Products You May Like

Overall markets are rather mixed so far, as guided by the volatile risk sentiment. There is no clear follow through moves in the markets. Sterling is the strongest one for the week so far, after the surprised BoE rate hike. But Swiss Franc is the second strongest, as helped by some safe haven flow. Canadian Dollar is the worst performing, while even the strong Aussie is losing much momentum. Dollar and Euro are mixed and they’re still bounded in range against each other.

Technically, Gold is probably displaying the clearest picture. A short term bottom is formed at 1752.32 with break of 1792.94 resistance. It’s supported by bullish convergence condition in 4 hour MACD too. Fall from 1877.05 should be finished. If Gold could grab firm hold above 1800 handle, there is prospect of further rise back to 1877.05 resistance. That, if happens, would be a sign of Dollar weakness.

In Asia, at the time of writing, Nikkei is down -1.63%. Hong Kong HSI is down -1.28%. China Shanghai SSE is down -0.90%. Singapore Strait Times is down -0.28%. Japan 10-year JGB yield is up 0.0016 at 0.046. Overnight, DOW dropped -0.08%. S&P 500 dropped -0.87%. NASDAQ dropped -2.47%. 10-year yield dropped -0.041 to 1.422.

BoJ keeps interest rates unchanged, scales back emergency funding

Under the yield curve control, BoJ kept short-term policy interest rate unchanged at -0.10%, and 10-year JGB target at around 0% without upper limit to purchases. It will continue to buy ETFs and J-REITs with upper limits of JPY 12T and JPY 180B respectively on annual paces.

The Special Program to Support Financing in Response to the Novel Coronavirus is extended in part by six months until the end of September 2022. The additional purchases of commercial paper and corporate bonds will be complete at the end of March 2022 as scheduled with outstanding amounts gradually drop back to pre-pandemic levels.

BoJ said, “Japan’s economy is projected to continue growing at a pace, albeit slower, above its potential growth rate.” Core CPI is “likely to increase moderately in positive territory in the short run,” and “projected to increase gradually as a trend”.

The course of COVID-19 continues to warrant attention”. There are “high uncertainties over whether the resumption of economic activity can progress smoothly”. Attentions should also be paid to risk that “effects of supply-side constraints seen in some areas will be amplified or prolonged.”

New Zealand ANZ business confidence dropped to -23.2, inflation expectations rose further

New Zealand ANZ business confidence dropped further to -23.2 in December, down from November’s -16.4. Own activity outlook dropped from 15.0 to 11.8. Export intentions dropped from 9.5 to 8.8. Investment intentions dropped from 16.3 to 11.4. Employment intentions dropped from 15.8 to 10.5. Pricing intentions dropped from 66.5 to 63.6. Inflation expectations rose further from 4.24% to 4.42%.

ANZ said: “Unfortunately the cloud of uncertainty that hangs over 2022 is not a great deal smaller, nor fluffier… Labour shortages and cost pressures rank high in firms’ list of concerns, and freight disruptions are getting worse… But having trouble meeting demand is probably a better problem to have than not having enough demand.

UK Gfk consumer confidence dropped to -14, slightly depressed end of year

UK Gfk consumer confidence dropped from -14 to -15 in December. Personal financial situation over the next 12 months dropped from 2 to 1. General economic situation over the next 12 months dropped from -23 to -24. Major purchase index also dropped from -3 to -6.

Joe Staton, Client Strategy Director, GfK says: “News about the Omicron variant could not have arrived at a worse time for festive celebrations… We end 2021 on a slightly depressed note and it looks like it will be a bleak midwinter for UK consumer confidence possibly with new COVID curbs and little likelihood of any real uplift in the first months of 2022.”

Looking ahead

Germany Ifo business climate, PPI and Eurozone CPI final will be released in European session. Canada will release foreign securities purchases.

