Products You May Like

Markets are generally steady as focus turns to non-farm payroll from US today. For the week so far, Sterling and Dollar are still the strongest ones, as supported by strong rally in benchmark yields and expectation of hawkish central bank actions. Euro is mixed, pressured by the Pound but steady against Dollar. Yen’s weakest place was overtaken by Aussie and Kiwi, as risk sentiment turned sour.

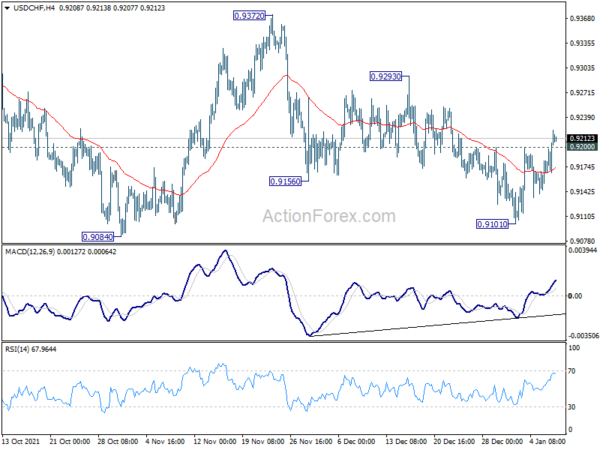

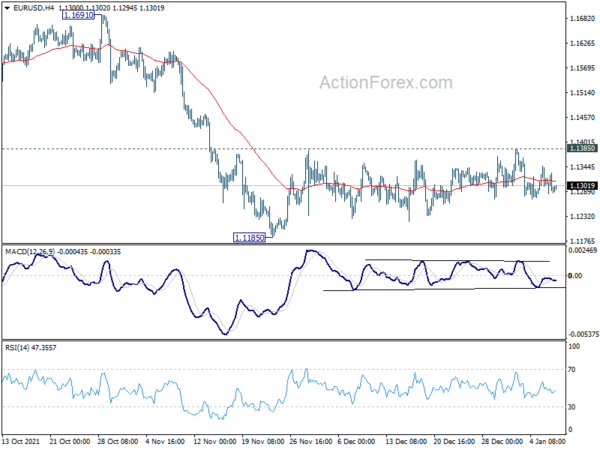

Technically, USD/CHF’s break of 0.9200 resistance suggests that fall from 0.9372 has completed with three waves down to 0.9101. Stronger rally is now in favor towards 0.9293 resistance, and possibly further to 0.9372. We’ll now see if EUR/USD would follow with more decline back towards 1.1185 low, and possibly a break there on Dollar strength.

In Asia, at the time of writing, Nikkei is down -0.13%. Hong Kong HSI is up 1.15%. China Shanghai SSE is up 0.35%. Singapore Strait Times is up 0.50%. Japan 10-year JGB yield is up 0.0043 at 0.123. Overnight, DOW dropped -0.47%. S&P 500 dropped -0.10%. NASDAQ dropped -0.13%. 10-year yield rose 0.028 to 1.733.

Fed Bullard: FOMC could hike as early as in March

St. Louis Fed James Bullard said yesterday, “the FOMC could begin increasing the policy rate as early as the March meeting in order to be in a better position to control inflation. Subsequent rate increases during 2022 could be pulled forward or pushed back depending on inflation developments.”

“There was a significant unanticipated inflation shock in the U.S. during 2021,” he said. “With the real economy strong but inflation well above target, U.S. monetary policy has shifted to more directly combat inflation pressure.”

“We could go ahead with balance sheet run off shortly after lifting off the policy rate,” Bullard said, and start reducing support for the economy “sooner rather than later.”

Fed Daly: We might need to, likely will need to, raise interest rates

San Francisco Fed President Mary Daly said yesterday that “I’m of the mind that we might need to, likely will need to, raise interest rates … in order to keep the economy in balance.” She clarified that “raising them a little bit is not the same as constraining the economy.”

But she also urged a data driven, measured approach. “If we act too aggressively to offset the high inflation that’s caused by the supply and demand imbalances, we won’t actually do very much to solve the supply chain problems, but we will absolutely bridal the economy in a way that will mean less job creation down the road,” she said.

10-year yield eyeing key resistance as NFP awaited

US non-farm payroll report is the major focus for today. Markets are expecting 400k job growth in December. Unemployment rate is expected to tick down from 4.2% to 4.1%. Wage growth is expected to continue to be strong, with average hourly earnings up 0.4% mom.

Looking at related data, ADP private employment grew strongly by 807k. ISM manufacturing component rose from 53.3 to 54.2. But ISM services employment dropped from 56.5 to 54.9. Four-week moving average of initial jobless claims dropped notably from 239k to 204.5. The NFP report is more likely a solid one than not.

