Products You May Like

The USDJPY is near unchanged levels for the week at 113.85

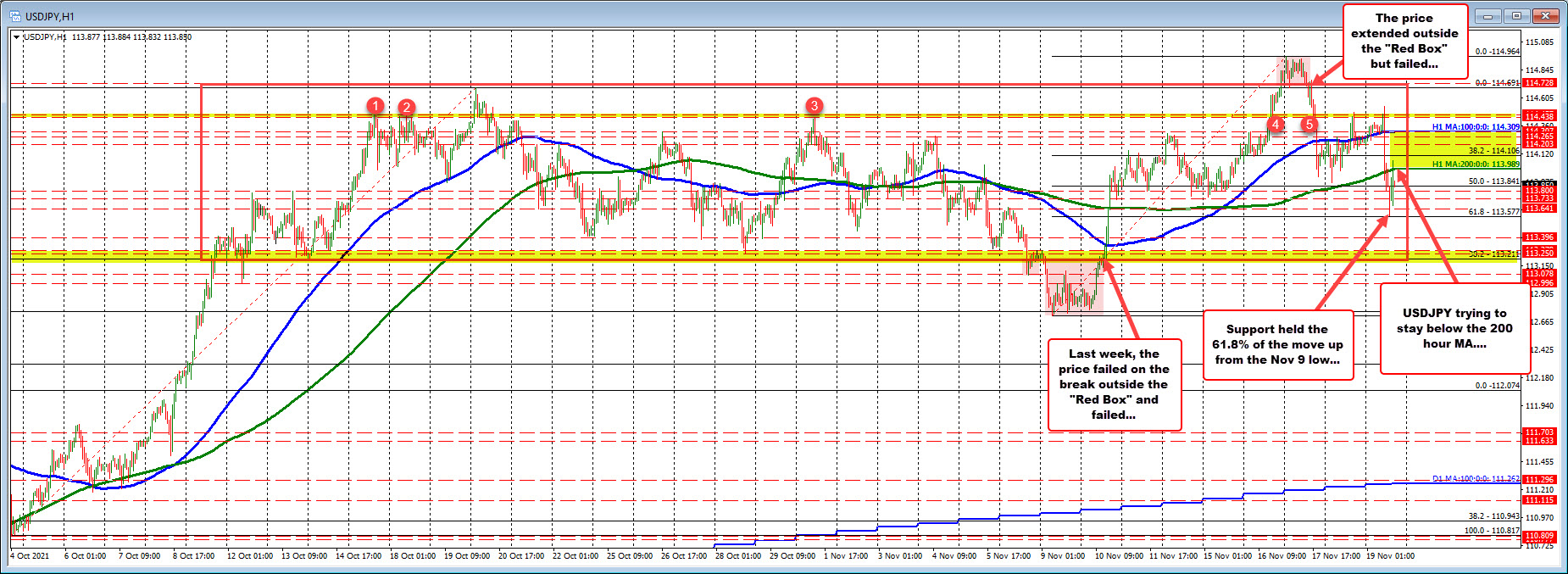

The USDJPY today has fallen back below the 100/200 hour MA at 114.309 and 113.989 respectively, as lower yields and lower crude oil prices sent the dollar lower. The move to the downside took the price down to test the 61.8% retracement of the move up from last week’s low at 113.577. Buyers leaned against that retracement level and pushed price back up toward the 200 hour moving average in the process. Although the price moved above the 200 hour moving average on the correction, the move was brief and the price now trading comfortably below the level.

Taking a broader look, recall from last week, the price moved outside (to the downside) of the “Red Box” that confined the range from mid October (below 113.21). That break failed. The price move higher.

This week, the price moved outside the Red Box again. This time to the upside (above 113.691). The price also moved above the November 2017 high at 114.728. Those breaks also failed.

The move lower today and break of the 100/200 hour MA tilts the bias more to the downside (but still within the range). Stay below is more bearish. The 61.8% is the next downside target to get to and through to increase the bearish bias.

For the week, the pair closed last week near 113.85. The current price is at 113.86. The price action spent most of the time above the close from last week, with only a few hours on Monday and the move lower today as the only time spent in the red for the week.

Nevertheless, if I were to characterize this week….”The buyers had their shot. The aimed, shot and missed”.

The thing is, the opposite could have been said last week after the pair moved outside the Red Box to the downside (i.e, “the sellers had their shot. They aimed, shot and missed”).