hire enough people. We can’t get

raw materials. Shipping times are increasing, and the cost of materials

goes up every week. We just keep having price increases, but this is

not driving down demand. I don’t think homebuilders care about costs

anymore; they just want supply, and in as short a lead time as possible. - It is beginning to feel like we are headed to a slowdown in a few months with inflation kicking in.

- Even though Biden terminated some of the incentives to promote folks not to work, there still seems little interest in working.

- We are anticipating a surge in business toward the end of the year and

the beginning of 2022. Business has been like a roller-coaster, with

sharp ups and downs. Incoming freight costs have skyrocketed, and the

lead time for supplies is extremely long. The only answer is to

anticipate future business and overstock raw materials to avoid

production disruptions, which is risky but unavoidable. - Although the level of uncertainty remains unchanged, there is still a

tremendous amount of uncertainty generally with component availability

and continued rising prices. Demand is high in some areas, but not all

areas, as some customers have overordered and are now pulling back - Raw materials domestically, such as steel bar and tubing, have been

pushed from a normal eight weeks out to nine to 12 months. We are being

forced to resort to European and Asian steel purchases. - Inflationary pressures had caused us to raise the price on our

production. We routinely pass on raw material costs based on a price

index widely used in the industry. This is the first non-raw-material

price increase we have had in the 15 years that I have owned this

company. This increase and the inflationary implication have added to

the customers’ belief that they must order against future price

increases. Our customers are deluged with price increases. It doesn’t

take long for the inflationary concept to take hold. Labor is

unavailable at virtually any level; $13- to $15-per-hour jobseekers (if

you can find any) now want $18. No experience. It is chaotic. - We have implemented a price increase to cover increased wages that we

will soon be paying, plus covering increased overhead items.

Viewing

Touch / Click anywhere to close

This article was originally published by Forexlive.com. Read the original article here.