Reactions from treasury yields to the data is worth a watch. 10-year yield is now close to 1.765 key near term resistance. A set of solid job data, in particular wage growth, could push TNX through this 1.765 resistance to resume larger up trend from 0.398. In this case, we could see TNX quickly accelerate through 2.0 handle to 61.8% retracement of 3.248 to 0.398 at 2.159 down the road, even within Q1. Such development would give USD/JPY and push upwards.

On the data front

Japan Tokyo CPI core accelerated to 0.5% yoy in December, up from 0.3% yoy, above expectation of 0.4% yoy. Labor cash earnings rose 0.0% yoy in November, below expectation of 0.5% yoy. Household spending dropped -1.3% yoy, much worse than expectation of 1.6% yoy.

In European session, Swiss will release unemployment rate and retail sales. Germany will release industrial production and trade balance. France will release trade balance, consumer spending and industrial output. UK will release PMI construction. Eurozone will release CPI flash, retail sales and economic sentiment indicator.

Later in the day, US will release non-farm payroll employment. Canada will also release job data and Ivey PMI.

EUR/USD Daily Outlook

Daily Pivots: (S1) 1.1279; (P) 1.1305; (R1) 1.1326; More…

EUR/USD is still staying in sideway consolidation form 1.1185 and intraday bias remains neutral. On the downside, break of 1.1185 will resume larger decline from 1.2348. Next target is 161.8% projection of 1.2265 to 1.1663 from 1.1908 at 1.0934. On the upside, firm break of 1.1385 resistance will resume the rebound from 1.1186. Sustained trading above 55 day EMA (now at 1.1382) will bring stronger rise back to 1.1663 support turned resistance.

In the bigger picture, there are various ways of interpreting the fall from 1.2348 (2021 high). It could be a correction to rise from 1.0635 (2020 low), the fourth leg of a sideway pattern from 1.0339 (2017 low), or resuming long term down trend. In any case, outlook will now stay bearish as long as 1.1703 support turned resistance holds. Sustained break of 61.8% retracement of 1.0635 to 1.2348 at 1.1289 would pave the way back to 1.0635.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:30 | JPY | Tokyo CPI Core Y/Y Dec | 0.50% | 0.40% | 0.30% | |

| 23:30 | JPY | Labor Cash Earnings Y/Y Nov | 0.00% | 0.50% | 0.20% | |

| 23:30 | JPY | Household Spending Y/Y Nov | -1.30% | 1.60% | -0.60% | |

| 06:45 | CHF | Unemployment Rate Dec | 2.50% | 2.50% | ||

| 07:00 | EUR | Germany Industrial Production M/M Nov | 1.00% | 2.80% | ||

| 07:00 | EUR | Germany Trade Balance (EUR) Nov | 12.7B | 12.5B | ||

| 07:30 | CHF | Real Retail Sales Y/Y Nov | 0.80% | 1.20% | ||

| 07:45 | EUR | France Trade Balance (EUR) Nov | -7.2B | -7.5B | ||

| 07:45 | EUR | France Consumer Spending M/M Nov | 0.50% | -0.40% | ||

| 07:45 | EUR | France Industrial Output M/M Nov | 0.90% | |||

| 09:30 | GBP | Construction PMI Dec | 53.9 | 55.5 | ||

| 10:00 | EUR | Eurozone CPI Y/Y Dec P | 4.70% | 4.90% | ||

| 10:00 | EUR | Eurozone CPI Core Y/Y Dec P | 2.30% | 2.60% | ||

| 10:00 | EUR | Eurozone Economic Sentiment Indicator Dec | 116 | 117.5 | ||

| 10:00 | EUR | Eurozone Services Sentiment Dec | 16.1 | 18.4 | ||

| 10:00 | EUR | Eurozone Industrial Confidence Dec | 14 | 14.1 | ||

| 10:00 | EUR | Eurozone Consumer Confidence Dec F | -8.3 | -8.3 | ||

| 10:00 | EUR | Eurozone Retail Sales M/M Nov | -0.50% | 0.20% | ||

| 13:30 | USD | Nonfarm Payrolls Dec | 400K | 210K | ||

| 13:30 | USD | Unemployment Rate Dec | 4.10% | 4.20% | ||

| 13:30 | USD | Average Hourly Earnings M/M Dec | 0.40% | 0.30% | ||

| 13:30 | CAD | Net Change in Employment Dec | 24.5K | 153.7K | ||

| 13:30 | CAD | Unemployment Rate Dec | 6.00% | 6.00% | ||

| 15:00 | CAD | Ivey Purchasing Managers Index Dec | 64.3 | 61.2 |