EUR/USD Daily Outlook

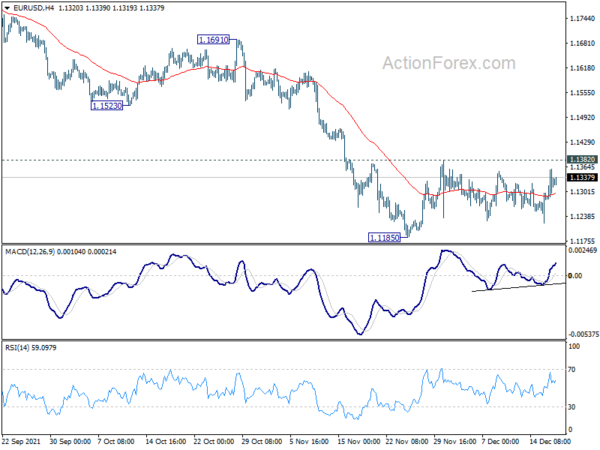

Daily Pivots: (S1) 1.1289; (P) 1.1324; (R1) 1.1368; More…

EUR/USD is still bounded in sideway trading in range of 1.1185/1382. Intraday bias remains neutral first. On the upside, firm break of 1.1382 resistance should confirm short term bottoming at 1.1186. Intraday bias will be turned back to the upside for 55 day EMA (now at 1.1436). Sustained break there will be a sign of larger bullish reversal. On the downside, break of 1.1185 will resume larger fall from 1.2348. Next target is 161.8% projection of 1.2265 to 1.1663 from 1.1908 at 1.0934.

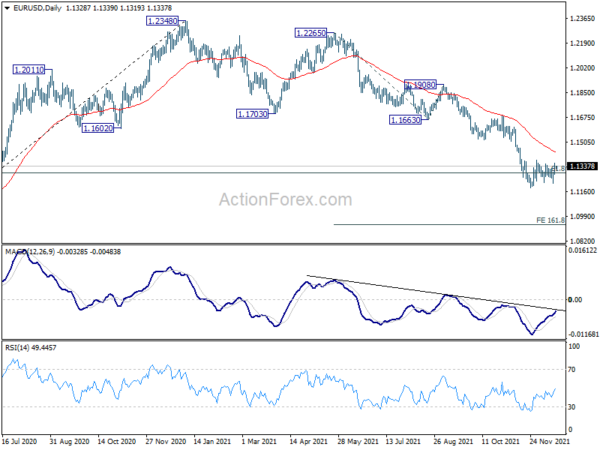

In the bigger picture, there are various ways of interpreting the fall from 1.2348 (2021 high). It could be a correction to rise from 1.0635 (2020 low), the fourth leg of a sideway pattern from 1.0339 (2017 low), or resuming long term down trend. In any case, outlook will now stay bearish as long as 1.1703 support turned resistance holds. Sustained break of 61.8% retracement of 1.0635 to 1.2348 at 1.1289 would pave the way back to 1.0635.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 0:01 | GBP | GfK Consumer Confidence Dec | -15 | -14 | ||

| 3:00 | JPY | BoJ Interest Rate Decision | -0.10% | -0.10% | -0.10% | |

| 7:00 | EUR | Germany PPI M/M Nov | 1.40% | 3.80% | ||

| 7:00 | EUR | Germany PPI Y/Y Nov | 19.80% | 18.40% | ||

| 9:00 | EUR | Germany IFO Business Climate Dec | 95.4 | 96.5 | ||

| 9:00 | EUR | Germany IFO Current Assessment Dec | 97.5 | 99 | ||

| 9:00 | EUR | Germany IFO Expectations Dec | 93.3 | 94.2 | ||

| 10:00 | EUR | Eurozone CPI Y/Y Nov F | 4.90% | 4.90% | ||

| 10:00 | EUR | Eurozone CPI Core Y/Y Nov F | 2.60% | 2.60% | ||

| 13:30 | CAD | Foreign Securities Purchases (CAD) Oct | 20.02B |