Products You May Like

Dollar bulls still in charge of proceedings this week

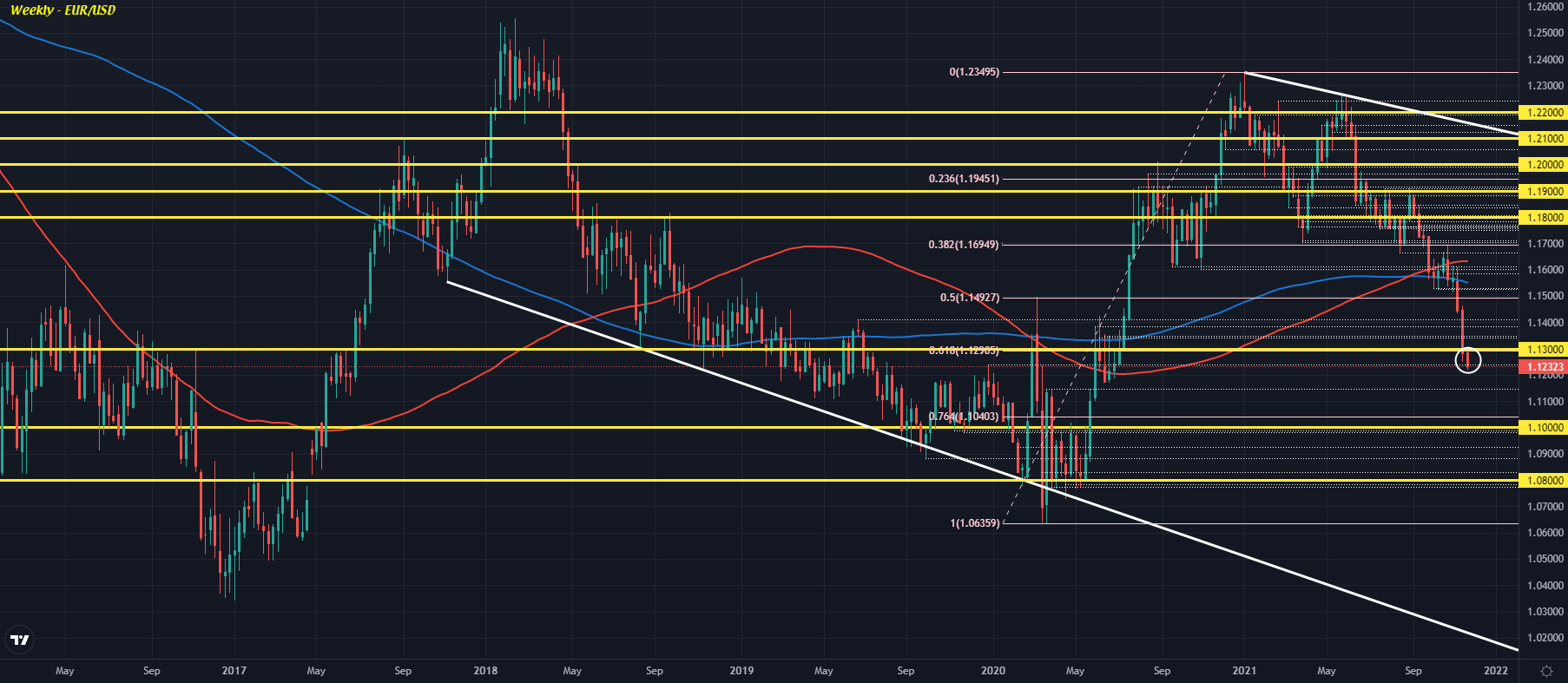

EUR/USD is down a touch and lingering at its lowest levels since July last year, seen around 1.1220-30 levels at the moment with little reprieve so far this week.

Sellers are still aiming for a push towards 1.1200 and dollar sentiment as a whole is helping to keep the downside pressure on the pair going for the time being.

The action in USD/JPY is helping in that regard as the pair now makes its way back above 115.00 after a light drop earlier amid a slight retreat in Treasury yields.

A slew of US data beckons later today that could see some push and pull but on the balance of things, yields seem to be underpinned so long as the inflation debate continues to keep as it is and as Fed officials reaffirm a potentially quicker pace of tightening.

But the key technical level to watch for USD/JPY remains that 115.00 level and keeping a break going into the weekly close above that will do buyers a world of good moving forward.

There will be little resistance seen in the pair through to 118.00 and that presents a big challenge for sellers to try and stand in the way of that and the dollar in general.

Other dollar pairs today are little changed for the most part though the kiwi is the notable laggard after falling as the RBNZ hiked its OCR by 25 bps.

There were some quarters of the market hoping for a 50 bps move but alas, that didn’t come and the kiwi dipped as a result with NZD/USD looking towards its end-September lows now upon breaching trendline support @ 0.6938: