Products You May Like

Will it move them?

The issue is to do whether asset prices are ‘sensibly valued’. Marion Kohler said:

- “Asset prices increase when risk-free rates are low, and this is part of the monetary transmission mechanism”

- “While bank bond spreads are around their lowest level in over a decade, difficult to know whether this is not aligned with fundamentals”

So, remember that the RBA’s official line is that no rate hikes until 2024 or until the labour market is showing sufficient progress. They have said that they want to see: ‘actual inflation is sustainably within the 2 to 3 per cent target range. This will require the labour market to be tight enough to generate wages growth that is materially higher than it is currently’.

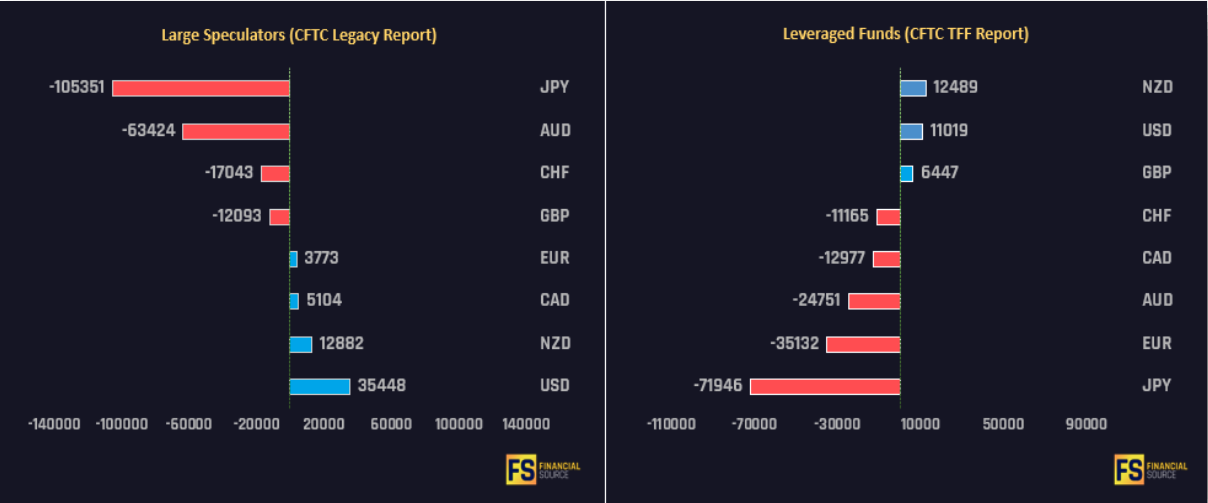

However, if asset prices are considered to be in a bubble then hiking interest rates, or threatening to, can help deflate those bubbles. The key thing to note all in all is that the AUD has been heavily sold for quite some time now. Any decent data out, especially on wages, should give the AUD a boost and a chance for some of the large AUD short positions to unwind.